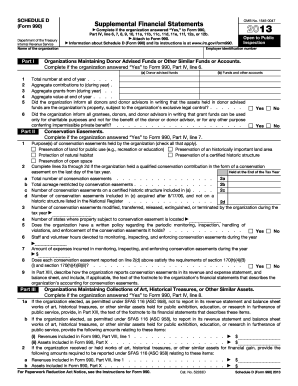

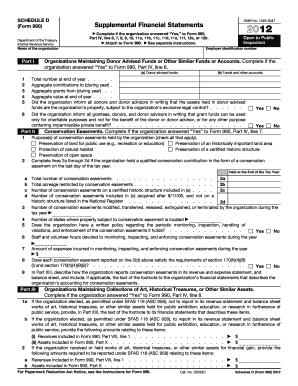

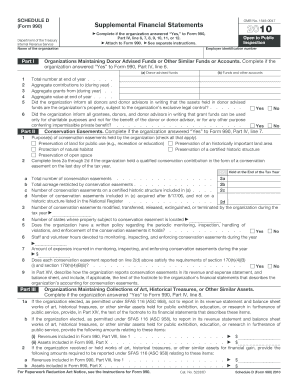

Schedule D (990 Form)

What is Schedule D (990 Form)?

The Schedule D (990 Form) is a document that must be filed by certain organizations to report their various investments. According to the Internal Revenue Service (IRS), this form is specifically used to report capital gains and losses, as well as any income or royalties received from investments. It provides important information about an organization's financial transactions and helps the IRS ensure compliance with tax laws.

What are the types of Schedule D (990 Form)?

There are different types of Schedule D (990 Form) that organizations may need to file, depending on their financial activities. 1. Schedule D Part I: This part is used to report short-term capital gains and losses from the sale of assets held for one year or less. 2. Schedule D Part II: This part is used to report long-term capital gains and losses from the sale of assets held for more than one year. 3. Schedule D Part III: This part is used to report royalties, rental income, or income from other investments. It's essential to understand the specific types of Schedule D forms applicable to your organization to ensure accurate reporting.

How to complete Schedule D (990 Form)

Completing Schedule D (990 Form) may seem daunting, but with the right approach, it can be a straightforward process. 1. Gather all relevant financial documents: Collect all necessary documents, such as financial statements, investment details, and receipts. 2. Start with Part I: Begin by filling out Schedule D Part I and enter the details of short-term capital gains and losses. 3. Move to Part II: Proceed to Schedule D Part II and provide information on long-term capital gains and losses. 4. Complete Part III: Finally, fill out Schedule D Part III by reporting any royalties, rental incomes, or income from other investments. 5. Review and double-check: Carefully review the form for accuracy before submitting it to avoid any errors or omissions. By following these steps, you can ensure the proper completion of Schedule D (990 Form) and fulfill your organization's reporting obligations.

pdfFiller empowers users to create, edit, and share documents online, making the process even easier. With unlimited fillable templates and powerful editing tools, pdfFiller is the go-to PDF editor for users who want to efficiently handle their document needs.