Canada REG/GAM 5443 2016-2025 free printable template

Show details

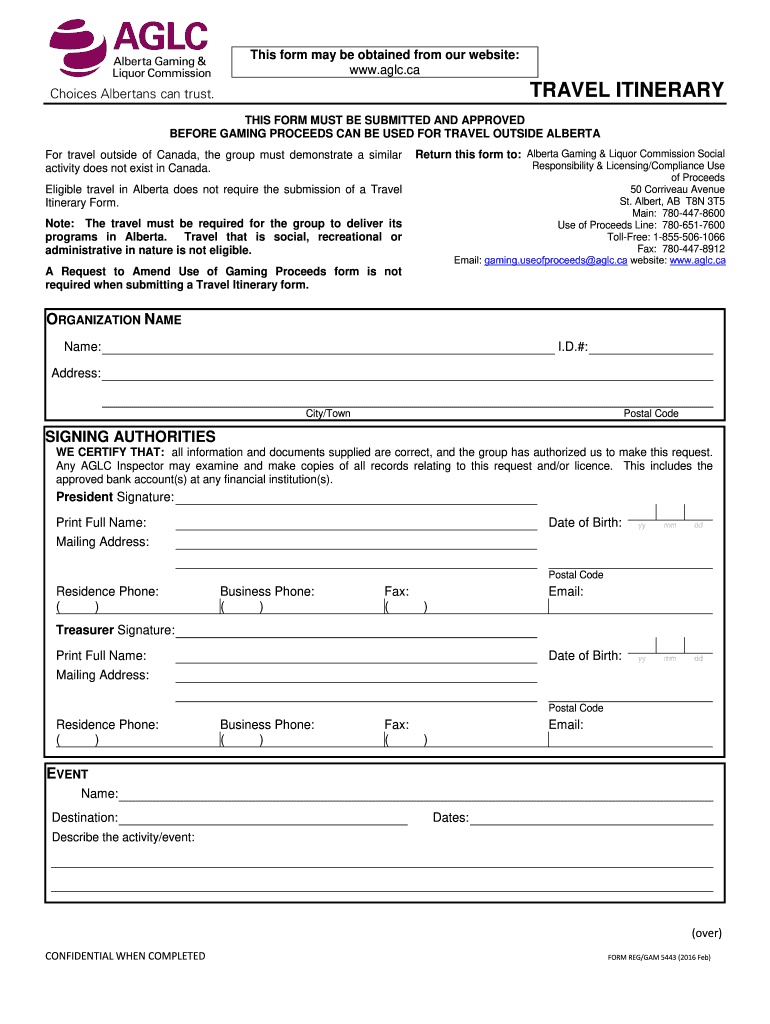

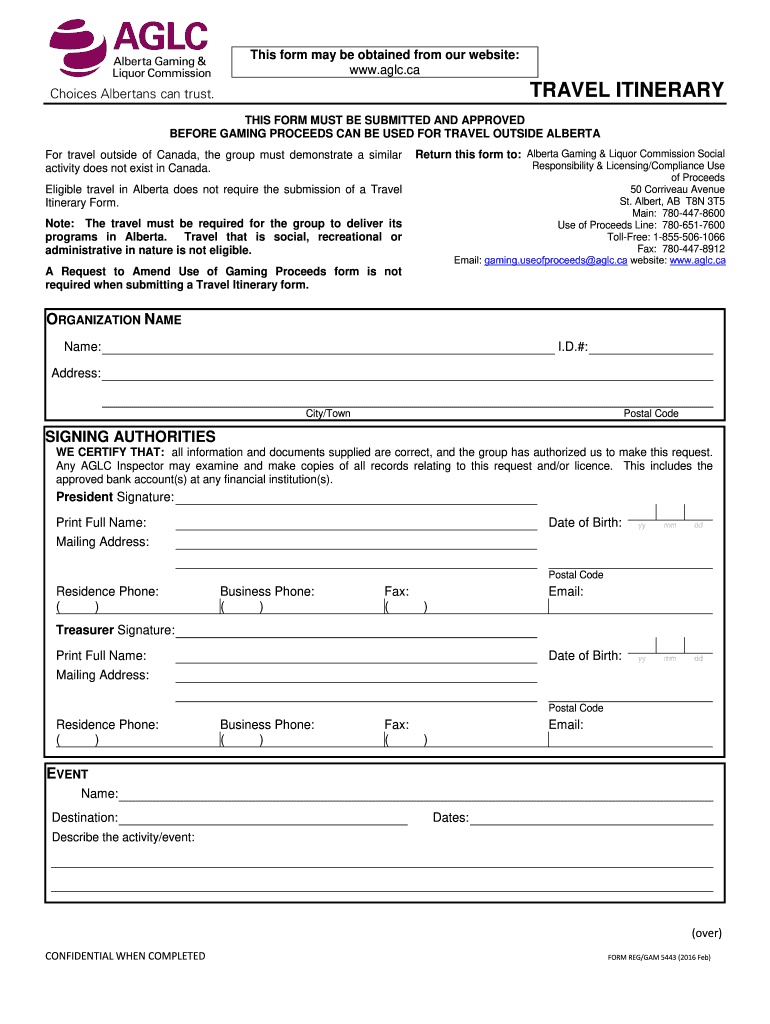

This form may be obtained from our website: www.aglc.ca TRAVEL ITINERARY THIS FORM MUST BE SUBMITTED AND APPROVED BEFORE GAMING PROCEEDS CAN BE USED FOR TRAVEL OUTSIDE ALBERTA For travel outside of

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign Canada REGGAM 5443

Edit your Canada REGGAM 5443 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada REGGAM 5443 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit Canada REGGAM 5443 online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit Canada REGGAM 5443. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out Canada REGGAM 5443

How to fill out Canada REG/GAM 5443

01

Obtain a copy of the Canada REG/GAM 5443 form from the official Canada Revenue Agency (CRA) website.

02

Ensure you have your personal information ready, including your name, address, and social insurance number.

03

Read the instructions on the form carefully to understand the requirements for filling it out.

04

Fill in the appropriate sections regarding your income and any deductions you wish to claim.

05

Double-check the accuracy of the information entered to avoid errors.

06

Sign and date the form in the designated area.

07

Submit the completed form to the appropriate CRA office as instructed.

Who needs Canada REG/GAM 5443?

01

Individuals or businesses that need to report certain income or claim deductions related to their tax situation in Canada.

02

Taxpayers who are required to disclose specific tax information for compliance with Canadian tax laws.

Fill

form

: Try Risk Free

People Also Ask about

What are examples of administrative costs?

List of Administrative Expenses Salaries and wages cost employees engaged in finance, accounts, human resources, information technology division, etc. Office maintenance cost. General Repairs and maintenance costs. Finance and insurance cost. Insurance Costs. IT Services Cost. Building Rent and Maintenance Costs.

How do you calculate administration cost?

How to calculate administrative expenses Identify all expenses. The first step to calculating a company's admin expenses requires that you identify and list all its expenses. Categorise costs. Consider infrequent purchases. Sum up the expenses. Use the sum to improve business management.

What are the administration costs?

Administration expenses are the costs of paying wages and salaries and providing benefits to non-sales personnel. They are one of three kinds of expense that make up a company's operating expenses. The others are selling and general expenses.

