Get the free BPetitionb For Property bTaxb Refund - Clark County Washington - clark wa

Show details

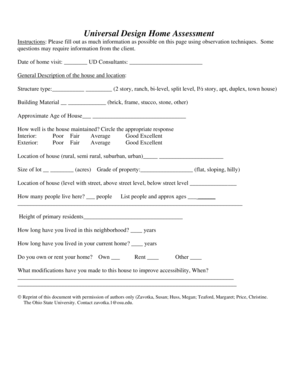

Petition For Property Tax Refund RCW 84.60.050 or 84.69.020 File With The County Treasurer Petition No: Claim for refund must be made within three years following payment of taxes. The petitioner,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign bpetitionb for property btaxb

Edit your bpetitionb for property btaxb form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bpetitionb for property btaxb form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit bpetitionb for property btaxb online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit bpetitionb for property btaxb. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out bpetitionb for property btaxb

How to fill out a petition for property tax:

01

Start by gathering all necessary information and documents related to the property tax issue you are addressing. This may include property ownership documents, tax assessment notices, previous tax payments, and any relevant correspondence with the tax authorities.

02

Identify the specific reason for filing the petition. It could be an incorrect property assessment, an unfair tax burden, or any other valid grounds for seeking a review or adjustment of the property tax.

03

Research the specific procedures and requirements for filing a petition for property tax in your jurisdiction. This may involve visiting the website of your local tax authority or contacting them directly to obtain the necessary forms and instructions.

04

Fill out the petition form accurately and completely. Provide all the required information, including your personal details, property information, and the reasons for seeking a review or adjustment of the property tax.

05

Attach any supporting documentation that strengthens your case. This may include property appraisals, comparable sales data, financial records, or any other evidence that supports your claim or highlights any inaccuracies in the tax assessment.

06

Double-check the completed petition form and attached documents for any errors or omissions. Make sure all information is clear and legible, as any mistakes may delay the processing of your petition.

07

Once you are satisfied with the petition and accompanying documents, make copies of everything for your records. It is also advisable to send the petition via certified mail or courier service to ensure a trackable delivery and receipt.

Who needs a petition for property tax?

01

Property owners who believe their property has been inaccurately assessed and want to challenge the tax amount.

02

Property owners facing an unfair tax burden compared to similar properties in their area.

03

Property owners who have experienced a significant change in their property's value or use that warrants a reassessment of the property tax.

Note: The specific eligibility criteria for filing a petition for property tax may vary depending on your location. It is essential to research and follow the guidelines provided by your local tax authority to ensure compliance with the applicable laws and procedures.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is petition for property tax?

A petition for property tax is a formal request submitted to challenge the assessed value of a property for tax purposes.

Who is required to file petition for property tax?

Property owners or their authorized representatives are required to file a petition for property tax.

How to fill out petition for property tax?

To fill out a petition for property tax, you must provide detailed information about the property, reasons for the challenge, and any supporting documentation.

What is the purpose of petition for property tax?

The purpose of a petition for property tax is to contest the assessed value of a property in order to potentially lower the property tax liability.

What information must be reported on petition for property tax?

Information such as property details, recent sales data of comparable properties, and any relevant appraisal reports must be reported on a petition for property tax.

How can I send bpetitionb for property btaxb for eSignature?

Once your bpetitionb for property btaxb is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I edit bpetitionb for property btaxb straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing bpetitionb for property btaxb.

Can I edit bpetitionb for property btaxb on an Android device?

You can make any changes to PDF files, like bpetitionb for property btaxb, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

Fill out your bpetitionb for property btaxb online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bpetitionb For Property Btaxb is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.