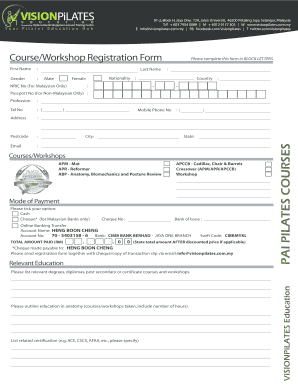

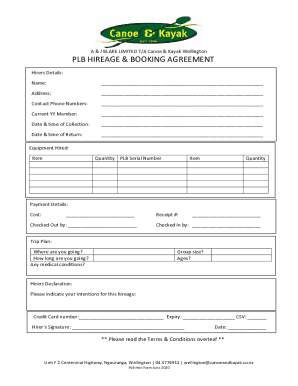

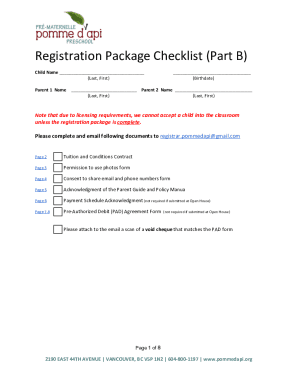

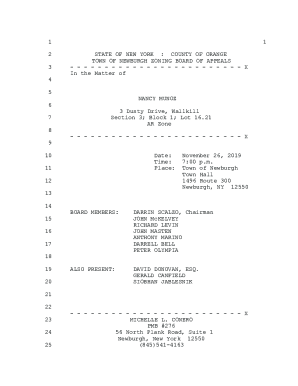

Get the free FORM-35

Show details

This form is used for submitting a return by individuals or departments responsible for tax deduction at source, detailing transactions and tax payments for the financial year.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form-35

Edit your form-35 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form-35 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form-35 online

Follow the guidelines below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit form-35. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form-35

How to fill out FORM-35

01

Begin by downloading FORM-35 from the official website or obtaining a hard copy from the relevant authority.

02

Fill in your personal details such as name, address, and contact information in the designated sections.

03

Provide your tax identification number (if applicable) or any other identification number required.

04

State the purpose for which you are submitting the form.

05

Attach any necessary supporting documents that are required for your specific case.

06

Review your entries thoroughly to ensure all information is accurate and complete.

07

Sign and date the form at the bottom where indicated.

08

Submit the completed FORM-35 to the relevant authority as per the guidelines provided.

Who needs FORM-35?

01

Individuals or businesses filing for a deduction or tax exemption.

02

Taxpayers who need to provide proof of tax compliance.

03

Anyone who is required to rectify or amend previous tax returns.

Fill

form

: Try Risk Free

People Also Ask about

What is the form 35 for?

Form 35 RTO is an official document used in India to notify the Regional Transport Office (RTO) about the termination of a hire-purchase, lease, or hypothecation agreement for a vehicle.

What is RTO form 35 used for?

RTO Form 35 is essential to remove hypothecation from a vehicle's registration certificate after repaying the loan. This guide simplifies the download and completion process for car owners.

Is Form 35 RTO required for vehicle transfer?

It is imperative to remember that the form is only essential if you have bought the vehicle through a bank loan. The form is mandatory for the completion of the selling process. After filling out the form, you must take it to the RTO to eliminate the word "Hypothecation" from the vehicle's certificate.

Who issues Form 34?

In the same way, Form 34 is an application form used for the addition of a loan to an RC of a vehicle having comprehensive car insurance . It is usually provided by the leasing company or the bank. As a vehicle owner, you may have purchased the vehicle by taking a vehicle loan from a financer.

What is the purpose of Form 35?

Form 35 RTO is an official document used in India to notify the Regional Transport Office (RTO) about the termination of a hire-purchase, lease, or hypothecation agreement for a vehicle.

What is the Rule 16.2 disclosure in Colorado?

Disclosure. (1) Parties to domestic relations cases owe each other and the court a duty of full and honest disclosure of all facts that materially affect their rights and interests and those of the children involved in the case.

What is the criminal rule 35 in Colorado?

A 35(b) motion asks the judge to impose a lesser or different sentence from what was imposed at the original sentencing hearing. It is due 126 days after sentencing or after the appeal is over. If you win a 35(b) motion, the trial judge may impose a shorter sentence or probation if you are eligible.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is FORM-35?

FORM-35 is a tax form used in India for the purpose of filing a revision application against the order of assessment or reassessment before the Income Tax Appellate Tribunal (ITAT).

Who is required to file FORM-35?

Any taxpayer who is aggrieved by an order of assessment or reassessment passed by the Income Tax authority and wishes to appeal before the ITAT is required to file FORM-35.

How to fill out FORM-35?

To fill out FORM-35, the applicant needs to provide details such as their personal information, the assessment year, the details of the order being appealed, grounds of appeal, and any other relevant information as specified in the form.

What is the purpose of FORM-35?

The purpose of FORM-35 is to facilitate the process of filing an appeal against orders made by the income tax authorities, allowing taxpayers a formal mechanism to contest decisions they believe are incorrect.

What information must be reported on FORM-35?

On FORM-35, the taxpayer must report their personal details, the order number and date of the order being appealed, the assessment year, the grounds for appeal, and any supporting evidence or documentation to substantiate their claims.

Fill out your form-35 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form-35 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.