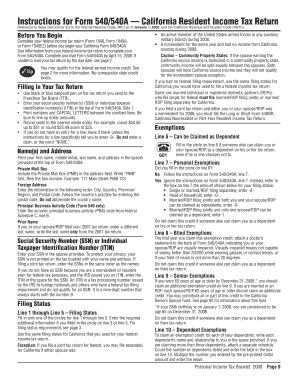

CA FTB Schedule CA (540) 2004 free printable template

Instructions and Help about CA FTB Schedule CA 540

How to edit CA FTB Schedule CA 540

How to fill out CA FTB Schedule CA 540

About CA FTB Schedule CA previous version

What is CA FTB Schedule CA 540?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about CA FTB Schedule CA 540

What should I do if I need to correct a mistake on my CA FTB Schedule CA 540?

If you discover an error after submitting your CA FTB Schedule CA 540, you need to file an amended return. Use the California Form 540X to correct the mistakes. Make sure to include any necessary documentation and explain the changes made.

How can I verify the status of my CA FTB Schedule CA 540 submission?

To check the status of your CA FTB Schedule CA 540 submission, you can use the FTB's online services portal. It allows you to verify if your form has been received and is being processed. If you e-filed and received a confirmation, ensure you save that as proof.

What technical requirements should I consider for e-filing the CA FTB Schedule CA 540?

When e-filing the CA FTB Schedule CA 540, ensure your software is compatible with the latest version of the form and supports the electronic filing format. Additionally, a stable internet connection and updated browser are crucial for a smooth filing experience.

What common errors occur when filing the CA FTB Schedule CA 540, and how can I avoid them?

Common errors when filing the CA FTB Schedule CA 540 include mismatched information, incorrect calculations, and failure to sign the form. To avoid these, double-check your entries for accuracy and ensure all required fields are completed before submission.

See what our users say