Get the free THE ASSAM VALUE ADDED TAX RULES, 2005

Show details

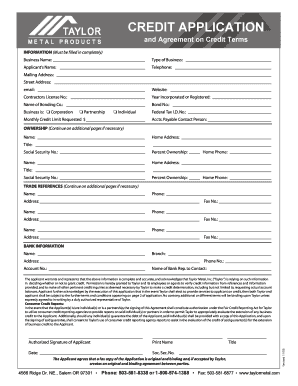

This document serves as a certificate relating to deduction of tax at source or no deduction, as it pertains to a specific works contract under the Assam Value Added Tax regulations.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form assam value added

Edit your form assam value added form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form assam value added form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form assam value added online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form assam value added. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form assam value added

How to fill out THE ASSAM VALUE ADDED TAX RULES, 2005

01

Obtain a copy of THE ASSAM VALUE ADDED TAX RULES, 2005.

02

Read through the rules to understand the requirements and procedures involved.

03

Gather necessary documentation such as business registration, tax identification number, and financial records.

04

Identify the goods and services your business provides and determine their tax applicability under the VAT system.

05

Fill out the VAT registration application form, providing accurate and complete information.

06

Submit the application along with the required documents to the appropriate tax authority in Assam.

07

Keep track of your VAT liability and ensure timely payments are made according to the prescribed schedule.

08

Maintain updated records of all transactions to facilitate future audits or inquiries.

Who needs THE ASSAM VALUE ADDED TAX RULES, 2005?

01

Business owners and entrepreneurs operating in Assam who engage in the sale of goods and services.

02

Tax professionals and accountants responsible for managing the tax compliance of businesses.

03

Organizations and individuals seeking to understand their obligations under Assam's VAT system.

04

Government agencies involved in tax collection and regulation enforcement.

Fill

form

: Try Risk Free

People Also Ask about

When was the VAT first introduced in India?

VAT came into effect on April 1, 2005. VAT is an indirect tax. It was introduced in India in 1986 and was called MODVAT (modified value-added tax).

Which year was GST introduced in India?

The GST was launched at midnight on 1 July 2017 by the President of India, and the Government of India. The launch was marked by a historic midnight (30 June – 1 July) session of both the houses of parliament convened at the Central Hall of the Parliament.

In which year were the stamp tax and income tax implemented in Assam?

-1 t is herehy enacterl in the Ninth Year of the Republic of India as follows:- ( 1) This Act may be called the Assam Stamp (Amendment) Act, 1958. (2) It extends to the whole of Assam. (3) It shall come into force with effect from the 1st of April, 1958.

In which year was the value added tax introduced in India?

Value-added tax (VAT) was introduced into the Indian taxation system from 1 April 2005.

Who proposed VAT in India?

The Empowered Committee of State Ministers, again endorsed, on February 8, 2003, the suggestion that all state legislations on VAT should contain a minimum set of common features. The Kelkar committee on tax reforms also recommended introduction of VAT in its report.

In which year were taxes introduced in India?

To fill the treasury, the first Income-tax Act was introduced in February 1860 by James Wilson (British India's first finance minister). The act received the assent of the Viceroy on 24 July 1860, and came into effect immediately.

What are VAT rules?

VAT Meaning Tax is assessed and collected at each point, starting from the manufacturer until the product reaches the retailer. It is a multistage tax system with provision for collection of tax paid on the purchases at every point of sale. Thus, it removes the tax-on-tax effect.

What is Assam value added tax?

Assam VAT Overview Assam introduced the Value Added Tax in May 2005. The Assam Value Added Tax Act, 2003 was duly notified on March 15th, 2005 while the Assam Value Added Tax Rules, 2005, was notified on April 26th, 2005. Also, tax on works contract comes within the purview of Assam Value Added Tax Act, 2003.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is THE ASSAM VALUE ADDED TAX RULES, 2005?

The Assam Value Added Tax Rules, 2005 are regulations that outline the framework for the implementation and administration of the Value Added Tax (VAT) system in the state of Assam, India. These rules provide guidelines for the assessment, collection, and payment of VAT on goods and services.

Who is required to file THE ASSAM VALUE ADDED TAX RULES, 2005?

Any individual or business entity that sells goods or provides taxable services in Assam and meets the prescribed turnover thresholds is required to file under the Assam Value Added Tax Rules, 2005. This includes manufacturers, wholesalers, retailers, and service providers.

How to fill out THE ASSAM VALUE ADDED TAX RULES, 2005?

To fill out the Assam Value Added Tax forms, one must provide details such as the taxpayer's identification number, business information, sales and purchase details, and any tax collected or paid during the reporting period. It is essential to follow the specific formats and instructions provided by the Assam taxation authorities.

What is the purpose of THE ASSAM VALUE ADDED TAX RULES, 2005?

The purpose of the Assam Value Added Tax Rules, 2005 is to establish a systematic and efficient framework for the collection of VAT, ensuring transparency and accountability in the taxation process, and to facilitate the smooth operation of business in Assam by regulating the tax obligations of vendors.

What information must be reported on THE ASSAM VALUE ADDED TAX RULES, 2005?

The information that must be reported includes details about the taxpayer, such as the name and address of the business, VAT registration number, total sales, purchases, VAT collected from customers, VAT paid on purchases, and any exemptions or deductions claimed during the reporting period.

Fill out your form assam value added online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Assam Value Added is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.