Get the free FORM NO.16AA

Show details

This document serves as a certificate for tax deducted at source for individuals employed in India, pertaining to income categorized under salaries, detailing income calculations, deductions, and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form no16aa

Edit your form no16aa form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form no16aa form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form no16aa online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit form no16aa. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form no16aa

How to fill out FORM NO.16AA

01

Obtain FORM NO.16AA from your employer or the relevant tax authority.

02

Fill in your personal details, including your name, address, and PAN.

03

Enter the assessment year for which the form is being filled.

04

Specify the income details in the respective sections, including salary and other income sources.

05

Enter the deductions you are eligible for under sections like 80C, 80D, etc.

06

Calculate the total taxable income by subtracting deductions from total income.

07

Fill in the tax calculation details and the corresponding amount payable.

08

Review the filled form for accuracy before submission.

09

Submit the completed form to your employer or the tax office as instructed.

Who needs FORM NO.16AA?

01

Individuals who have income that is taxable and wish to claim deductions for certain investments or expenses.

02

People who are filing their income tax returns and need to show proof of income and deductions.

03

Employees who receive a salary and need to verify their TDS deductions.

Fill

form

: Try Risk Free

People Also Ask about

Who generates form 16A?

16A income tax form is a vital document for taxpayers that acts as proof of Tax Deducted at Source (TDS) paid on income earned other than through a salary. It is issued by the deductors and verifies the amount of TDS deducted and deposited to the government.

Can I file ITR without form 16A?

If you don't have Form 16, you can still file your income tax return by using your salary slips and Form 26AS to calculate your total income and the tax deducted. Salary slips provide details of your earnings and deductions, while Form 26AS provides a summary of taxes deducted and deposited against your PAN.

What income does Form 16A cover?

Form 16A serves as proof that TDS was deducted from income sources other than salary and provides essential details about the same. For instance, income generated in the form of interest of fixed deposits, insurance commissions, rent receipts, securities, etc., are some of the details that are included.

What is Form 16 A of income tax?

Form 16/ 16A is the certificate of deduction of tax at source and issued on deduction of tax by the employer on behalf of the employees. These certificates provide details of TDS / TCS for various transactions between deductor and deductee. It is mandatory to issue these certificates to Tax Payers.

What's the difference between form 16 and 16A?

Form 16 is a certificate stating the details of tax deducted at source from taxable salary income. Form 16A is a certificate stating the details of tax deducted at source from non-salary earnings.

Can I download Form 16A online?

Step 1 – Visit Income Tax's official website. Step 2 – Login to TRACES. Step 3 – Navigate to the 'Downloads' tab. Step 4 – Select 'Form 16A'.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is FORM NO.16AA?

FORM NO.16AA is a certificate that provides details of tax deducted at source (TDS) for an individual taxpayer. It is issued by the employer or the deductor of TDS.

Who is required to file FORM NO.16AA?

FORM NO.16AA must be filed by taxpayers who receive income from sources where TDS is deducted by their employers or deductors. It is typically used by salaried individuals.

How to fill out FORM NO.16AA?

To fill out FORM NO.16AA, an individual needs to provide personal details, the relevant financial year, TDS details, and income information as required in the form layout.

What is the purpose of FORM NO.16AA?

The purpose of FORM NO.16AA is to serve as proof of TDS deduction, allowing taxpayers to claim credit for the tax deducted while filing their income tax returns.

What information must be reported on FORM NO.16AA?

FORM NO.16AA must report information such as the taxpayer's name, PAN, details of the deductor, the amount of income, total TDS deducted, and the financial year.

Fill out your form no16aa online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form no16aa is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

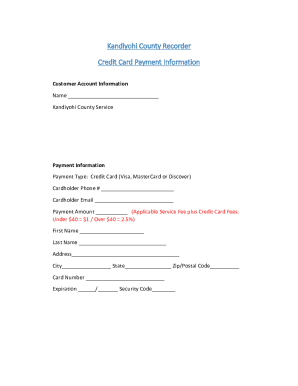

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.