Get the free Skip-a-Payment Request

Show details

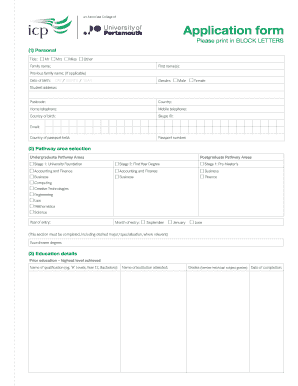

An application form for members of First Cheyenne FCU to skip their loan payments for the months of November, December, or January, with an option to skip multiple loans with a processing fee.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign skip-a-payment request

Edit your skip-a-payment request form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your skip-a-payment request form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing skip-a-payment request online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit skip-a-payment request. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out skip-a-payment request

How to fill out Skip-a-Payment Request

01

Obtain the Skip-a-Payment Request form from your lender's website or branch.

02

Fill out your personal information, including your name, account number, and contact details.

03

Specify the loan type for which you are requesting the skip payment.

04

Select the month you wish to skip and provide a reason if required.

05

Review any applicable fees or terms associated with the skip payment.

06

Sign the form to authorize the request.

07

Submit the completed form to your lender via the specified method (online, in person, or by mail).

Who needs Skip-a-Payment Request?

01

Borrowers facing temporary financial hardships who wish to defer a payment.

02

Individuals who have unexpected expenses and want to manage their cash flow.

03

Customers who have a good payment history and are eligible for the program.

Fill

form

: Try Risk Free

People Also Ask about

Does skip a payment hurt credit?

Usually, banks offer skip-a-payment to customers in good standing with the institution. This means those customers can skip a car or loan payment for one month of their choosing. As we previously mentioned, this is beneficial because it allows breathing room for those in a tough spot financially.

How do I ask to skip a payment?

If your lender already has a payment deferment option in your loan agreement, you only need to choose “skip a payment” in your payment coupon book or apply to skip a payment on the lender's website. If your lender doesn't explicitly mention deferment in the agreement, first call them to understand your options.

Can you request to skip a car payment?

While some auto loans have a built-in deferment policy, you'll want to speak to your lender for approval as well as learn how often deferment is allowed. Be prepared to have an honest conversation with your lender about your current financial situation. They'll want to know why you're asking to defer your car payment.

How to request a payment request?

How to Ask for Payment Professionally Check the Client Received the Invoice. Send a Brief Email Requesting Payment. Speak to the Client By Phone. Consider Cutting off Future Work. Research Collection Agencies. Review Your Legal Options. First Email Payment Request Template. Second Email Payment Request Template.

What is it called to skip a payment?

Deferment is an option that allows you to temporarily pause your loan payments with the lender's approval during times of financial hardship. Deferring your payments can help keep your accounts in good standing while you get back on your feet, but it's just a short-term solution.

What's a good excuse to defer a car payment?

Reasons to Defer a Car Payment You've experienced a one-off financial hardship. If money is unexpectedly tight this month due to an unexpected bill for medical treatment or car repair, a deferment may make sense. You need time to make new arrangements.

What is skip a pay?

Skip-a-Pay can be used to skip a payment on eligible loans once every six months, i.e., once you skip a payment, you must wait six months to skip another payment on that loan.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Skip-a-Payment Request?

A Skip-a-Payment Request is a formal request made by a borrower to their lender to temporarily defer a scheduled loan or credit payment.

Who is required to file Skip-a-Payment Request?

Borrowers facing financial difficulties or those who wish to temporarily ease their financial burden are required to file a Skip-a-Payment Request.

How to fill out Skip-a-Payment Request?

To fill out a Skip-a-Payment Request, borrowers must complete the designated form provided by their lender, specify the payment they wish to skip, and provide any required financial information or statements.

What is the purpose of Skip-a-Payment Request?

The purpose of a Skip-a-Payment Request is to provide borrowers with temporary relief from making payments, allowing them to manage their finances more effectively during challenging times.

What information must be reported on Skip-a-Payment Request?

Information that must be reported on a Skip-a-Payment Request typically includes the borrower's account number, the payment details, reason for the request, and any supporting financial documentation required by the lender.

Fill out your skip-a-payment request online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Skip-A-Payment Request is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.