CA FTB Schedule CA (540) 2004 free printable template

Show details

Reset Form Print and Reset Form TAXABLE YEAR 2004 SCHEDULE CA (540) California Adjustments Residents Important: Attach this schedule directly behind Form 540, Side 2. Name(s) as shown on return Social

pdfFiller is not affiliated with any government organization

Instructions and Help about CA FTB Schedule CA 540

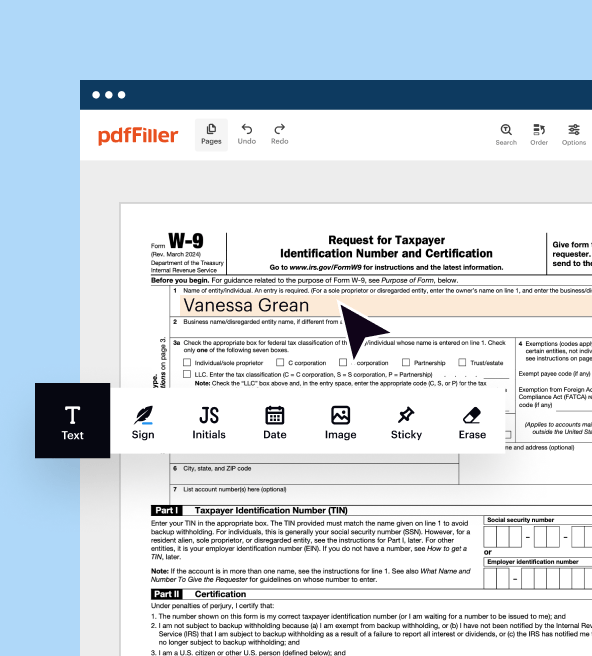

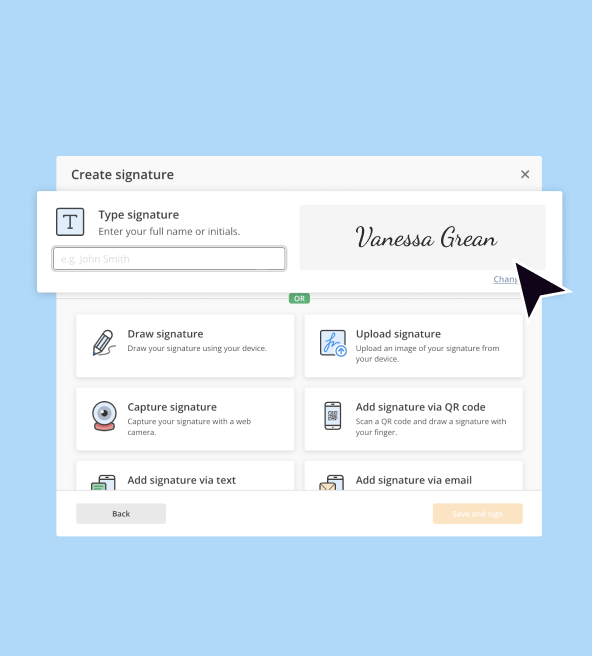

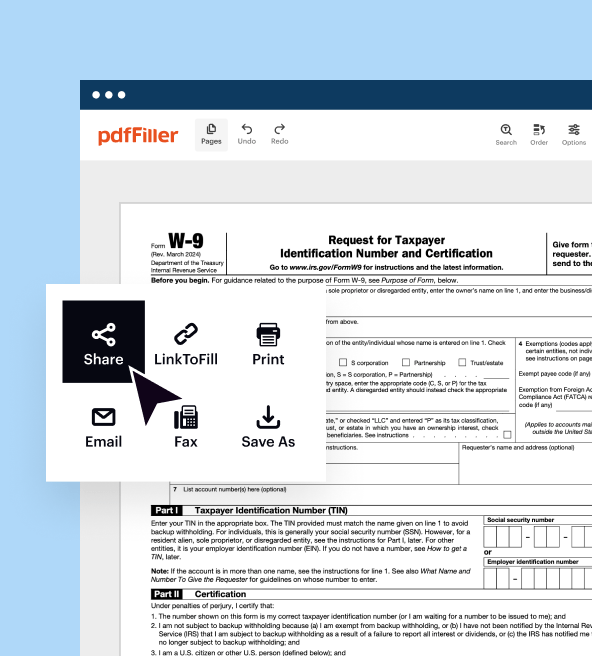

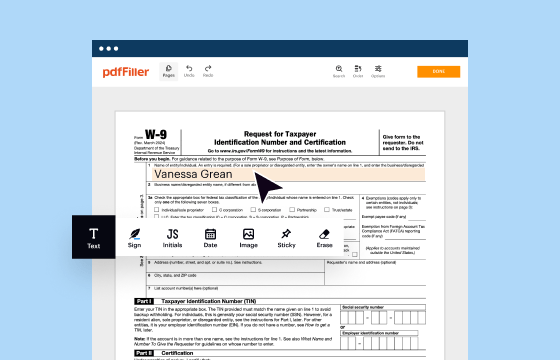

How to edit CA FTB Schedule CA 540

How to fill out CA FTB Schedule CA 540

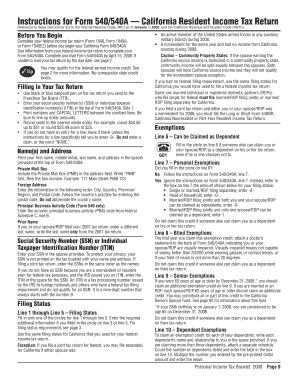

Instructions and Help about CA FTB Schedule CA 540

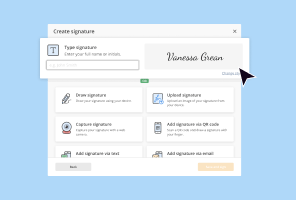

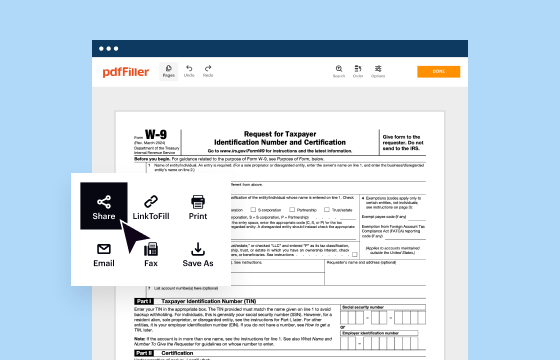

How to edit CA FTB Schedule CA 540

To edit the CA FTB Schedule CA 540 form, use a reliable PDF editing tool such as pdfFiller. Start by uploading your existing form into the platform. You can then make necessary changes, such as updating personal information or correcting numerical entries. Once you finish editing, ensure you save your changes properly to maintain the integrity of the document.

How to fill out CA FTB Schedule CA 540

To fill out the CA FTB Schedule CA 540, follow these steps:

01

Gather all necessary documents, including W-2s, 1099s, and deduction records.

02

Provide personal information, such as your name, address, and Social Security number.

03

Report income received during the tax year in the appropriate fields.

04

Claim any eligible deductions or credits, ensuring you have supporting documents available.

05

Review all entered information for accuracy before submission.

About CA FTB Schedule CA previous version

What is CA FTB Schedule CA 540?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About CA FTB Schedule CA previous version

What is CA FTB Schedule CA 540?

CA FTB Schedule CA 540 is a state tax form used for California residents to report income, claim deductions, and calculate taxes owed to the state. This specific version of the form was relevant for the tax year 2004, reflecting the regulations and tax laws applicable during that period.

What is the purpose of this form?

The primary purpose of the CA FTB Schedule CA 540 is to determine the taxpayer's California tax liability for the year. It allows taxpayers to report their income from various sources and to claim any deductions or credits for which they qualify. This form is essential for ensuring compliance with California tax laws.

Who needs the form?

Individuals who were residents of California during the tax year and have a reportable income are required to fill out this form. This includes those who had earnings from wages, self-employment, investments, or other income sources. It is mandatory for all residents filing their state income tax returns.

