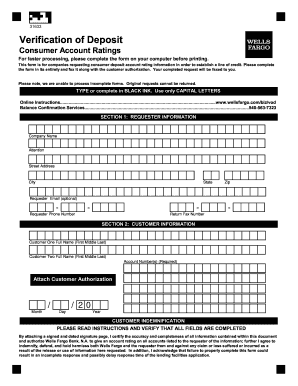

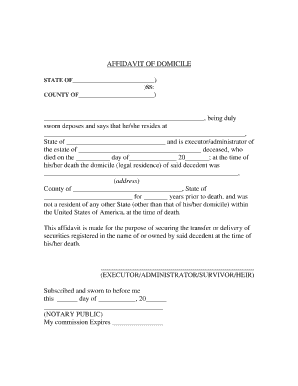

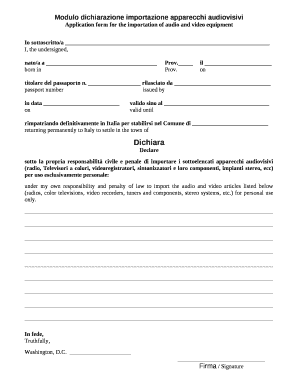

Get the free Tax Incentives Application Act to Promote the Transfer ... - Luca Center

Show details

Department of Economic Development and Commerce Office of Industrial Tax Exemption 355 Franklin D. Roosevelt NATO Rey, PR 00918 ×787× 7646363 Form Last Revised 07×02/2013 Tax Incentives Application

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax incentives application act

Edit your tax incentives application act form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax incentives application act form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax incentives application act online

To use the services of a skilled PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit tax incentives application act. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax incentives application act

How to fill out tax incentives application act:

01

Gather all necessary information and documents: Before starting the application, make sure you have all the required information and documents such as your personal details, financial records, and any relevant supporting documents.

02

Research and understand the eligibility criteria: Familiarize yourself with the eligibility criteria for the tax incentives application act. Check if you meet the required qualifications and if your business or organization qualifies for the incentives.

03

Complete the application form: Fill out the application form accurately and completely. Provide all the necessary details as requested, ensuring that there are no errors or missing information. Double-check your entries for accuracy.

04

Attach supporting documentation: Attach any required supporting documentation, such as financial statements, business plans, or other relevant documents that substantiate your eligibility for the incentives. Make sure to include all necessary paperwork to avoid delays or rejection.

05

Review and proofread: Before submitting your application, thoroughly review and proofread all the information provided. Check for any errors, missing information, or inconsistencies. It is crucial to ensure the accuracy and completeness of your application.

06

Submit the application: Once you are confident that your application is accurate and complete, submit it according to the instructions provided. Follow the submission guidelines, whether it is through an online portal, mail, or in-person submission.

Who needs tax incentives application act:

01

Individuals or businesses seeking financial incentives: The tax incentives application act is intended for individuals or businesses that want to apply for specific financial incentives offered by the government or regulatory bodies.

02

Startups and small businesses: Startups and small businesses often take advantage of tax incentives to support their growth and development. These incentives can include tax credits, grants, exemptions, or deductions, depending on the program and jurisdiction.

03

Investors and developers: Investors and developers involved in specific industries or projects may require tax incentives to encourage investment, job creation, or economic development. Incentives may include tax breaks, low-interest loans, or other financial support to incentivize their participation.

04

Non-profit organizations: Non-profit organizations may also be eligible for tax incentives, such as exemptions from certain taxes or the ability to receive tax-deductible donations. These incentives can support the organization's mission and help attract donations and funding.

Note: The specific eligibility criteria and incentives vary depending on the jurisdiction and program. It is essential to research and understand the specific requirements and benefits available in your particular location.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find tax incentives application act?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific tax incentives application act and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I edit tax incentives application act online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your tax incentives application act to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How can I edit tax incentives application act on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing tax incentives application act.

What is tax incentives application act?

The tax incentives application act is a legislation that allows individuals or businesses to apply for tax breaks or reductions to encourage certain behaviors or investments.

Who is required to file tax incentives application act?

Any individual or business that wants to take advantage of tax incentives must file a tax incentives application act.

How to fill out tax incentives application act?

To fill out a tax incentives application act, individuals or businesses must provide information about their income, investments, or activities that qualify for tax incentives.

What is the purpose of tax incentives application act?

The purpose of tax incentives application act is to promote certain economic behaviors or investments by providing tax breaks to individuals or businesses.

What information must be reported on tax incentives application act?

On a tax incentives application act, individuals or businesses must report their income, investments, or activities that qualify for tax incentives.

Fill out your tax incentives application act online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Incentives Application Act is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.