Get the free RDS Local Event Sales Tax Form - townofberryalabama

Show details

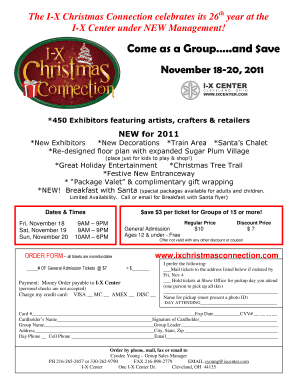

This form is used for filing single event sales tax associated with local festivals, craft shows, exhibitions, fairs, etc.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign rds local event sales

Edit your rds local event sales form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rds local event sales form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing rds local event sales online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit rds local event sales. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

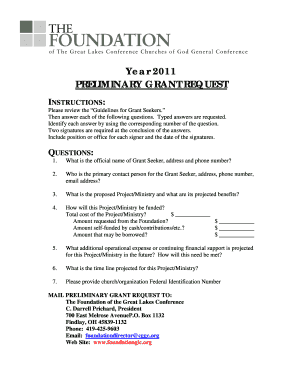

How to fill out rds local event sales

How to fill out RDS Local Event Sales Tax Form

01

Obtain the RDS Local Event Sales Tax Form from the official website or local tax office.

02

Fill in the event name in the designated section.

03

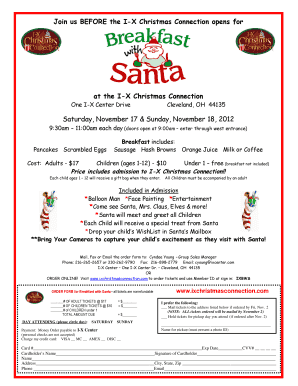

Enter the event date(s) in the provided field.

04

Provide the location of the event in the appropriate box.

05

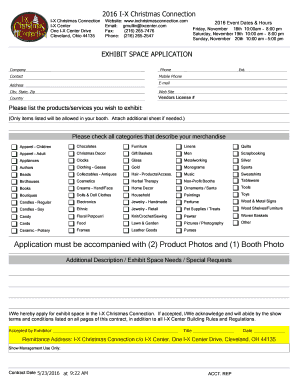

List all products or services sold at the event, including prices.

06

Calculate the total sales and enter it in the total sales field.

07

Compute the applicable sales tax based on your local rate and fill it in.

08

Provide your contact information, including name and address.

09

Sign and date the form to certify that the information is accurate.

10

Submit the completed form to the appropriate tax authority by the specified deadline.

Who needs RDS Local Event Sales Tax Form?

01

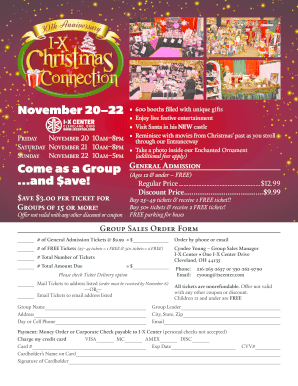

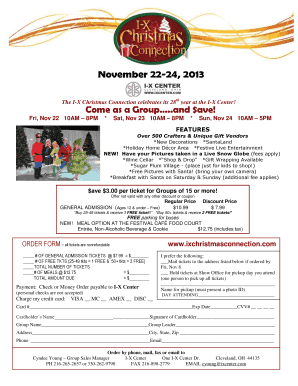

Any individual or organization that hosts a local event where goods or services are sold and is responsible for collecting and remitting sales tax.

Fill

form

: Try Risk Free

People Also Ask about

What qualifies as a taxable event?

It is an event that results in the obligation to pay taxes to the relevant tax authority, whether it's the IRS in the U.S. or another governing body. Taxable events can be triggered by a variety of situations, including earning income, selling assets, or receiving gifts, among others.

Are event tickets subject to sales tax in Texas?

For live events in Texas, you'll see sales tax applied to the total amount charged to the attendee ('buyer total') based on the applicable tax rate. Eventbrite is also required to collect and remit tax on applicable ticket sales for online events, unless you're exempt from sales tax.

What does it mean if something is subject to tax?

Subject to tax is a nuanced term within international taxation that can refer to an individual's or entity's overall tax status (sometimes called subjective tax liability) or the taxability of specific income or capital (often referred to as objective tax liability).

What is a non-taxable event?

Examples of non-taxable distributions include stock dividends, stock splits, stock rights, and distributions received from a partial or complete liquidation of a corporation. The distribution is a non-taxable event when it is disbursed, but it will be taxable when the stock is sold.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is RDS Local Event Sales Tax Form?

The RDS Local Event Sales Tax Form is a document used to report and remit sales tax collected from local events to the appropriate tax authority.

Who is required to file RDS Local Event Sales Tax Form?

Individuals or businesses hosting or organizing local events that collect sales tax on goods or services sold during those events are required to file the RDS Local Event Sales Tax Form.

How to fill out RDS Local Event Sales Tax Form?

To fill out the RDS Local Event Sales Tax Form, one must provide details such as the event name, date, location, total sales, total tax collected, and any deductions or exemptions applicable.

What is the purpose of RDS Local Event Sales Tax Form?

The purpose of the RDS Local Event Sales Tax Form is to ensure accurate reporting and payment of sales tax collected from local events, ensuring compliance with tax regulations.

What information must be reported on RDS Local Event Sales Tax Form?

The information that must be reported includes the event details, total sales figures, amount of sales tax collected, any applicable deductions, and the organizer's contact information.

Fill out your rds local event sales online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Rds Local Event Sales is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.