Get the free Know Your Client (KYC) Application Form (For ... - L&T Mutual Fund

Show details

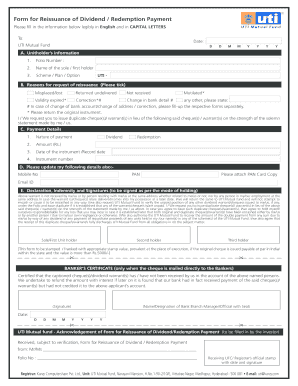

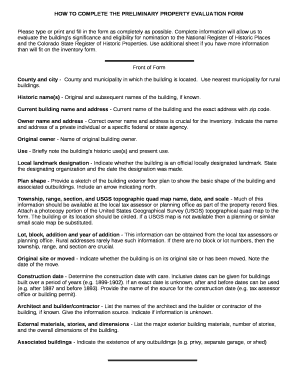

I Know Your Client (KYC) Application Form (For Individuals Only) Application No. Please fill this form in ENGLISH and in BLOCK LETTERS. www.camskra.com A. Identity Details (please see guidelines

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign know your client kyc

Edit your know your client kyc form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your know your client kyc form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit know your client kyc online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit know your client kyc. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out know your client kyc

Points on how to fill out know your client (KYC) form:

01

Begin by entering your personal information such as your full name, date of birth, and contact details.

02

Provide your residential address, including any additional addresses if applicable, such as your permanent address or mailing address.

03

Indicate your occupation, job title, and employer. In case you are unemployed or self-employed, mention that as well.

04

Submit identification documents, including a valid passport, driver's license, or national identity card. Ensure that these documents are up to date and not expired.

05

If required, provide additional documents to verify your identity. This can include a utility bill or bank statement displaying your name and address.

06

If you are completing the KYC form on behalf of a company or organization, include information about the entity, such as its legal name, registration number, and address.

07

Answer any additional questions or sections pertaining to your financial situation, investment objectives, and risk tolerance. This helps the organization better understand your financial background and goals.

08

Sign and date the KYC form to validate the information provided.

09

Review the completed form to ensure all sections are accurately filled out and all required documents are attached.

10

Submit the filled-out KYC form along with the necessary supporting documents to the organization or institution requesting the KYC.

Points on who needs know your client (KYC) information:

01

Banks and financial institutions require KYC information from their customers to comply with anti-money laundering (AML) and counter-terrorism financing (CTF) regulations.

02

Investment firms and brokerage houses need KYC information to assess the suitability of investment options for their clients and to ensure compliance with financial regulations.

03

Insurance companies may request KYC information to evaluate the risks associated with underwriting policies and ensure compliance with legal requirements.

04

Non-profit organizations may ask for KYC information to verify the identities of their donors and to comply with regulations regarding funds received.

05

Government agencies may require KYC information for various purposes, such as issuing identification documents, administering social welfare programs, or conducting background checks for security clearances.

06

Online platforms and service providers may collect KYC information as part of their identity verification process and to prevent fraudulent activities.

07

Any entity that deals with financial transactions, sensitive information, or requires accurate identification of individuals may need KYC information. These could include real estate agencies, gaming establishments, and professional service providers, among others.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in know your client kyc?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your know your client kyc to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I make edits in know your client kyc without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit know your client kyc and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

How do I fill out the know your client kyc form on my smartphone?

Use the pdfFiller mobile app to fill out and sign know your client kyc. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

What is know your client kyc?

Know Your Client (KYC) is a process used by financial institutions and other companies to verify the identity of their clients. It is designed to prevent fraud, money laundering, and terrorist financing.

Who is required to file know your client kyc?

Financial institutions, banks, brokerage firms, and certain other regulated entities are required to file KYC data for their clients as part of their regulatory obligations.

How to fill out know your client kyc?

To fill out a KYC form, clients typically provide personal information such as their name, address, date of birth, identification number, and occupation. Additional documents may also be required for verification.

What is the purpose of know your client kyc?

The purpose of KYC is to ensure that organizations understand who their clients are, assess potential risks of illegal activities, and comply with legal requirements in order to mitigate fraud and financial crime.

What information must be reported on know your client kyc?

KYC reports must include personal details such as full name, residential address, date of birth, nationality, identification documents, and sometimes financial information to assess the client’s risk profile.

Fill out your know your client kyc online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Know Your Client Kyc is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.