Get the free Family First - Checking - secure mcul

Show details

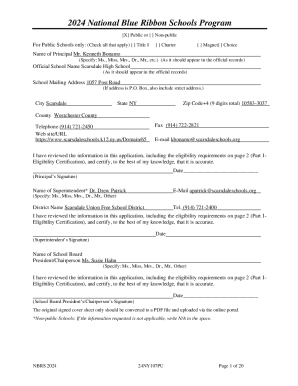

Family First Checking Juggling soccer practice, carpools, dance recitals and play dates? Our checking account plus debit card has the convenience and features you and your family need to manage your

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign family first - checking

Edit your family first - checking form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your family first - checking form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing family first - checking online

Follow the steps down below to use a professional PDF editor:

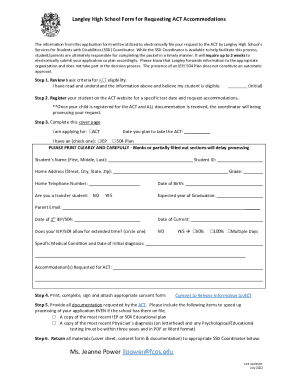

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit family first - checking. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out family first - checking

How to fill out Family First - Checking?

01

Gather all necessary documents: Before filling out the Family First - Checking form, make sure you have all the required documents at hand. This may include identification proof, social security numbers, and any other relevant financial information.

02

Access the form: Visit the website of the financial institution offering Family First - Checking or obtain a physical copy of the form from their branch. Familiarize yourself with the form and its sections to understand the information you need to provide.

03

Personal information: Start by entering your personal details such as your full name, address, date of birth, and contact information. This helps the bank identify you as the primary account holder.

04

Joint account holders: If you are opening the Family First - Checking account with a spouse or other family member, provide their details as well. This is common when couples or parents want to manage their finances jointly.

05

Social security numbers: Enter the social security numbers of all account holders as requested. The bank requires this information for legal and identification purposes.

06

Funding the account: Decide how you want to fund your Family First - Checking account. You may choose to deposit an initial amount, set up direct deposits, or transfer funds from another account. Follow the instructions provided on the form to complete this step accurately.

07

Signature and date: After reviewing all the information you have entered, sign and date the form. This signifies your agreement to the terms and conditions of the Family First - Checking account.

Who needs Family First - Checking?

01

Families: As the name suggests, the Family First - Checking account is designed to cater to the financial needs of families. It offers features and benefits specifically tailored for managing family finances effectively.

02

Parents: Parents who want to teach their children about financial responsibility can opt for the Family First - Checking account. It provides an opportunity for children to learn about banking, budgeting, and saving money.

03

Joint account holders: Couples or any individuals who prefer to have a joint account with their spouse, parents, or other family members can benefit from the Family First - Checking account. This enables seamless sharing of expenses, tracking spending, and managing household finances.

04

Individuals seeking additional features: Family First - Checking often offers additional features such as no minimum balance requirements, free checks, and special discounts for family-oriented events or services. If these perks align with your financial goals, this account may be suitable for you.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my family first - checking in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your family first - checking and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

Where do I find family first - checking?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the family first - checking in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I complete family first - checking on an Android device?

Complete family first - checking and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is family first - checking?

Family first - checking is a program that allows families to monitor and manage their finances while promoting financial literacy.

Who is required to file family first - checking?

All individuals or families who want to improve their financial health and manage their finances effectively are encouraged to file family first - checking.

How to fill out family first - checking?

To fill out family first - checking, individuals or families can use the online platform provided by financial institutions or consult with a financial advisor.

What is the purpose of family first - checking?

The purpose of family first - checking is to help individuals and families better understand and manage their finances, ultimately leading to improved financial well-being.

What information must be reported on family first - checking?

Information such as income, expenses, savings, investments, debts, and financial goals must be reported on family first - checking.

Fill out your family first - checking online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Family First - Checking is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.