Get the free Mail To 214 E Oak Avenue Visalia CA 93291 WINTER - artsvisalia

Show details

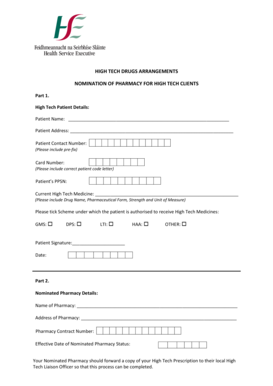

Mail To: 214 E. Oak Avenue, Visalia, CA 93291 Phone: (559× 739 0905 Email: artsvisalia global.net ART SCHOLARSHIP APPLICATION WINTER SPRING 2013 CHILDREN ART CLASSES www.artsvisalia.org Which class

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mail to 214 e

Edit your mail to 214 e form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mail to 214 e form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mail to 214 e online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit mail to 214 e. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mail to 214 e

How to fill out mail to 214 e:

01

Start by addressing the recipient. Write their name, title, and address on the first line of the mail.

02

Include your own contact information next. Write your name, title, and address below the recipient's information.

03

Write the date of the mail on the next line. Make sure to use the correct format, such as "March 21, 2022."

04

Begin the mail with a formal salutation, such as "Dear Mr./Ms. [Last Name]." If you do not know the recipient's name, you can use a general salutation like "To Whom It May Concern."

05

Introduce yourself or your company in the opening paragraph. Provide a brief background or context for the mail.

06

In the body of the mail, clearly state the purpose of the mail. Be concise and specific in conveying your message.

07

Use paragraphs or bullet points to organize your thoughts and make the mail easier to read. Each paragraph or point should address a separate aspect of the subject.

08

Provide any necessary supporting information or documents. If there are attachments, clearly mention them in the mail and ensure they are included.

09

Summarize the main points or the request towards the end of the mail. If there are any specific actions needed from the recipient, clearly state them.

10

End the mail with a polite closing, such as "Sincerely" or "Best regards." Sign your name below the closing.

11

Proofread the mail for any errors or typos before sending it.

12

Make a copy of the mail for your records.

13

Send the mail using the appropriate mailing service or method.

Who needs mail to 214 e?

01

Individuals or businesses who need to communicate important information or requests to a specific recipient.

02

Anyone who wants to send a professional and formal message while maintaining a proper structure and format.

03

People who want to ensure their mail is organized and easily understandable by the recipient.

04

Individuals or companies who require a record of their communications for future reference.

05

Anyone who wants to present their message clearly and concisely in writing.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find mail to 214 e?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the mail to 214 e. Open it immediately and start altering it with sophisticated capabilities.

How can I edit mail to 214 e on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing mail to 214 e right away.

How do I fill out mail to 214 e on an Android device?

Complete your mail to 214 e and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is mail to 214 e?

Mail to 214 e is a form used to report foreign financial accounts.

Who is required to file mail to 214 e?

U.S. persons, including individuals, corporations, partnerships, and trusts, who have a financial interest in or signature authority over foreign financial accounts.

How to fill out mail to 214 e?

Mail to 214 e can be filled out online through the Financial Crimes Enforcement Network (FinCEN) website or by paper form mailed to the IRS.

What is the purpose of mail to 214 e?

The purpose of mail to 214 e is to report foreign financial accounts to the U.S. government in order to prevent tax evasion and money laundering.

What information must be reported on mail to 214 e?

Information such as the account number, account value, type of account, name of the financial institution, and the maximum value of the account during the reporting period must be reported on mail to 214 e.

Fill out your mail to 214 e online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mail To 214 E is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.