Get the free PH-1040 · ES - porthuron

Show details

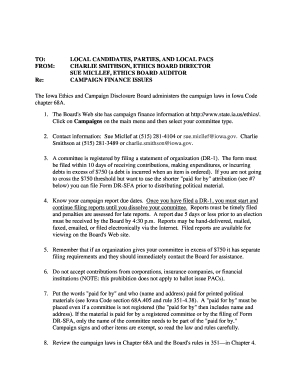

This document serves as a voucher for estimated tax payments to be made to the City of Port Huron for the calendar year 2013, including details for multiple payment due dates.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ph-1040 es - porthuron

Edit your ph-1040 es - porthuron form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ph-1040 es - porthuron form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ph-1040 es - porthuron online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit ph-1040 es - porthuron. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ph-1040 es - porthuron

How to fill out PH-1040 · ES

01

Obtain a copy of the PH-1040 · ES form from the official website or a local office.

02

Gather necessary personal information, including your Social Security number, income details, and deductions.

03

Complete each section of the form according to the instructions provided, ensuring accuracy in your entries.

04

Calculate your estimated tax payment based on your expected income and applicable tax rates.

05

Double-check all entries for correctness and completeness.

06

Sign and date the form at the designated area.

07

Submit the PH-1040 · ES form to the appropriate tax authority by the specified deadline.

Who needs PH-1040 · ES?

01

Individuals who earn income in a self-employed capacity.

02

People who have income that isn't subject to withholding.

03

Taxpayers who expect to owe at least $1,000 in taxes for the current year.

04

Those who want to make estimated tax payments in installments throughout the year.

Fill

form

: Try Risk Free

People Also Ask about

What triggers IRS estimated tax payments?

Generally, you must make estimated tax payments for the current tax year if both of the following apply: You expect to owe at least $1,000 in tax for the current tax year after subtracting your withholding and refundable credits.

Why did I receive a Form 1040-ES?

Use Form 1040-ES to figure and pay your estimated tax for 2025. Estimated tax is the method used to pay tax on income that isn't subject to withholding (for example, earnings from self-employment, including gig economy work, interest, dividends, rents, alimony, etc.).

Who generally does not need to pay estimated taxes?

If your federal income tax withholding (plus any timely estimated taxes you paid) amounts to at least 90 percent of the total tax that you will owe for this tax year, or at least 100 percent of the total tax on your previous year's return (110 percent for AGIs greater than $75,000 for single and separate filers and

Is form 1040es mandatory?

Exception to filing requirement If you had no tax liability for the prior year, you were a U.S. citizen or resident for the whole year and your prior tax year covered a 12-month period, then you do not have to file Form 1040-ES.

Who needs to pay 1040-ES?

Individuals, including sole proprietors, partners, and S corporation shareholders, generally use Form 1040-ES, to figure estimated tax. Nonresident aliens use Form 1040-ES(NR) to figure estimated tax.

What triggers the underpayment penalty?

An underpayment penalty is a charge the IRS imposes on taxpayers who did not pay all of their estimated income taxes for the year or paid their taxes late. You'll face an underpayment penalty if you: Didn't pay at least 90% of the tax on your current-year return or 100% of the tax shown on the prior year's return.

What happens if I don't pay 1040-ES?

What if I don't pay? You could end up owing the IRS an underpayment penalty in addition to the taxes that you owe. The penalty will depend on how much you owe and how long you have owed it to the IRS. Result: You might have to write a larger check to the IRS when you file your return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is PH-1040 · ES?

PH-1040 · ES is a tax form used for making estimated income tax payments in Puerto Rico. It is specifically designed for individuals and businesses who anticipate owing tax for the tax year.

Who is required to file PH-1040 · ES?

Individuals and businesses that expect to owe $500 or more in tax for the year and do not have enough withholding can be required to file PH-1040 · ES. This includes self-employed individuals, business owners, and those with significant income not subject to withholding.

How to fill out PH-1040 · ES?

To fill out PH-1040 · ES, taxpayers must provide their personal information, estimated income for the year, and calculate the estimated tax due based on that income. Instructions included with the form will guide users through specific calculations and required fields.

What is the purpose of PH-1040 · ES?

The purpose of PH-1040 · ES is to allow taxpayers in Puerto Rico to estimate and pay their income tax liabilities throughout the year, rather than waiting until the annual tax return is filed.

What information must be reported on PH-1040 · ES?

PH-1040 · ES must report personal details such as the taxpayer's name, address, Social Security number, estimated gross income, allowable deductions, and the amount of estimated tax due.

Fill out your ph-1040 es - porthuron online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ph-1040 Es - Porthuron is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.