Get the free Saadiq Property Financing Application Form

Show details

This form collects personal, employment, income, and financial information for individuals applying for property financing through Standard Chartered Saadiq Berhad.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign saadiq property financing application

Edit your saadiq property financing application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your saadiq property financing application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit saadiq property financing application online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit saadiq property financing application. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

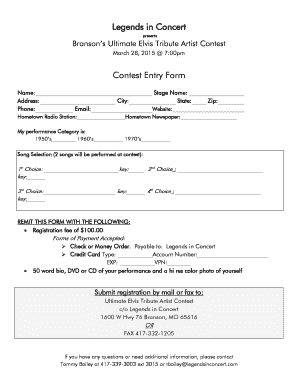

How to fill out saadiq property financing application

How to fill out Saadiq Property Financing Application Form

01

Start by downloading or obtaining the Saadiq Property Financing Application Form from the official website or your bank branch.

02

Fill in your personal details, including your full name, address, contact number, and email address.

03

Provide information about your employment status, including your employer's name, position, and duration of employment.

04

Detail your financial information, including your monthly income, additional income sources, and current liabilities.

05

Specify the property details you wish to finance, including the location, price, and type of property.

06

Include any information required for identification, such as a copy of your ID or passport.

07

Review the application for accuracy, ensuring all required fields are filled out correctly.

08

Sign and date the application form at the designated area.

09

Submit the completed application form along with any required supporting documents to the bank.

Who needs Saadiq Property Financing Application Form?

01

Individuals looking to purchase residential or commercial property through financing.

02

Home buyers seeking to leverage Islamic financing options for their property purchases.

03

Investors interested in funding real estate ventures in accordance with Shariah principles.

Fill

form

: Try Risk Free

People Also Ask about

Can you get a mortgage in Pakistan?

Banks can finance up to 99% of the property value for purchase or construction of house; for renovation of house, financing is capped up to 40% of the property value. No mortgage of property, equitable or registered, is required against lien based financing facility.

What is the minimum amount for opening a time deposit?

Four category of Time Deposit Account available – 1 year, 2 year, 3 year & 5 year. Minimum deposit ₹1000/- and thereafter in the multiples of ₹100. No maximum deposit limit. A guardian may open an account on behalf of a minor or a person of unsound mind. An account can be closed after six months.

What is the minimum period of deposit?

Regular Fixed Deposits: Regular FDs typically have a minimum investment period ranging from 7 days to 10 years, depending on the bank or financial institution.

What is saadiq?

Inspired by the Arabic word for 'truthful', Saadiq is our global Islamic banking network, spanning Asia, Africa, and the Middle East.

Is there a minimum deposit requirement?

Minimum deposits vary depending on the type of account and the financial institution. Some banks do not request a minimum deposit to open a basic checking or savings account, while others require between $25 and $100.

Is there a minimum amount for a term deposit?

Most term deposits will have a minimum balance deposit required, often between $1,000-$5,000.

Is Standard Chartered an Islamic bank?

Standard Chartered Saadiq is the Islamic Banking window offered by Standard Chartered bank which offers comprehensive international banking services with a wide range of Sharia compliant financial products.

What is the minimum deposit requirement for booking a Saadiq term deposit?

Minimum of PKR 50,000. Accessible through SC Mobile & Internet Banking.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Saadiq Property Financing Application Form?

The Saadiq Property Financing Application Form is a document used to apply for property financing services offered under Shariah-compliant banking principles.

Who is required to file Saadiq Property Financing Application Form?

Individuals or entities seeking to obtain property financing from a financial institution that offers Saadiq (Islamic) financing options are required to file this form.

How to fill out Saadiq Property Financing Application Form?

To fill out the Saadiq Property Financing Application Form, applicants need to provide personal information, details of the property, financial status, and any required supporting documentation to verify their information.

What is the purpose of Saadiq Property Financing Application Form?

The purpose of the Saadiq Property Financing Application Form is to collect necessary information from applicants in order to assess their eligibility and process their financing requests in accordance with Islamic finance principles.

What information must be reported on Saadiq Property Financing Application Form?

The Saadiq Property Financing Application Form typically requires information such as applicant's personal details, income, employment status, details about the property being financed, and other financial information relevant to the application.

Fill out your saadiq property financing application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Saadiq Property Financing Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.