Get the free (Tto iados mus by vyplnen itatene a palikovm psmom - pozagas

Show details

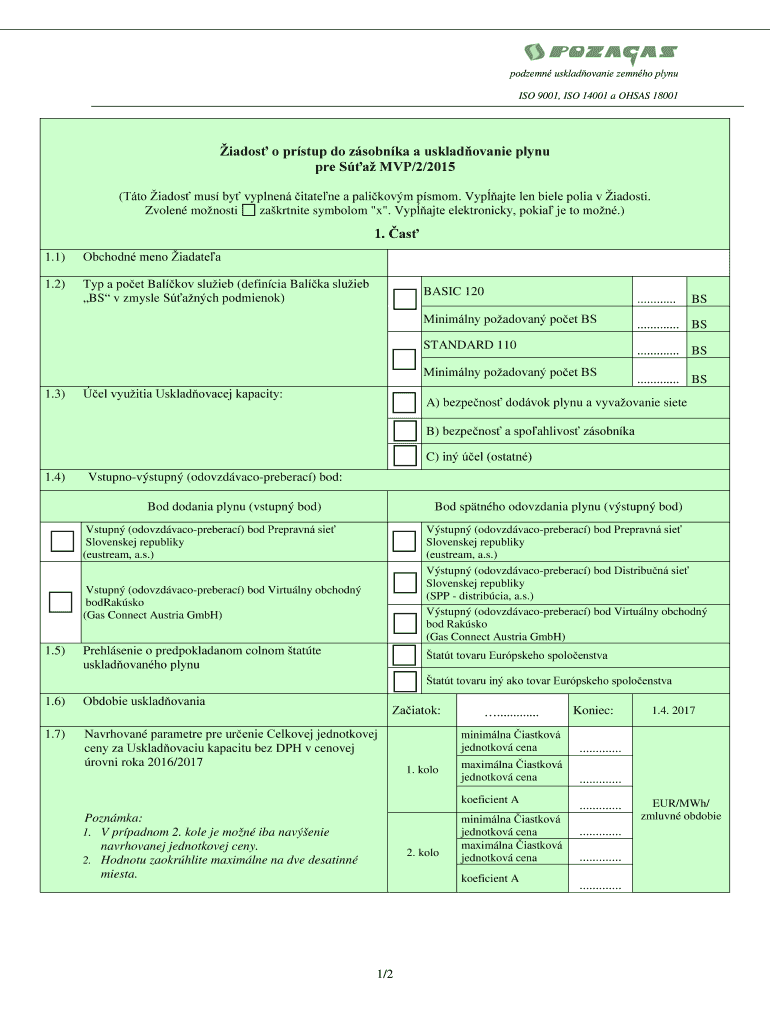

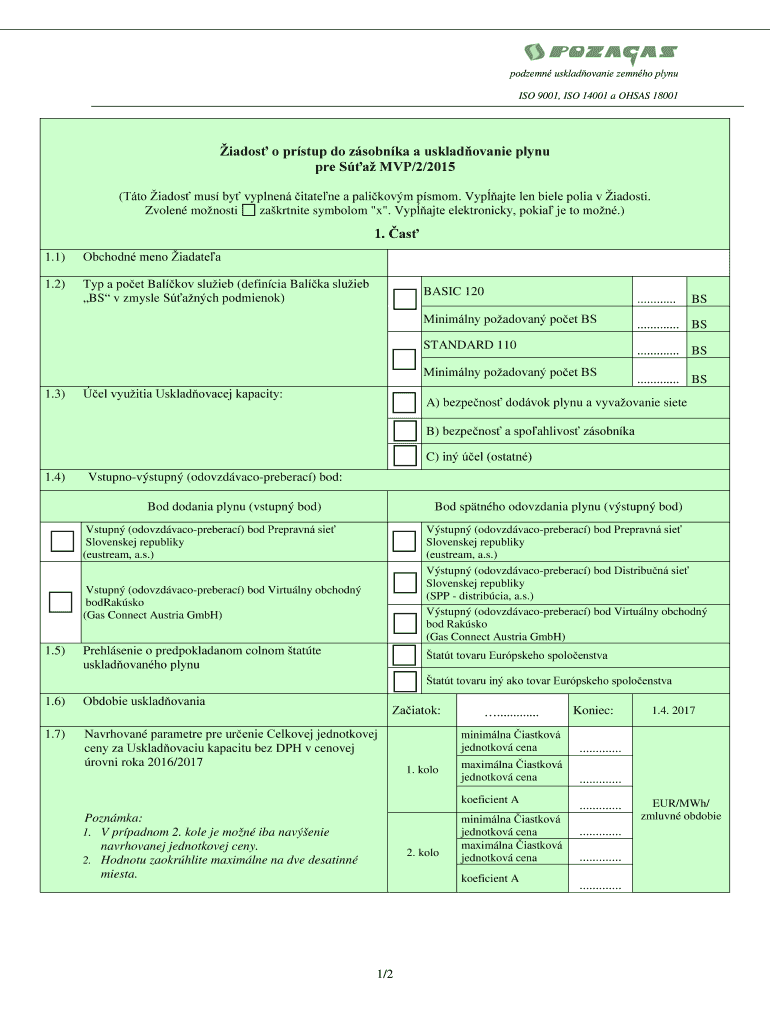

Modern uskladovanie Zeno ply nu ISO 9001, ISO 14001 a OHSA 18001 IATOS o prenup do Csonka an uskladovanie ply nu PRE SA MVP×2/2015 (TTO IATOS mus by hyphen Staten a palimony mom. Paste Len Bible

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tto iados mus by

Edit your tto iados mus by form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tto iados mus by form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tto iados mus by online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit tto iados mus by. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tto iados mus by

How to fill out tto iados mus by:

01

Start by gathering all the necessary information and documentation required for the form. This may include personal identification, financial records, and any applicable supporting documents.

02

Carefully read the instructions provided with the tto iados mus by form. Understanding the requirements and guidelines will help ensure accuracy and prevent any issues during the submission process.

03

Begin filling out the form by providing the requested personal information. This may include your full name, contact details, and any other required identification details.

04

Follow the prompts on the form and fill in each section accurately and completely. Pay attention to any specific fields that may require additional information or attachments, such as proof of income or marriage certificates.

05

Double-check all the information you've entered to make sure it is correct and matches the supporting documents you've gathered. Any mistakes or inconsistencies could result in delays or rejections.

06

If you are unsure about how to complete a particular section or have questions, consult the form's instructions or seek assistance from a professional, such as a tax advisor or legal expert.

07

Once you have completed all the required sections of the tto iados mus by form, review it one last time to ensure everything is accurate and in order. Any missing or incorrect information could cause delays or complications.

Who needs tto iados mus by:

01

Individuals who are required by law to report certain financial or income-related information to the relevant authorities may need to fill out tto iados mus by. This can include taxpayers, businesses, and organizations.

