Get the free International Trade Account (ITA)

Show details

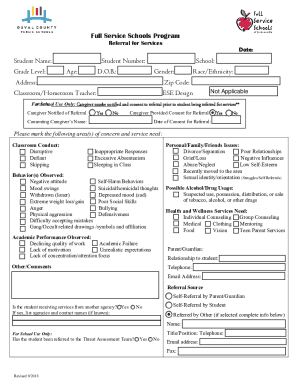

The document serves as an account opening package for the International Trade Account provided by Standard Chartered Bank (Hong Kong) Limited, including necessary forms and a documentation checklist.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign international trade account ita

Edit your international trade account ita form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your international trade account ita form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing international trade account ita online

Follow the steps down below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit international trade account ita. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out international trade account ita

How to fill out International Trade Account (ITA)

01

Gather all necessary documentation including invoices, bills of lading, and other trade-related records.

02

Access the International Trade Account (ITA) form on the relevant government or trade website.

03

Start by filling out the applicant's information, including name, address, and contact details.

04

Provide details about the business activities related to international trade.

05

List all products being exported or imported, including descriptions, values, and classifications.

06

Include information on the countries involved in the trade transactions.

07

Verify and provide any additional information requested, such as transfer pricing agreements or customs information.

08

Review the entire form for accuracy and completeness before submission.

09

Submit the completed ITA form through the designated submission method (online or mail).

10

Keep a copy of the submitted form and all associated documents for your records.

Who needs International Trade Account (ITA)?

01

Businesses engaged in importing or exporting goods.

02

Companies looking to take advantage of international trade agreements.

03

Exporters who need to comply with customs regulations.

04

Importers needing to report their trade activities for tax purposes.

05

Freight forwarders and logistics companies handling international shipments.

06

Government agencies monitoring and regulating international trade activities.

Fill

form

: Try Risk Free

People Also Ask about

What are 5 examples of international trade?

Almost every kind of product can be found in the international market, for example: food, clothes, spare parts, oil, jewellery, wine, stocks, currencies, and water. Services are also traded, such as in tourism, banking, consulting, and transportation.

What is an international trading account?

An account tailor-made for international trade and foreign exchange transactions, for more convenience and preferential pricing on forex deals, trade and remittances as the quarterly throughput routed through the account increases.

Which account is used for international trade?

A Nostro account is a bank account that a bank holds with a foreign bank in the domestic currency of the country where the funds are held. It is used to facilitate the settlement of international trade and foreign exchange transactions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is International Trade Account (ITA)?

The International Trade Account (ITA) is a financial document or report that records cross-border transactions and trade activities between countries, detailing information about imports, exports, and related economic interactions.

Who is required to file International Trade Account (ITA)?

Entities engaged in international trade, including businesses exporting and importing goods and services, and sometimes individuals partaking in significant cross-border transactions, are required to file the International Trade Account.

How to fill out International Trade Account (ITA)?

To fill out the ITA, one must gather relevant data on trade activities, including transaction details, product descriptions, values, and countries involved. This information is then entered into the designated sections of the ITA form, following any specific guidelines provided by the relevant authority.

What is the purpose of International Trade Account (ITA)?

The purpose of the International Trade Account is to provide a comprehensive overview of a country’s trade status, facilitate economic analysis, inform policy decisions, and ensure compliance with international trade regulations.

What information must be reported on International Trade Account (ITA)?

Information that must be reported on the ITA includes details of the goods and services traded, transaction values, trade partners, dates of transactions, and any tariffs or taxes applicable to the trade.

Fill out your international trade account ita online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

International Trade Account Ita is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.