Get the free Payment Card Industry (PCI) Executive Report ASV Scan Report ... - atsec

Show details

Payment Card Industry (PCI) Executive Report 02/20/2012 ASV Scan Report Attestation of Scan Compliance Scan Customer Information Approved Scanning Vendor Information Company: Company: ATSEM information

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign payment card industry pci

Edit your payment card industry pci form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your payment card industry pci form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit payment card industry pci online

Follow the steps below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit payment card industry pci. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out payment card industry pci

How to fill out Payment Card Industry PCI:

Gather necessary documents and information:

01

Identify the type of PCI assessment required (Self-Assessment Questionnaire or Report on Compliance).

02

Obtain any relevant policies, procedures, and documentation related to your organization's cardholder data environment.

03

Collect network diagrams, system inventories, and other technical documentation.

Determine the scope of your PCI assessment:

01

Identify all systems, networks, and processes that store, transmit, or process cardholder data.

02

Define the boundaries of the cardholder data environment (CDE) and ensure all relevant components are included.

Understand the PCI Data Security Standard (PCI DSS) requirements:

01

Familiarize yourself with the twelve high-level requirements of PCI DSS.

02

Review the detailed sub-requirements and associated testing procedures for each requirement.

03

Ensure your organization is compliant with all applicable requirements.

3.1

Complete the Self-Assessment Questionnaire (SAQ) or engage a Qualified Security Assessor (QSA):

04

If eligible, choose the appropriate SAQ based on your organization's payment channels and processing methods.

05

Answer all questions in the SAQ honestly and accurately, providing supporting documentation where required.

06

If necessary, engage a QSA to perform an on-site assessment and guide you through the compliance process.

Perform vulnerability scans and penetration tests:

01

Conduct regular internal and external network vulnerability scans.

02

Address any vulnerabilities identified and ensure they are resolved.

03

Perform penetration testing to identify potential security weaknesses and validate the effectiveness of controls.

Implement necessary controls and security measures:

01

Ensure encryption is used for cardholder data transmission across public networks.

02

Implement strong access controls, including unique user IDs, strong passwords, and multi-factor authentication.

03

Regularly update and patch systems to protect against known vulnerabilities.

04

Use secure coding practices and regularly test applications for security flaws.

Who needs Payment Card Industry PCI?

Payment Card Industry Data Security Standard (PCI DSS) compliance is mandatory for any organization that handles payment card data. This includes:

01

Merchants: Businesses that accept payment cards (credit, debit, or prepaid) as a form of payment. This can range from small e-commerce websites to large retail chains.

02

Service Providers: Any organization that processes, stores, or transmits payment card data on behalf of merchants. This may include payment gateways, web hosting providers, software vendors, or third-party payment processors.

03

Issuing Banks: Financial institutions that issue payment cards to consumers and are responsible for ensuring their customers' card data is secure.

04

Acquiring Banks: Financial institutions that partner with merchants to facilitate payment card transactions and ensure compliance with PCI DSS.

Compliance with PCI DSS helps protect cardholder data and maintain the trust of customers, mitigate the risk of data breaches, and avoid potential financial penalties or loss of payment card processing capabilities.

Fill

form

: Try Risk Free

People Also Ask about

Is PCI certification mandatory?

All business that store, process or transmit payment cardholder data must be PCI Compliant.

What is the executive summary of PCI?

The Executive Summary shows whether each scanned component (IP address) received a passing score and met the scan validation requirement, and displays a list of all vulnerabilities noted for each IP address.

What is ASV in PCI compliance?

Meaning. ASV Acronym for "Approved Scanning Vendor." Refers to a company qualified by PCI SSC for ASV Program purposes to conduct external vulnerability scanning services in ance with PCI DSS Requirement 11.2.

Is PCI compliance required by law?

Though the PCI DSS is not the law, it applies to merchants in at least two ways: (1) as part of a contractual relationship between a merchant and card company, and (2) states may write portions of the PCI DSS into state law.

Is PCI compliance a legal mandate?

