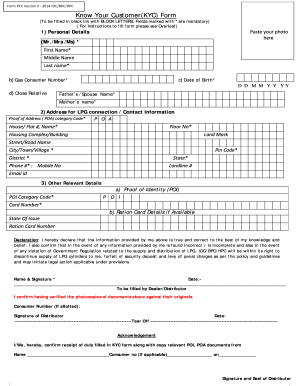

Ckyc Form

What is ckyc form?

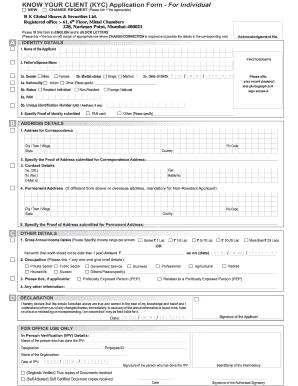

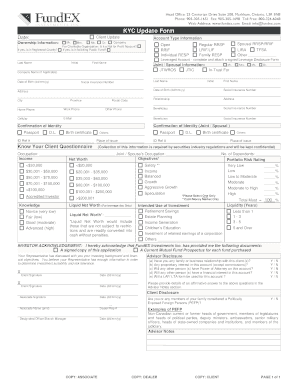

CKYC form stands for Central KYC form. It is a standardized form developed by the Central Registry of Securitization and Asset Reconstruction and Security Interest of India (CERSAI) to centralize and streamline the Know Your Customer (KYC) process for financial institutions. The form collects essential information about an individual or entity, such as personal details, identification documents, address proof, etc. The CKYC form helps in creating a central repository of KYC records, making it easier for financial institutions to verify the identity and address of their customers.

What are the types of ckyc form?

There are two types of CKYC forms:

How to complete ckyc form

Completing the CKYC form is a straightforward process. Here are the steps to follow:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.