Get the free Working Capital AR Factoring Credit Application Cover

Show details

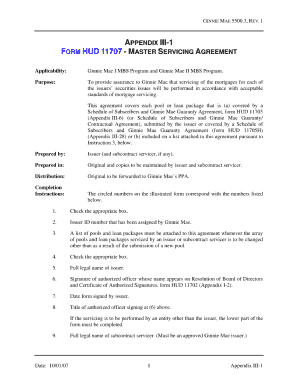

TOMORROWS GROWTH TODAY 1550 Park side Dr., Suite 240 Walnut Creek, CA 94596 P: 8006044817 F: 9252628244 www.FirstStarCapital.com Working Capital A×R Factoring Credit Application Cover Sheet IMPORTANT

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign working capital ar factoring

Edit your working capital ar factoring form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your working capital ar factoring form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit working capital ar factoring online

Follow the steps below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit working capital ar factoring. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out working capital ar factoring

How to fill out working capital ar factoring:

01

Obtain a copy of your accounts receivable (AR) along with supporting documentation such as invoices and receipts.

02

Calculate the total value of your AR by adding up the outstanding amounts from each customer.

03

Identify the invoices that are eligible for factoring, which typically include invoices that are not more than 90 days overdue and do not have any disputes or payment issues.

04

Contact a factoring company or lender that specializes in working capital AR factoring and inquire about their application process.

05

Submit the required documents to the factoring company, which may include your AR information, business financial statements, and any additional paperwork they request.

06

Wait for the factoring company to review your application and assess the creditworthiness of your customers. This may involve them conducting credit checks on your customers.

07

Once approved, negotiate the terms of the factoring agreement, including the percentage of your AR that will be advanced to you (typically around 80-90%) and any fees or discount rates that apply.

08

Review the factoring agreement carefully and sign it if you agree with the terms and conditions.

09

Provide the factoring company with the necessary information to set up the funding process, such as your bank account details.

10

Receive the funding from the factoring company, which is typically done through a wire transfer or direct deposit.

11

Continue to manage your AR as usual, but now the factoring company will handle the collections process and collect payments directly from your customers.

12

Repay the factoring company as customers settle their invoices, minus any fees or discounts agreed upon.

Who needs working capital ar factoring:

01

Small and medium-sized businesses that face cash flow problems due to slow-paying customers or late payments.

02

Companies that have a high volume of accounts receivable and need a quick infusion of cash to cover expenses or invest in growth opportunities.

03

Businesses in industries where it is customary for customers to have extended payment terms, such as manufacturing, wholesale, or distribution.

04

Startups or businesses with limited or no access to traditional financing options, such as bank loans or lines of credit.

05

Companies that want to outsource their accounts receivable collections and focus on core business operations.

06

Businesses experiencing seasonal fluctuations in cash flow and need additional working capital to bridge the gaps.

07

Organizations seeking to mitigate the risk of bad debt or credit losses by transferring the responsibility of collections to a factoring company.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the working capital ar factoring in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How do I fill out the working capital ar factoring form on my smartphone?

Use the pdfFiller mobile app to fill out and sign working capital ar factoring on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

How can I fill out working capital ar factoring on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your working capital ar factoring by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is working capital ar factoring?

Working capital AR factoring is a financial transaction where a business sells its accounts receivable to a third party at a discount in order to free up cash flow.

Who is required to file working capital ar factoring?

Companies that use accounts receivable factoring as a financing tool are required to report it as part of their working capital.

How to fill out working capital ar factoring?

To fill out working capital AR factoring, businesses need to provide details of the accounts receivable being factored, the discount rate, and the third party involved in the transaction.

What is the purpose of working capital ar factoring?

The purpose of working capital AR factoring is to provide businesses with immediate cash flow by selling their accounts receivable at a discount.

What information must be reported on working capital ar factoring?

Businesses must report details of the accounts receivable being factored, the discount rate, and the third party involved in the transaction.

Fill out your working capital ar factoring online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Working Capital Ar Factoring is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.