While there is not necessarily a regulatory mandate for PCI compliance, it is regarded as mandatory through court precedent. In general, PCI compliance is a core component of any credit card company's security protocol. It is generally mandated by credit card companies and discussed in credit card network agreements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out payment card industry pci using my mobile device?

Use the pdfFiller mobile app to fill out and sign payment card industry pci. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

How do I complete payment card industry pci on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your payment card industry pci from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

How do I complete payment card industry pci on an Android device?

Complete payment card industry pci and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

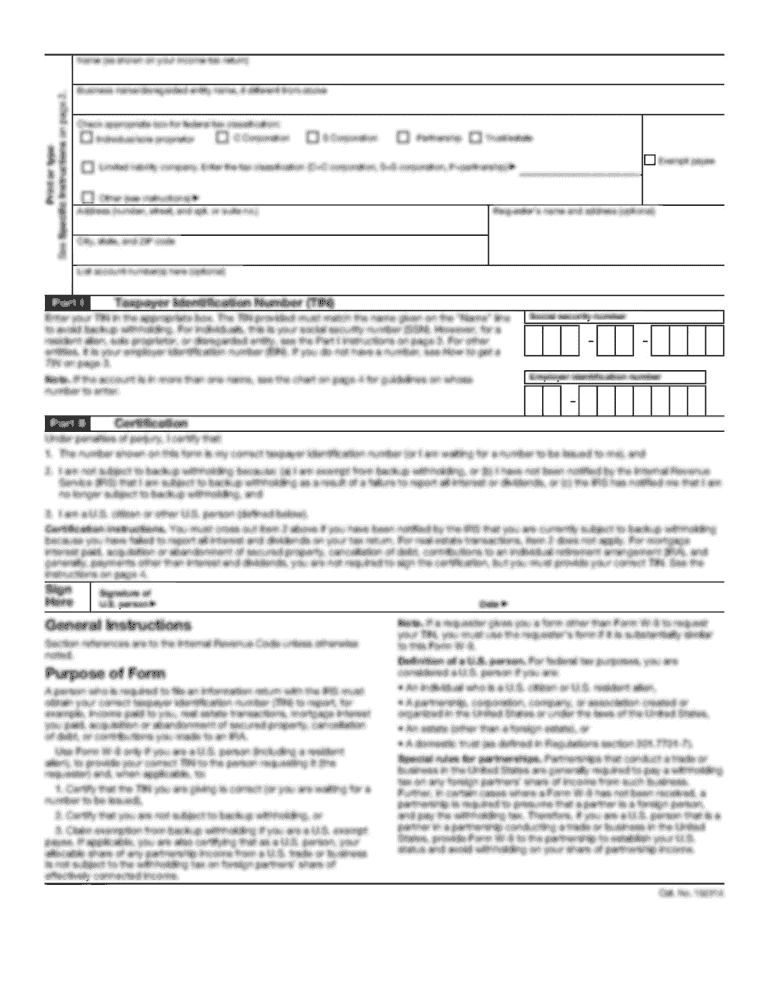

What is payment card industry pci?

Payment Card Industry Data Security Standard (PCI DSS) is a set of security standards designed to ensure that all companies that accept, process, store, or transmit credit card information maintain a secure environment to protect cardholder data.

Who is required to file payment card industry pci?

Any company that accepts, processes, stores, or transmits credit card information is required to comply with the Payment Card Industry Data Security Standard (PCI DSS) and file a PCI compliance report.

How to fill out payment card industry pci?

Filling out the Payment Card Industry Data Security Standard (PCI DSS) involves assessing your cardholder data environment, implementing security measures, documenting policies and procedures, and completing a self-assessment or engaging a qualified third-party assessor to perform an onsite assessment.

What is the purpose of payment card industry pci?

The purpose of the Payment Card Industry Data Security Standard (PCI DSS) is to protect cardholder data and ensure the secure handling of credit card information to prevent data breaches and the potential misuse of sensitive payment card information.

What information must be reported on payment card industry pci?

On the Payment Card Industry Data Security Standard (PCI DSS) report, companies need to report information such as their network architecture, access control measures, security policies, software development practices, and incident response procedures.

Fill out your payment card industry pci online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Payment Card Industry Pci is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.