Get the free BSales Taxb Exemption bFormb - S3 amazonaws com

Show details

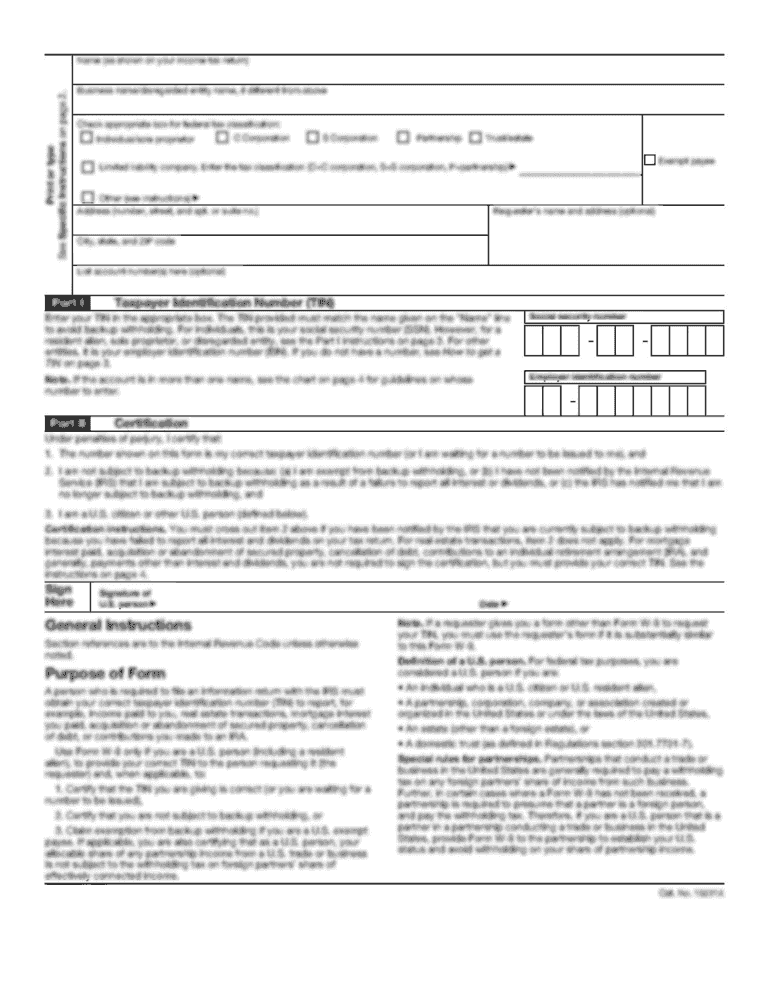

& 0 1339 (Back) : (Rev 907×6) TEXAS SALES AND USE TAX EXEMPTION CERTIFICATION Name of purchaser, firm or agency PARIS INDEPENDENT SCHOOL DISTRICT I Phone Address (Street f & number, P.O. Box or Route

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign bsales taxb exemption bformb

Edit your bsales taxb exemption bformb form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bsales taxb exemption bformb form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing bsales taxb exemption bformb online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit bsales taxb exemption bformb. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out bsales taxb exemption bformb

How to fill out a sales tax exemption form:

01

Gather the required information: Before starting to fill out the form, gather all the necessary information such as your organization's name, address, tax identification number, and any supporting documentation that may be required.

02

Review the form: Carefully read through the sales tax exemption form to understand the sections and information being requested. Make sure you have a clear understanding of the requirements and any specific instructions mentioned on the form.

03

Complete the organization details: Begin by filling out the organization details section of the form. Provide accurate information about your company, including its legal name, address, and contact information. If there is a specific department or individual responsible for tax matters, make sure to include their details as well.

04

State the reason for the exemption: In this section, clearly state the reason why your organization is eligible for a sales tax exemption. Provide any supporting documentation, such as a non-profit status certificate or a copy of a government-issued exemption letter, if required.

05

Provide relevant tax identification numbers: Include any relevant tax identification numbers such as your organization's Employer Identification Number (EIN) or State Tax ID number. These numbers help the tax authorities to identify and process your exemption accurately.

06

Explain the nature of your business: Provide a brief description of your organization's nature of business and the types of goods or services it deals with. This information helps the tax authorities to determine if your business qualifies for the sales tax exemption.

07

Sign and date the form: Once you have completed all the necessary sections of the form, make sure to sign and date it. By doing so, you are certifying that the information provided is true and accurate to the best of your knowledge.

08

Submit the form: After completing the form, make copies for your records and submit the original form to the relevant tax authority or department. Ensure that you follow any specific instructions regarding submission methods or additional documents needed.

Who needs a sales tax exemption form?

01

Non-profit organizations: Non-profit organizations that meet specific criteria, such as being a registered charity or educational institution, often need to obtain a sales tax exemption to avoid paying taxes on qualifying purchases.

02

Government entities: Federal, state, or local government agencies typically qualify for sales tax exemption as they are not subject to sales taxes for their purchases. They may need to provide documentation to prove their status.

03

Resellers: Businesses that purchase goods for resale rather than for their own use may require a sales tax exemption form. This allows them to buy products without paying sales tax upfront and charge sales tax to the end consumer when the goods are sold.

04

Some specific industries or activities: Depending on the jurisdiction and specific laws, certain industries or activities may be eligible for sales tax exemption. This can include healthcare providers, religious organizations, and some agricultural businesses, among others.

It is important to note that the eligibility criteria for a sales tax exemption vary across jurisdictions, and it is recommended to consult with local tax authorities or seek professional advice to ensure compliance with the specific requirements in your area.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is sales tax exemption form?

Sales tax exemption form is a document that allows certain individuals or organizations to make purchases without paying sales tax.

Who is required to file sales tax exemption form?

Entities that qualify for sales tax exemption based on their non-profit status, resale status, or other specific reasons are required to file sales tax exemption form.

How to fill out sales tax exemption form?

Sales tax exemption form must be filled out with accurate information regarding the entity's qualification for exemption, including tax ID numbers and specific details about the purchases.

What is the purpose of sales tax exemption form?

The purpose of sales tax exemption form is to provide a legal basis for exempting certain purchases from sales tax, in order to support non-profit organizations, encourage certain economic activities, or for other specific reasons.

What information must be reported on sales tax exemption form?

Sales tax exemption form typically requires information such as the entity's legal name, tax ID number, explanation of exemption qualification, and details about the purchases being made.

How can I modify bsales taxb exemption bformb without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your bsales taxb exemption bformb into a dynamic fillable form that you can manage and eSign from anywhere.

Can I create an electronic signature for the bsales taxb exemption bformb in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your bsales taxb exemption bformb in seconds.

Can I edit bsales taxb exemption bformb on an Android device?

You can make any changes to PDF files, like bsales taxb exemption bformb, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

Fill out your bsales taxb exemption bformb online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bsales Taxb Exemption Bformb is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.