Get the free Our bCharitableb Gift Policies - Indianapolis Zoo

Show details

INDIANAPOLIS ZOOLOGICAL SOCIETY, INC. CHARITABLE GIFT POLICIES FIRST EDITION APPROVED / RATIFIED: PLANNED GIVING COMMITTEE 2×11/03 INSTITUTIONAL ADVANCEMENT COMMITTEE 8×19/03 BOARD OF TRUSTEES 10×16/03

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign our bcharitableb gift policies

Edit your our bcharitableb gift policies form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your our bcharitableb gift policies form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing our bcharitableb gift policies online

Follow the guidelines below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit our bcharitableb gift policies. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out our bcharitableb gift policies

How to fill out our bcharitableb gift policies:

01

Start by reviewing the purpose and objectives of your charitable organization. Understand the goals and mission that the gift policies will support.

02

Familiarize yourself with the legal and tax regulations that apply to charitable gifts in your jurisdiction. This includes understanding the requirements for tax-deductible donations and any limitations or restrictions imposed by the law.

03

Identify the types of gifts that your organization is willing to accept. This can include cash, securities, real estate, valuable assets, and other forms of donations. Specify any conditions or restrictions for each type of gift.

04

Determine the minimum and maximum gift amounts that your organization will accept. This can help you manage donor expectations and ensure that each gift aligns with your organization's financial needs.

05

Define the process for accepting gifts. Provide clear instructions on how donors should communicate their intent to make a gift, and outline the necessary documentation or forms that need to be completed.

06

Establish guidelines for evaluating and accepting restricted gifts. This involves outlining the criteria for accepting donations with specific purposes or restrictions, and determining how the organization will determine whether to accept or decline such gifts.

07

Create a section outlining any naming opportunities or recognition for donors based on the gift amount or type. This can help incentivize and acknowledge donors, encouraging their continued support.

08

Include a section on confidentiality and privacy. Define how donor information will be handled and safeguarded, ensuring that the organization complies with relevant privacy laws and regulations.

Who needs our bcharitableb gift policies:

01

Nonprofit organizations: Charitable gift policies are essential for nonprofit organizations to establish clear guidelines and processes for accepting and managing donations.

02

Donors: Potential donors often seek information on an organization's gift policies before making a donation. Having well-defined policies can provide transparency and build trust with donors.

03

Board members and executives: The leadership of a nonprofit organization needs to be well-informed about the gift policies to ensure proper oversight and decision-making regarding donations.

04

Legal and financial advisors: Professionals assisting donors or working with nonprofit organizations require knowledge of the organization's gift policies to provide accurate advice and guidance.

05

Regulators and auditors: Government agencies and auditors may review an organization's gift policies to ensure compliance with tax laws and regulations.

In summary, filling out bcharitableb gift policies involves understanding your organization's objectives, complying with legal requirements, defining gift acceptance procedures, and addressing various considerations surrounding gifts. These policies benefit nonprofits, donors, leadership, advisors, government regulators, and auditors.

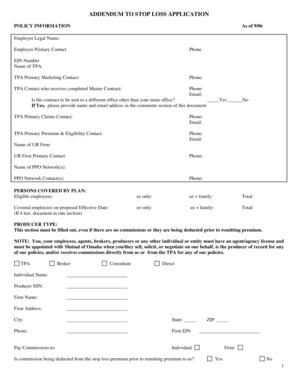

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I fill out our bcharitableb gift policies on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your our bcharitableb gift policies, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

How do I edit our bcharitableb gift policies on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as our bcharitableb gift policies. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

How do I fill out our bcharitableb gift policies on an Android device?

On Android, use the pdfFiller mobile app to finish your our bcharitableb gift policies. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is our bcharitableb gift policies?

Our charitable gift policies outline the guidelines and procedures for accepting and managing donations.

Who is required to file our bcharitableb gift policies?

All employees and volunteers involved in fundraising activities are required to adhere to our charitable gift policies.

How to fill out our bcharitableb gift policies?

Our charitable gift policies can be filled out by following the instructions provided in the policy document and submitting the necessary documentation.

What is the purpose of our bcharitableb gift policies?

The purpose of our charitable gift policies is to ensure transparency, accountability, and compliance with legal and ethical standards in fundraising and donation management.

What information must be reported on our bcharitableb gift policies?

Our charitable gift policies require reporting of all donations received, including the amount, source, and any restrictions or specifications.

Fill out your our bcharitableb gift policies online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Our Bcharitableb Gift Policies is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.