Get the free TRUST ACCOUNT CERTIFICATE OF PERFORMANCE

Show details

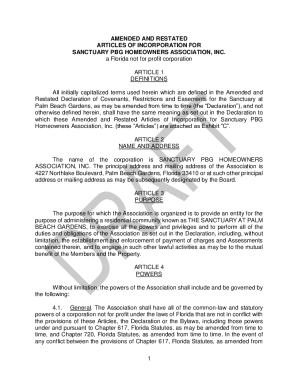

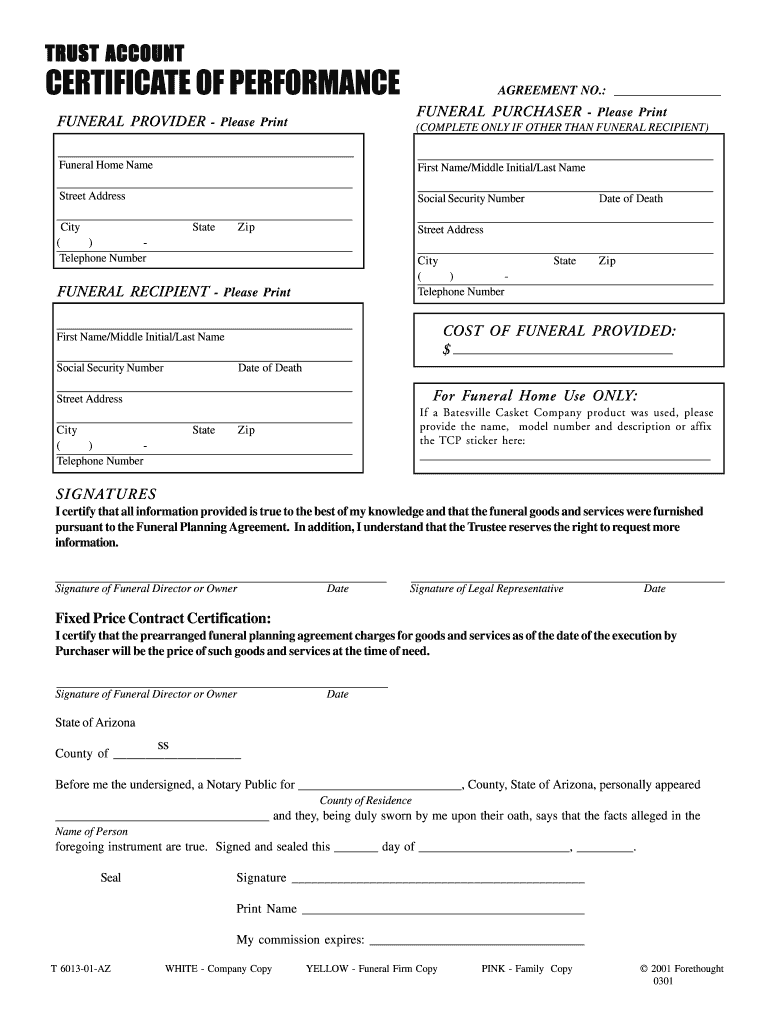

This document serves as a certificate for the performance of funeral services, including necessary information about the funeral purchaser, provider, and recipient, as well as conditions regarding

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign trust account certificate of

Edit your trust account certificate of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your trust account certificate of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit trust account certificate of online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit trust account certificate of. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

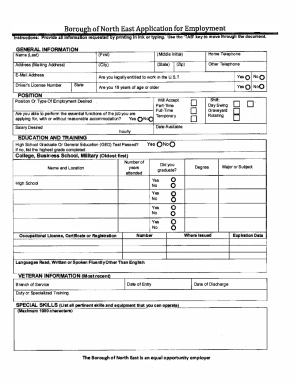

How to fill out trust account certificate of

How to fill out TRUST ACCOUNT CERTIFICATE OF PERFORMANCE

01

Obtain the TRUST ACCOUNT CERTIFICATE OF PERFORMANCE form from the relevant authority or website.

02

Fill in your personal or business information in the designated fields.

03

Provide details regarding the trust account, including account number, bank name, and branch.

04

Indicate the period of performance for which the certificate is being filled.

05

Include transaction details or balances as required by the form.

06

Sign and date the certificate to verify the information provided.

07

Submit the completed form to the appropriate regulatory body or organization.

Who needs TRUST ACCOUNT CERTIFICATE OF PERFORMANCE?

01

Individuals or businesses managing a trust account requiring verification of account performance.

02

Regulatory authorities or organizations that oversee financial institutions.

03

Clients who need assurance of the management and performance of funds in trust accounts.

Fill

form

: Try Risk Free

People Also Ask about

What assets are in a trust account?

Assets that DO belong in a trust These may include: Your house or other real estate, even if you still have a mortgage. Your bank accounts. Your non-retirement investment accounts that have your stocks, bonds, mutual funds and the like.

What is included in a trust accounting?

You should include specific information in a trust accounting that revolves around: Taxes paid, disbursements made to trust beneficiaries, and gains and losses on trust assets. Fees and expenses paid to advisors of the trustee, such as attorneys, CPAs, and financial advisors.

What are the expenses of a trust account?

Key Takeaways Trusts cover essential expenses: Living costs, healthcare, education and transportation are commonly approved expenses. Some payments require trustee approval: Large purchases, investments and discretionary spending must align with the trust's terms.

What is included in trust accounting income?

Trust accounting income includes all income generated by the trust, including interest, dividends, and capital gains.

What is the difference between a certificate of trust and a trust document?

The trust agreement is the parent document that details anything and everything regarding the trust, including its agreements. Meanwhile, the certificate of trust is used in tandem to keep nonessential information confidential.

What is the method of accounting for a trust?

Trust accounting involves the systematic recording of deposits, disbursements, income, expenses, and overall financial transactions within this fiduciary arrangement. This process ensures transparency and provides an accurate picture of the trust's financial status, safeguarding both the trustee and the beneficiary.

What is a lawyer's trust account?

(C) “IOTA account” means an interest or dividend-bearing trust account benefiting The Florida Bar Foundation established in an eligible institution for the deposit of nominal or short-term funds of clients or third persons.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is TRUST ACCOUNT CERTIFICATE OF PERFORMANCE?

The TRUST ACCOUNT CERTIFICATE OF PERFORMANCE is a formal document that certifies that funds have been maintained in a trust account for a specific purpose, typically related to real estate transactions or property management.

Who is required to file TRUST ACCOUNT CERTIFICATE OF PERFORMANCE?

Individuals or entities managing trust accounts, such as real estate brokers, property managers, or other fiduciaries responsible for handling client funds, are typically required to file this certificate.

How to fill out TRUST ACCOUNT CERTIFICATE OF PERFORMANCE?

To fill out a TRUST ACCOUNT CERTIFICATE OF PERFORMANCE, one must provide the name of the trust account holder, the account number, the financial institution's name, the balance in the account, and a declaration of compliance with applicable laws and regulations.

What is the purpose of TRUST ACCOUNT CERTIFICATE OF PERFORMANCE?

The purpose of the TRUST ACCOUNT CERTIFICATE OF PERFORMANCE is to ensure transparency and accountability in the management of trust funds, affirming that the funds are being used appropriately and in accordance with legal requirements.

What information must be reported on TRUST ACCOUNT CERTIFICATE OF PERFORMANCE?

Information that must be reported includes the identity of the account holder, the account number, the name of the institution holding the trust account, the current balance, and a statement of compliance with trust account management regulations.

Fill out your trust account certificate of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Trust Account Certificate Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.