Get the free Schedules of Assets and Liabilities

Show details

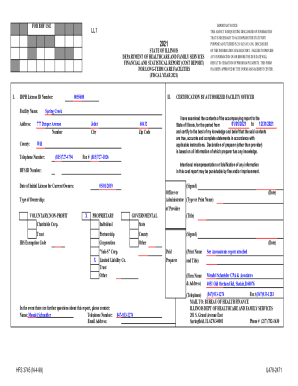

This document contains the schedules detailing the assets and liabilities of Patriot Coal Services LLC as part of the bankruptcy proceedings under Chapter 11.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign schedules of assets and

Edit your schedules of assets and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your schedules of assets and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit schedules of assets and online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit schedules of assets and. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out schedules of assets and

How to fill out Schedules of Assets and Liabilities

01

Gather all financial information, including bank statements, property deeds, and loan documents.

02

Start with assets: List all valuable items you own, such as cash, real estate, vehicles, and investments.

03

Assign a fair market value to each asset and ensure all values are up-to-date.

04

Next, list all liabilities: Include all debts such as mortgages, car loans, credit card debts, and any other financial obligations.

05

Provide the total amount owed for each liability and ensure accuracy.

06

Review the completed schedule for any omissions or inaccuracies.

07

Finally, submit the completed Schedules of Assets and Liabilities as required by the relevant authority or during bankruptcy proceedings.

Who needs Schedules of Assets and Liabilities?

01

Individuals undergoing bankruptcy proceedings.

02

Businesses seeking to assess their financial health.

03

Creditors evaluating outstanding debts.

04

Financial planners creating a comprehensive financial profile.

05

Legal professionals handling bankruptcy or estate matters.

Fill

form

: Try Risk Free

People Also Ask about

What are assets and liabilities in English language?

How to fill out the Declaration of Assets and Liabilities Form? Gather all necessary documents related to your finances. Fill in details regarding movable and immovable assets. Document any outstanding liabilities and dues. Provide personal information accurately. Review the form for accuracy before submission.

What is an asset and liability schedule?

Schedule AL is a part of ITR, which requires disclosure of all assets and liabilities held by a taxpayer at the end of every financial year.

What is the schedule of liabilities?

What is a 'Schedule of Assets'? The Schedule of Assets is a list of the assets that you hold in your Trust and subject to the provisions of the Trust. This can be easily updated as you add or remove Trust assets. This document is included in the Trust-Based Estate Plan.

What is a schedule of assets and liabilities?

Schedules of Assets and Liabilities means the Schedule of All Liabilities of Debtor and Statement of All Property of Debtors Filed by a Debtor, as the same have been or may be amended or supplemented from time to time prior to the Effective Date.

How to fill a declaration of assets and liabilities?

Businesses also refer to assets and liabilities as "profits" and "losses." Assets represent a company's resources, while liabilities represent a company's obligations. An asset helps business owners and financial professionals find out what the company owns. Liabilities show what a company owes.

What is the schedule of assets and liabilities?

Assets are the items your company owns that can provide future economic benefit. Liabilities are what you owe other parties. In short, assets put money in your pocket, and liabilities take money out!

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Schedules of Assets and Liabilities?

Schedules of Assets and Liabilities is a financial document that provides a detailed listing of an individual's or entity's assets and liabilities at a specific point in time. It is often used in bankruptcy filings to assess financial standing.

Who is required to file Schedules of Assets and Liabilities?

Individuals or businesses filing for bankruptcy are typically required to file Schedules of Assets and Liabilities. This includes both Chapter 7 and Chapter 13 bankruptcy filers.

How to fill out Schedules of Assets and Liabilities?

To fill out Schedules of Assets and Liabilities, individuals must list all assets and liabilities in specified categories, providing details such as type, value, and ownership of each asset, as well as the nature and amount of each liability.

What is the purpose of Schedules of Assets and Liabilities?

The purpose of Schedules of Assets and Liabilities is to provide the court and creditors with a clear overview of the financial situation of the debtor, helping to determine eligibility for bankruptcy and guiding the distribution of assets.

What information must be reported on Schedules of Assets and Liabilities?

The information that must be reported includes all assets (such as real estate, bank accounts, and personal property) and all liabilities (such as debts, loans, and obligations), along with their respective values and descriptions.

Fill out your schedules of assets and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Schedules Of Assets And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.