Get the free Group Life

Show details

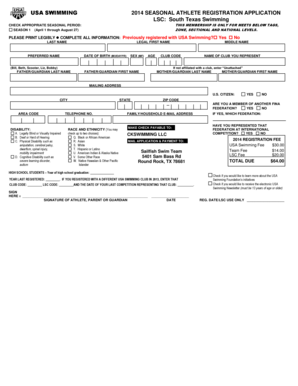

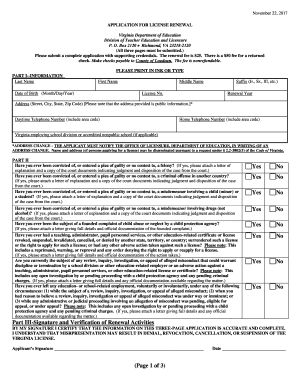

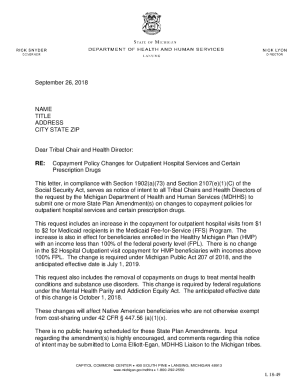

This document outlines the Group Life Insurance options available for employees of Dysart Unified School District No. 89, detailing coverage benefits, costs, features, and eligibility requirements

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign group life

Edit your group life form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your group life form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing group life online

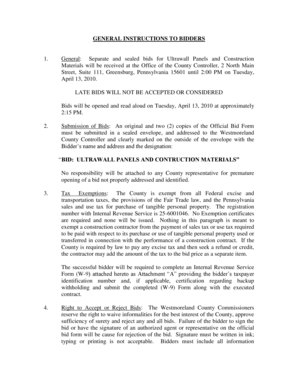

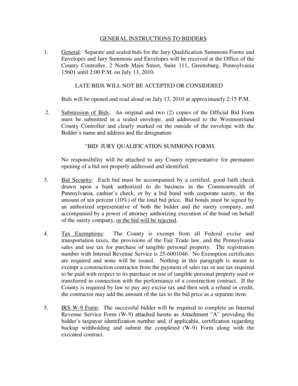

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit group life. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out group life

How to fill out Group Life

01

Obtain Group Life Insurance application form from your employer or insurance provider.

02

Fill in the required personal information such as your name, address, and contact details.

03

Specify the amount of coverage required and any additional benefits you may want.

04

List any dependents who will be covered under the policy.

05

Review the terms and conditions thoroughly before signing.

06

Submit the completed application form to your employer or directly to the insurance provider.

Who needs Group Life?

01

Individuals working in companies that offer Group Life Insurance as part of their employee benefits.

02

Families looking for financial protection in case of an untimely death of a breadwinner.

03

Employers wanting to provide a safety net for their employees and enhance workplace morale.

04

Employees seeking affordable life insurance coverage as part of a group plan.

Fill

form

: Try Risk Free

People Also Ask about

What is group term life on my paycheck?

Typically, term life insurance benefits are paid when the insured has died and the beneficiary files a death claim with the insurance company. Many states allow insurers 30 days to review the claim after receiving a certified copy of the death certificate.

How does group term life work?

The core concept of group life insurance is simple: a single policy covers all eligible participants, offering a death benefit in the unfortunate event of an insured's death. The employer owns the policy and certificates of coverage are issued to its employees.

What does group term life mean on my paycheck?

Group term life insurance through your employer or an association offers affordable, easy-to-get coverage that provides financial protection for your family if you die. However, employment-based group life is temporary coverage that may not provide a sufficient death benefit to meet all your family's financial needs.

What is the meaning of group life?

Group life cover is a type of term insurance, also known as death in service benefit, which an employer may offer to their staff. It is set up by your employer to cover you while you are employed within their organisation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Group Life?

Group Life is a type of life insurance coverage that provides financial protection to a group of people, typically employees of a company, under a single policy.

Who is required to file Group Life?

Employers or organizations that offer group life insurance to their employees or members are required to file Group Life.

How to fill out Group Life?

To fill out Group Life, one must complete the designated form provided by the insurance company, which typically includes details about the group, coverage amounts, and the insured individuals.

What is the purpose of Group Life?

The purpose of Group Life is to provide insurance coverage to a large number of individuals, offering them financial security and peace of mind in the event of death.

What information must be reported on Group Life?

The information that must be reported on Group Life includes the group's name, policy number, names of insured individuals, their ages, coverage amounts, and any applicable beneficiaries.

Fill out your group life online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Group Life is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.