Get the free Unemployment Insurance Trust Fund Annual Assessment CY2010 - oet ky

Show details

This document provides an assessment of Kentucky's Unemployment Insurance Trust Fund, detailing financial metrics, historical trends, legislative changes, and projections for the upcoming year.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign unemployment insurance trust fund

Edit your unemployment insurance trust fund form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your unemployment insurance trust fund form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing unemployment insurance trust fund online

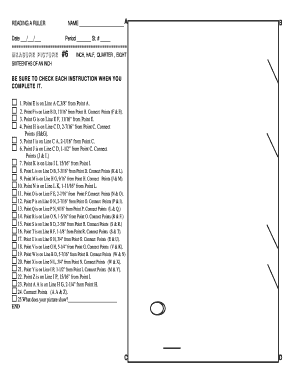

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit unemployment insurance trust fund. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out unemployment insurance trust fund

How to fill out Unemployment Insurance Trust Fund Annual Assessment CY2010

01

Gather all necessary financial documents from the relevant assessment period.

02

Access the official Unemployment Insurance Trust Fund Annual Assessment form for CY2010.

03

Complete the identification section with accurate details about your business or organization.

04

Calculate your total payroll during the specified period and enter this information into the designated section of the form.

05

Determine the assessment rate applicable to your entity and apply it to the total payroll to calculate the required assessment amount.

06

Fill in the assessment amount on the form and ensure that all calculations are accurate.

07

Review the completed form for any errors or omissions.

08

Submit the form and payment by the specified due date to avoid penalties.

Who needs Unemployment Insurance Trust Fund Annual Assessment CY2010?

01

Employers who are required to contribute to the Unemployment Insurance Trust Fund.

02

Businesses with employees who may be eligible for unemployment benefits.

03

Organizations that need to report their payroll information to fulfill state regulatory requirements.

04

Any entity that operates in the state and has an obligation to the unemployment insurance program.

Fill

form

: Try Risk Free

People Also Ask about

Do you have to pay back unemployment funds?

In most situations, you do not need to pay back unemployment benefits. If you meet the eligibility requirements, those benefits are yours to keep. The exception to this is if an overpayment was issued.

Are employees required in all states to contribute to the state unemployment insurance fund True or false?

With the exception of three states, unemployment benefits are funded exclusively by a tax imposed on employers. The three remaining states (Alaska, New Jersey, and Pennsylvania) require both employer and (minimal) employee contributions.

What is an unemployment trust?

The federal unemployment insurance (UI) trust fund finances the costs of administering unemployment insurance programs, loans made to state unemployment insurance funds, and half of extended benefits during periods of high unemployment.

What is the administrative contingency assessment in South Carolina?

Effective January 1, 1986, the departmental administrative contingency assessment is an assessment of six one-hundredths of one percent to be assessed upon the wages as defined in Section 41-27-380(2) of all employers except those who have either elected to make payments in lieu of contributions as defined in Section

What is the purpose of the unemployment trust fund?

The federal unemployment insurance (UI) trust fund finances the costs of administering unemployment insurance programs, loans made to state unemployment insurance funds, and half of extended benefits during periods of high unemployment.

Does the government have a trust fund for me?

There are two separate Social Security trust funds, the Old-Age and Survivors Insurance (OASI) Trust Fund pays retirement and survivors benefits, and the Disability Insurance (DI) Trust Fund pays disability benefits.

What is the purpose of the unemployment insurance fund?

The Unemployment Insurance Fund (UIF) gives short-term relief to workers when they become unemployed or are unable to work because of maternity, adoption and parental leave, or illness.

What is the FUTA for unemployment insurance?

The Federal Unemployment Tax Act (FUTA), with state unemployment systems, provides for payments of unemployment compensation to workers who have lost their jobs. Most employers pay both a Federal and a state unemployment tax.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Unemployment Insurance Trust Fund Annual Assessment CY2010?

The Unemployment Insurance Trust Fund Annual Assessment CY2010 is a financial evaluation conducted to determine the funding requirements and ensure the stability of the unemployment insurance program for the calendar year 2010.

Who is required to file Unemployment Insurance Trust Fund Annual Assessment CY2010?

Employers who are subject to state unemployment insurance laws and have had employees during the calendar year 2010 are required to file the Unemployment Insurance Trust Fund Annual Assessment.

How to fill out Unemployment Insurance Trust Fund Annual Assessment CY2010?

To fill out the Unemployment Insurance Trust Fund Annual Assessment CY2010, employers must complete the designated form, providing information about their payroll, the number of employees, and any relevant financial data as requested in the assessment form.

What is the purpose of Unemployment Insurance Trust Fund Annual Assessment CY2010?

The purpose of the Unemployment Insurance Trust Fund Annual Assessment CY2010 is to collect necessary funds to maintain the solvency of the unemployment insurance program, ensuring that benefits can be paid to eligible unemployed workers.

What information must be reported on Unemployment Insurance Trust Fund Annual Assessment CY2010?

The information that must be reported includes the total wages paid, the number of employees, tax liability, prior year assessments, and any other financial details relevant to the employer's unemployment insurance obligations.

Fill out your unemployment insurance trust fund online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Unemployment Insurance Trust Fund is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.