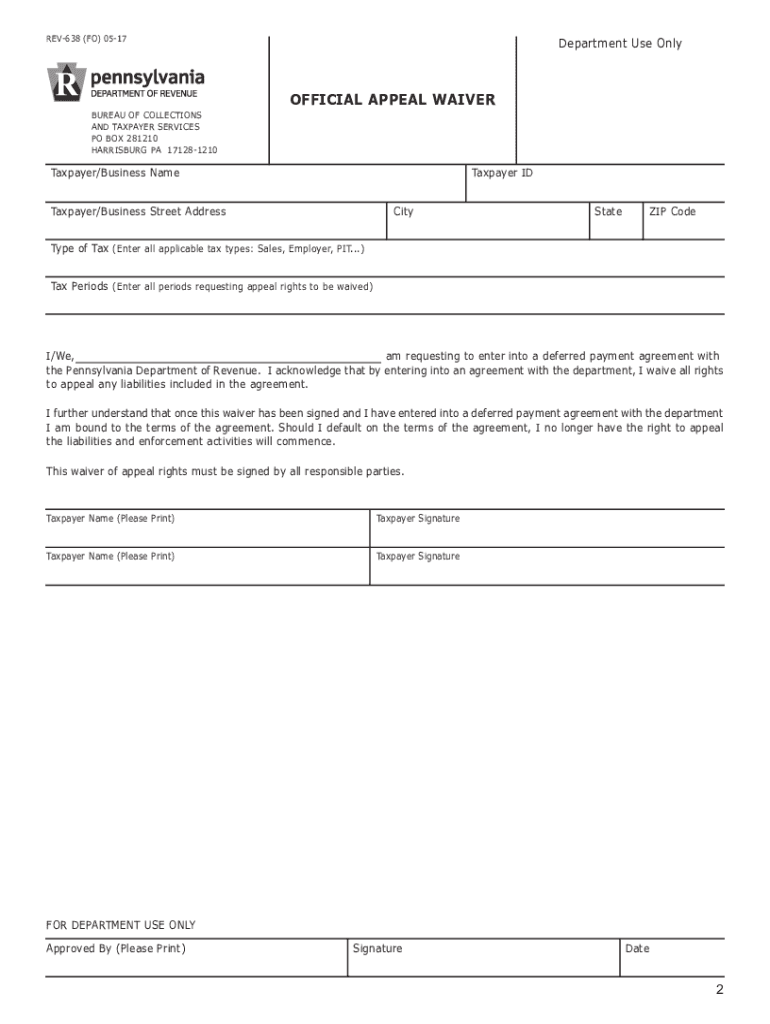

Get the free rev 638

Get, Create, Make and Sign rev 638 form

Editing rev 638 form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out rev 638 form

How to fill out rev 638?

Who needs rev 638?

Video instructions and help with filling out and completing rev 638

Instructions and Help about rev 638 form

Hey this is Chris wb2 I'm going to show you a die Alice x64 off running full speed no frame skip or anything on my PSP 3000 the special thing about this particular diet is that it is signed that means it does not have to be used with custom firmware or HPL it can be used on all firmware and all types of TSB's now I'm going to go down to the signed Dallas usually you would click on this then find the file for the diet list and then click on it so the HBA would read it but since it's signed I can just click on it and run it the only full speed game that I've seen so far is Super Mario 64 I've tried Super Smash Bros it's okay um the sound is very choppy I also tried golden I double seven that was pretty slow then double 07 the world is something, and it worked very good except there was no audio let me turn the volume up there's no frame skippering for me, you can see the sound is perfect and the movement of this right usually with all the other dialysis or whatever the salary would be very coffee with gaps in it, I'm sorry about the video being crappy as my only webcam is like made in 2003 and this sucks and all the sounds are synced so soon if something happens you'll hear the sound that happens if it Is painted it sometimes happen you'll get a tiny bug like that which happened as you can see it runs perfect all the other statuses that I will see for custom firmware is not as even closer good as this one as soon as I find the place where I downloaded this from I'll put the link-up on this video in the description the Dancing's no different as if you were playing Nintendo 64 on your TV except the sea buttons or the pad, and you just have to take your left thumb off the analog stick real fast he'll use the pad whenever you want to change the gear so there you have it please comment or subscribe to my other videos that I'll be posting and thank you for watching

People Also Ask about

Who must collect sales tax in pa?

How do I pay sales tax in PA?

Do I charge PA sales tax for out of state customers?

What is the sales tax in PA?

How do I get a PA sales tax ID number?

How do I file an amended sales tax return in PA?

How do I get a PA Revenue ID number?

How do I find my PA Revenue ID?

How much does it cost to get a PA tax ID number?

How do I get a PA sales tax license?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my rev 638 form in Gmail?

How can I edit rev 638 form from Google Drive?

Can I edit rev 638 form on an Android device?

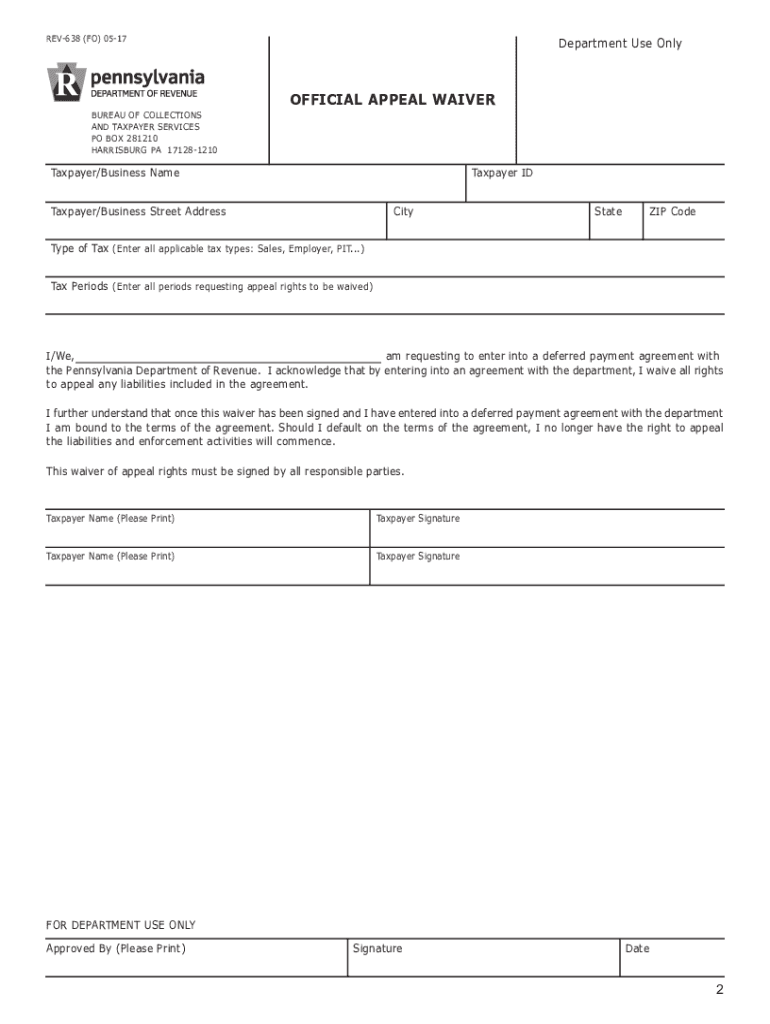

What is rev 638?

Who is required to file rev 638?

How to fill out rev 638?

What is the purpose of rev 638?

What information must be reported on rev 638?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.