What are administrative costs in a budget?

Administrative budgets are financial plans that include all expected selling, general and administrative expenses for a period. Expenses in an administrative budget include any non-production expenses, such as marketing, rent, insurance, and payroll for non-manufacturing departments.

What are the administrative costs?

Administrative expenses are costs that relate to regular business operations. Administrative expenses can be fixed or semi-variable. Common examples include rent, utilities, equipment, supplies, insurance policies, salaries, benefits and legal counsel.

What are examples of administration costs?

Typical items listed as general and administrative expenses include: Rent. Utilities. Insurance. Executives wages and benefits. The depreciation on office fixtures and equipment. Legal counsel and accounting staff salaries. Office supplies.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find Canada REGGAM 5443?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the Canada REGGAM 5443 in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I edit Canada REGGAM 5443 straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing Canada REGGAM 5443 right away.

How do I edit Canada REGGAM 5443 on an Android device?

With the pdfFiller Android app, you can edit, sign, and share Canada REGGAM 5443 on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is Canada REG/GAM 5443?

Canada REG/GAM 5443 is a regulatory form used by Canada Revenue Agency (CRA) for reporting certain tax information related to specific activities or businesses operating in Canada.

Who is required to file Canada REG/GAM 5443?

Entities such as corporations, partnerships, and individuals engaged in specific types of business activities within Canada that meet certain criteria are required to file Canada REG/GAM 5443.

How to fill out Canada REG/GAM 5443?

To fill out Canada REG/GAM 5443, one must provide detailed information regarding the business activities, financial information, and other required details as specified in the form instructions.

What is the purpose of Canada REG/GAM 5443?

The purpose of Canada REG/GAM 5443 is to ensure proper reporting and compliance with Canadian tax laws, allowing the CRA to monitor business activities and tax obligations.

What information must be reported on Canada REG/GAM 5443?

The information that must be reported on Canada REG/GAM 5443 includes business identification details, financial transactions, income, expenses, and other operational data relevant to tax obligations.

Fill out your Canada REGGAM 5443 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada REGGAM 5443 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.