Get the free FORM 48

Show details

This document is used to request a refund adjustment under the Chhattisgarh Value Added Tax Act, detailing the amount, recipient, and reason for the refund.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 48

Edit your form 48 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 48 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 48 online

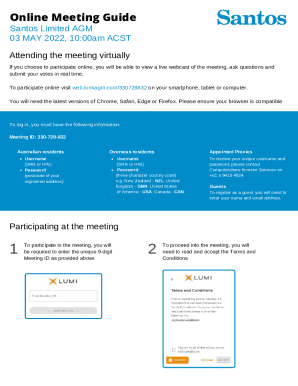

Follow the steps down below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form 48. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 48

How to fill out FORM 48

01

Obtain a copy of FORM 48 from the relevant authority or website.

02

Fill in your personal details in the designated fields, including your name, address, and contact information.

03

Provide any necessary identification numbers, such as your Social Security Number or Tax Identification Number, if required.

04

Clearly state the purpose for submitting FORM 48 in the appropriate section.

05

Review all the information you have entered for accuracy and completeness.

06

Sign and date the form at the bottom where indicated.

07

Attach any supporting documents that may be required.

08

Submit the completed FORM 48 to the appropriate office by mail or in-person.

Who needs FORM 48?

01

Individuals who are applying for a specific legal determination or relief under applicable laws may need FORM 48.

02

Organizations or entities requiring formal recognition or status may also need to submit FORM 48.

03

Legal representatives or agents acting on behalf of individuals or organizations may need to complete and submit FORM 48.

Fill

form

: Try Risk Free

People Also Ask about

What is a 48 form?

The purpose of Form 48 is to authorize the USPTO to communicate with a patent practitioner regarding a patent application.

What is the purpose of Rita tax?

The RITA reimburses an eligible transferred employee substantially all of the additional Federal, State, and local income taxes incurred as a result of receiving taxable travel income. Travel W-2 wages/income and withholdings are reported to the IRS.

What is Rita Form 48?

This file contains the Business Registration Form 48 provided by the Regional Income Tax Agency of Ohio. It is essential for businesses registering for tax purposes in the RITA municipalities.

What happens if you don't file RITA?

Penalties for Not Paying RITA Taxes RITA is known for aggressively pursuing unpaid local taxes, whether they are for services like waste collection or general municipal obligations. Missing even a single payment can result in late fees, wage garnishments, or other serious financial consequences.

Who has to file an Ohio RITA return?

Resident individuals who are 18 years of age and older must file an annual return, even if no tax is due. Non-resident individuals who have earned income in a RITA municipality that is not subject to employer withholding must file an annual return.

What is Form 16 in English?

Form 16 is a tax document issued by employers to their employees. It serves as a certificate of tax deducted at source (TDS) on salary payments. The form contains details about the income earned, TDS deducted, and other deductions allowed under the Income Tax Act.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is FORM 48?

FORM 48 is a document used in specific regulatory contexts that typically requires individuals or entities to report information related to transactions, compliance, or financial status.

Who is required to file FORM 48?

Typically, individuals or entities involved in certain types of transactions or regulatory compliance in specific industries, such as manufacturers, financial institutions, or other entities subject to regulatory oversight, are required to file FORM 48.

How to fill out FORM 48?

To fill out FORM 48, one must accurately provide all required information as specified in the form's guidelines, ensuring that any necessary documentation or supplemental information is also included.

What is the purpose of FORM 48?

The purpose of FORM 48 is to ensure transparency and compliance with regulatory requirements by collecting necessary information from filers regarding their financial or operational activities.

What information must be reported on FORM 48?

FORM 48 typically requires reporting on financial details, transaction specifics, compliance statements, and any other information relevant to the regulatory authority overseeing the filer's operations.

Fill out your form 48 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 48 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.