Central Kyc Form

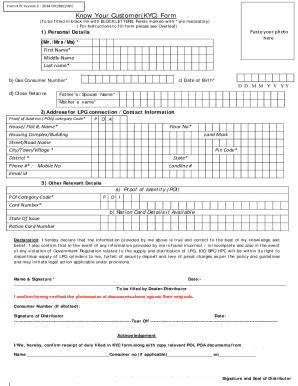

What is central kyc form?

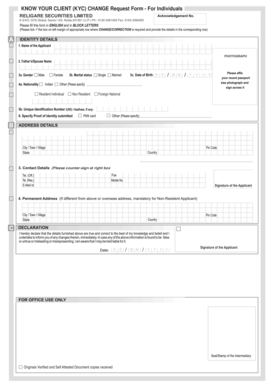

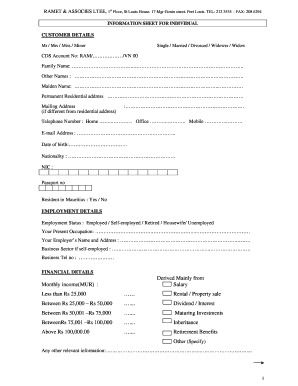

A central KYC form is a document that is used to centralize and streamline the Know Your Customer (KYC) process. KYC is a regulatory requirement that financial institutions and other organizations must comply with to verify the identity and address of their customers.

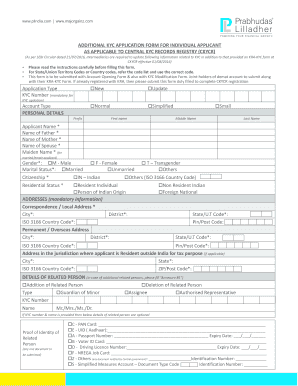

What are the types of central kyc form?

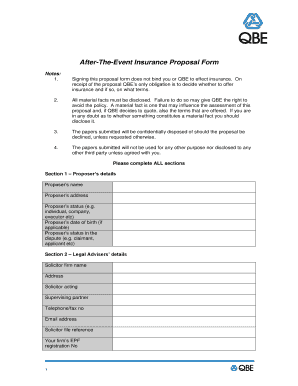

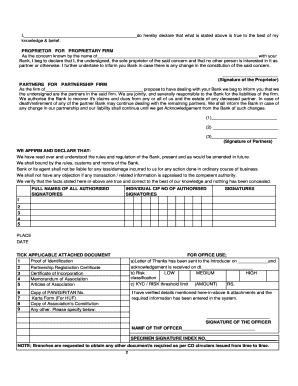

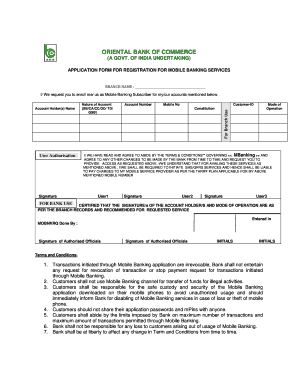

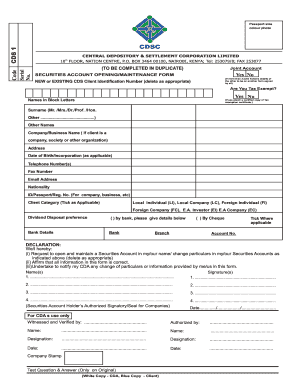

There are two types of central KYC forms: 1. CKYC Individual Form: This form is used for individual investors or customers who wish to open a new account or update their existing KYC details. 2. CKYC Entity Form: This form is used for entities such as companies, partnerships, trusts, etc., who wish to open a new account or update their KYC details.

How to complete central kyc form

Completing a central KYC form is a relatively straightforward process. Here are the steps to follow: 1. Obtain the central KYC form from the financial institution or organization that requires it. 2. Provide accurate and up-to-date information in the form, including personal details, contact information, and identification documents. 3. Ensure that all required documents are attached to the form, such as proof of identity and address. 4. Review the form to ensure all information is filled correctly. 5. Sign and date the form, as required. 6. Submit the completed form along with the necessary documents to the financial institution or organization.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.