Get the free utkal grameen bank kyc form pdf download

Fill out, sign, and share forms from a single PDF platform

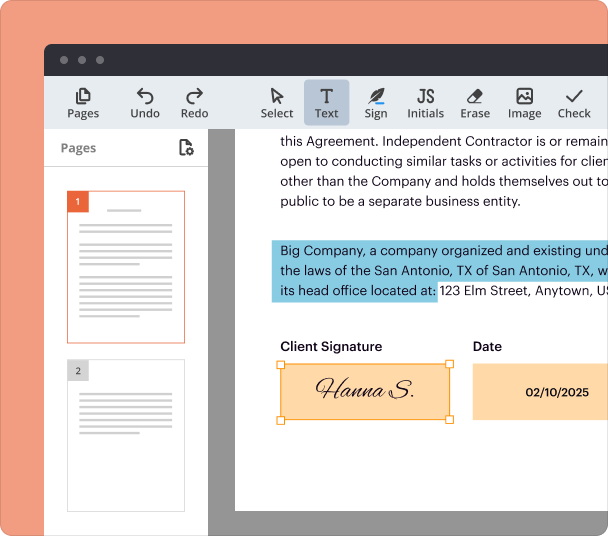

Edit and sign in one place

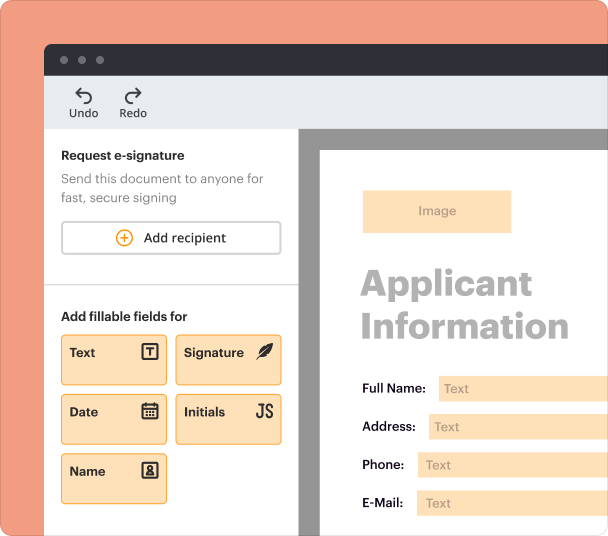

Create professional forms

Simplify data collection

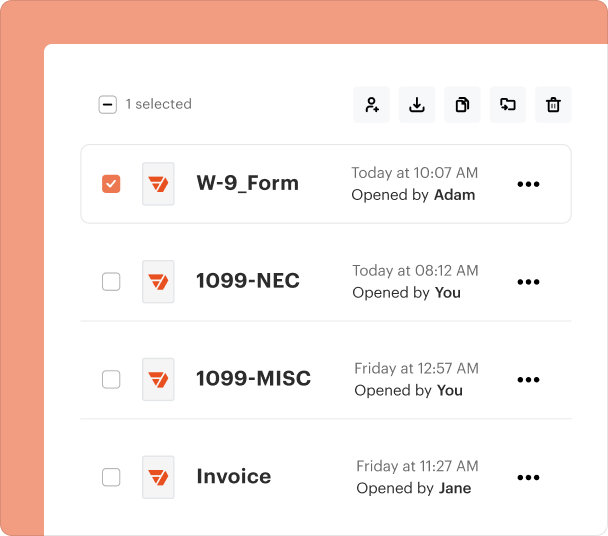

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

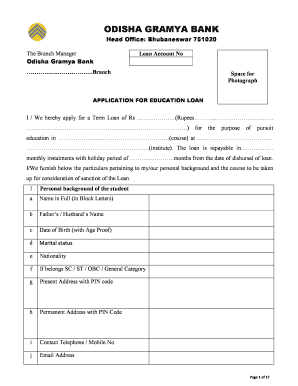

Understanding the Utkal Grameen Bank KYC Form

What is the Utkal Grameen Bank KYC Form?

The Utkal Grameen Bank KYC form is a document required for identity verification in compliance with Know Your Customer regulations. This form is essential for account holders who wish to establish or update their personal information with the bank. It serves to ensure that the bank can confirm the identity of its customers and mitigate the risks associated with fraud and money laundering.

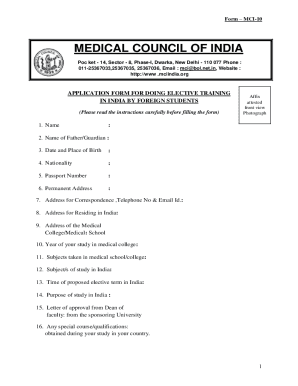

Required Documents and Information

When filling out the Utkal Grameen Bank KYC form, applicants typically need to provide several key pieces of information. This includes a government-issued photo ID, proof of address, and relevant financial details. Documents such as a driver's license, passport, utility bills, or bank statements can be used to validate identity and residence.

How to Fill the Utkal Grameen Bank KYC Form

Filling the form requires attention to detail to ensure all information is accurately entered. Applicants should start by providing their full name, date of birth, and contact details. It is also important to carefully complete sections regarding your identification documents. Ensure to double-check all provided information before submission to avoid delays.

Security and Compliance for the Utkal Grameen Bank KYC Form

The Utkal Grameen Bank KYC form follows strict compliance guidelines to safeguard customer information. This includes encryption of personal data during online submissions and rigorous checks against government regulations. Users should feel confident knowing that their information is protected according to the highest security standards.

Common Errors and Troubleshooting

Applicants may face common errors while completing the KYC form, such as incorrect data entry or missing required documents. To troubleshoot these issues, ensure that all information matches the provided identification and that no sections are left blank. If problems persist, it may be beneficial to reach out for assistance from bank representatives.

Submission Methods and Delivery

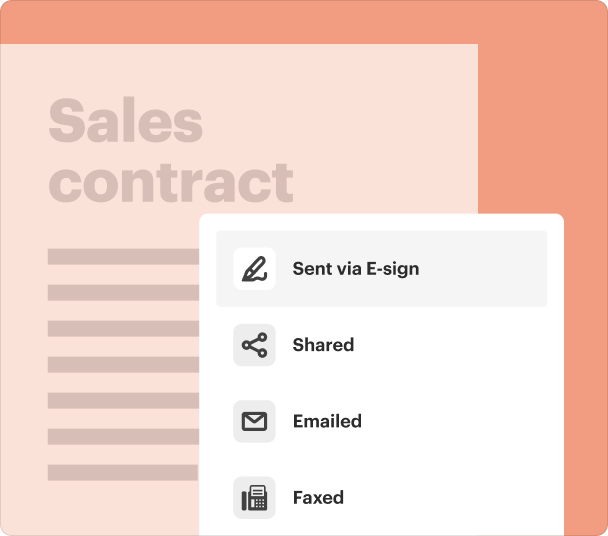

The Utkal Grameen Bank KYC form can usually be submitted through various methods. This includes in-person submission at the nearest bank branch or online through the bank's secure portal. Ensure to retain a copy of the completed form for personal records and follow up with the bank if necessary.

Frequently Asked Questions about ugb kyc form

What should I do if I lose my KYC form?

If you lose your KYC form, you should visit your nearest Utkal Grameen Bank branch to request a duplicate. They will assist you in re-filling the form or provide alternative solutions.

Is there a fee for submitting the KYC form?

Typically, there is no fee associated with submitting the Utkal Grameen Bank KYC form. However, it is best to confirm with your bank branch to avoid unexpected costs.

pdfFiller scores top ratings on review platforms