Get the free DESIRED REPAYMENT

Show details

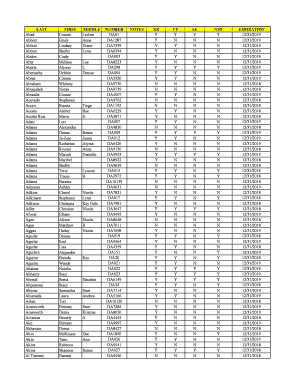

CREDIT APPLICATION IMPORTANT APPLICANT INFORMATION: Federal law requires financial institutions to obtain sufficient information to verify your identity. You may be asked several questions and to

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign desired repayment

Edit your desired repayment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your desired repayment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit desired repayment online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit desired repayment. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out desired repayment

To fill out the desired repayment, follow these steps:

01

Start by clearly stating your desired repayment amount. This refers to the specific sum of money that you wish to repay towards your debt or loan.

02

Next, indicate the frequency at which you plan to make the repayments. Specify whether it will be a monthly, bi-weekly, or other interval-based payment schedule.

03

Consider the duration within which you aim to complete the repayment. This refers to the time frame or the number of months or years you expect to take to fully repay the debt.

04

Assess your financial situation to ensure that your desired repayment is feasible and realistic. Consider factors such as your income, expenses, and any other financial obligations.

05

Review any terms and conditions regarding repayment set by the lender or creditor. These might include specific guidelines on interest rates, late payment fees, or other relevant details. Make sure your desired repayment aligns with these terms.

06

Seek advice from a financial advisor or expert if you have uncertainties or need guidance on creating a suitable repayment plan.

Who needs desired repayment?

01

Individuals with outstanding loans: If you have borrowed money, it is crucial to have a clear desired repayment plan in order to effectively manage and pay off your debt.

02

People who want to become debt-free: Having a desired repayment plan helps individuals who are determined to eliminate their debts and achieve financial freedom.

03

Those seeking to establish good credit: Timely and consistent repayments contribute to a positive credit history, thereby benefiting individuals who are working towards building a strong credit score.

04

Borrowers looking to avoid extra charges: By clearly defining your desired repayment, you can ensure that you meet the lender's requirements and avoid any additional fees or penalties associated with missed or late payments.

In summary, anyone with outstanding debt and a desire to manage and pay it off effectively should have a properly filled out desired repayment plan. It is essential for establishing financial stability and achieving financial goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is desired repayment?

Desired repayment refers to the amount of money that needs to be paid back by the borrower to the lender.

Who is required to file desired repayment?

The borrower is required to file the desired repayment.

How to fill out desired repayment?

Desired repayment can be filled out by providing accurate information about the amount borrowed, interest rate, and repayment schedule.

What is the purpose of desired repayment?

The purpose of desired repayment is to ensure that the borrower repays the loan amount in a timely manner.

What information must be reported on desired repayment?

The information that must be reported on desired repayment includes the loan amount, interest rate, repayment schedule, and any additional fees.

How do I modify my desired repayment in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your desired repayment along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How do I fill out the desired repayment form on my smartphone?

Use the pdfFiller mobile app to complete and sign desired repayment on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How do I complete desired repayment on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your desired repayment. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

Fill out your desired repayment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Desired Repayment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.