When am I exempt from filling out this form?

You may be exempt from filling out CA FTB Schedule CA 540 if your total income falls below the state's filing threshold or if you qualify for certain specific exemptions as outlined by California tax law. Additionally, certain non-residents may not need to file based on their income sources and California residency duration during the year.

Components of the form

The CA FTB Schedule CA 540 consists of various components, including sections for reporting income, deductions, and credits. Key sections typically involve personal information, total income calculation, adjustments to income, and tax credits applicable to California residents. Each section is carefully structured to facilitate accurate reporting.

What are the penalties for not issuing the form?

Penalties for failing to submit CA FTB Schedule CA 540 can include fines and interest on unpaid taxes. The California Franchise Tax Board typically charges a late filing penalty, which increases the longer the taxpayer waits to file. It's essential to meet filing deadlines to avoid unnecessary costs.

What information do you need when you file the form?

When filing CA FTB Schedule CA 540, you will need several pieces of information, including:

01

Your Social Security number and the Social Security numbers of any dependents.

02

Documentation of all income sources, such as W-2s and 1099 forms.

03

Records of any deductions you plan to claim, such as mortgage interest or medical expenses.

04

Bank account information if you are opting for direct deposit for any refund.

Is the form accompanied by other forms?

Yes, CA FTB Schedule CA 540 may be accompanied by other forms depending on your specific tax situation. Commonly, taxpayers will need to submit additional schedules or forms related to specific deductions, credits, or adjustments. It is crucial to review the instructions carefully to ensure all necessary documents are included.

Where do I send the form?

The completed CA FTB Schedule CA 540 should be mailed to the address specified in the filing instructions based on your residence category and whether you are enclosing a payment. Commonly, forms can be sent to the California Franchise Tax Board using the designated address found on the form or the official FTB website.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

Excellent product and excellent customer service team.

Excellent product of easy manipulation with expected result. They have an excellent customer service team. I recommend!!

good service

good service,but expensive.

See what our users say