02

People who have received specific notices or requests from tax authorities to complete a tto iados mus by form may need to do so in order to comply with the request.

03

Individuals or entities involved in certain financial activities, such as investments, real estate transactions, or foreign income, may be required to file tto iados mus by forms to fulfill their reporting obligations.

In summary, filling out a tto iados mus by form requires careful attention to detail and adherence to the provided instructions. It is crucial to gather all necessary information and review the form before submission. Those who are legally obligated or have been requested to submit the form by tax authorities or relevant organizations should ensure compliance. Seeking professional assistance or guidance can be valuable to ensure accurate and timely completion of the form.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my tto iados mus by directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your tto iados mus by and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How can I send tto iados mus by to be eSigned by others?

When you're ready to share your tto iados mus by, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Can I edit tto iados mus by on an iOS device?

Use the pdfFiller mobile app to create, edit, and share tto iados mus by from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is tto iados mus by?

Tto iados mus by is a tax form that must be submitted to report income and expenses.

Who is required to file tto iados mus by?

Individuals and businesses earning income are required to file tto iados mus by.

How to fill out tto iados mus by?

Tto iados mus by can be filled out either manually or electronically, providing detailed information about income, expenses, and deductions.

What is the purpose of tto iados mus by?

The purpose of tto iados mus by is to report taxable income and calculate taxes owed to the government.

What information must be reported on tto iados mus by?

Information such as total income, deductions, credits, and tax owed must be reported on tto iados mus by.

Fill out your tto iados mus by online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tto Iados Mus By is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.