Kyc Form For Bank

What is kyc form for bank?

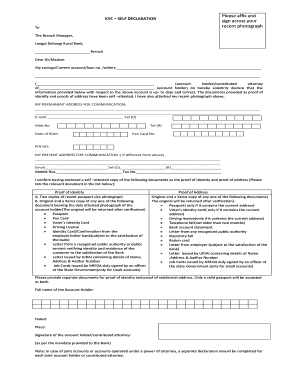

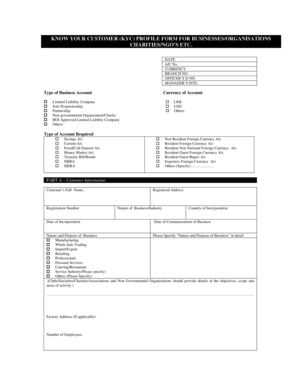

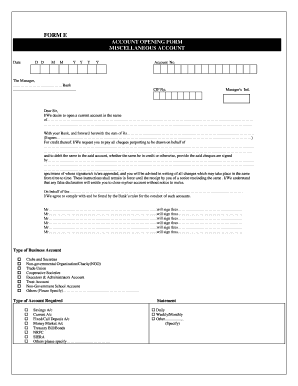

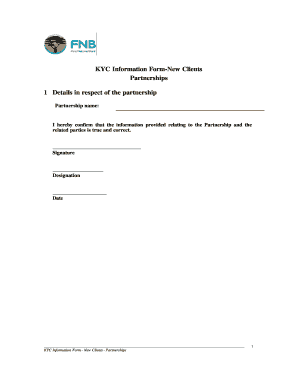

A KYC (Know Your Customer) form for a bank is a standard document that banks use to verify the identity and address of their customers. It is an essential requirement for opening a new bank account or performing certain financial transactions. The KYC form collects important information such as the customer's full name, date of birth, address, contact details, and proof of identification and address.

What are the types of kyc form for bank?

There are different types of KYC forms that banks may use based on the nature and purpose of the account or transaction. Some common types include: 1. Individual KYC form: Used for personal bank accounts. 2. Corporate KYC form: Used for businesses and organizations. 3. NRI KYC form: Used for Non-Resident Indians. 4. Simplified KYC form: Used for low-risk accounts or simplified KYC compliance. Please note that the exact types of KYC forms may vary between banks and jurisdictions.

How to complete kyc form for bank

Completing a KYC form for a bank is a straightforward process. Follow these steps to ensure a smooth submission: 1. Obtain the KYC form from your bank. It is typically available on their website or provided at the branch. 2. Fill in all the required fields with accurate and up-to-date information. Provide details such as your full name, date of birth, address, and contact information. 3. Attach copies of the necessary supporting documents, such as your proof of identification (passport, driver's license, etc.) and proof of address (utility bill, bank statement, etc.). 4. Review the completed form and documents for any errors or omissions. 5. Sign the form and submit it along with the supporting documents to the bank. Make sure to keep a copy of the filled KYC form and supporting documents for your records.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.