Get the free Use of Customer Deposit - related Information Consent Form

Show details

此表格用於客戶同意渣打銀行使用其存款相關資料以提供投資及財富管理服務。

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign use of customer deposit

Edit your use of customer deposit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your use of customer deposit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit use of customer deposit online

Follow the steps below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit use of customer deposit. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out use of customer deposit

How to fill out Use of Customer Deposit - related Information Consent Form

01

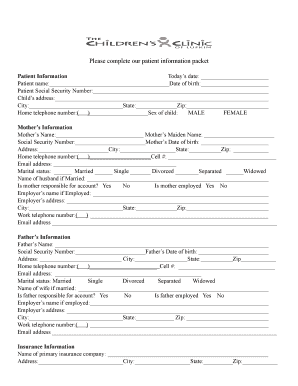

Start with your personal information: Enter your full name, address, and contact details.

02

Provide the account number: Include the account or reference number related to the customer deposit.

03

Specify the purpose: Clearly state the purpose for which the customer deposit will be used.

04

Include terms and conditions: Read and acknowledge the terms and conditions related to the consent form.

05

Sign and date the form: Ensure you provide your signature and the date of completion.

06

Submit the form: Send the completed form to the designated department or office.

Who needs Use of Customer Deposit - related Information Consent Form?

01

Customers who are making a deposit and require a formal acknowledgment of their consent to use the deposit information.

02

Businesses or institutions that hold customer deposits and need to obtain consent for processing and using this information.

Fill

form

: Try Risk Free

People Also Ask about

What is the accounting treatment for customer deposit?

Customer deposit accounting means that the funds will be credited. It follows the accounting principle; the deposit is a current liability that is debited and sales revenue credited. Since there are no cash earnings, the money is debit to the bank and credit to the customer's deposit account.

Is a customer deposit an asset or liability?

Are customer deposits current liabilities? So, are customer deposits current liabilities or assets? Under the rules of double-entry accounting, they would qualify as a current liability. Although you've received money, it's not really yours until you've provided the finished product or service.

What is the meaning of customer deposit?

A customer deposit is money from a customer to a company before the company earns it. It is a simple cycle whereby when the company receives cash from a customer and in return, they need to supply goods and services or return the money. Customer deposit accounting means that the funds will be credited.

What type of account is customer deposits?

Anytime there is a customer deposit account, remember that it will be treated as a current liability. It happens when the goods and services provided are within a year; it becomes a long-term liability when it is a more extended period.

What is customer deposit?

A customer deposit is money from a customer to a company before the company earns it. It is a simple cycle whereby when the company receives cash from a customer and in return, they need to supply goods and services or return the money. Customer deposit accounting means that the funds will be credited.

What is a deposit classified as in accounting?

Deposits paid by a business (e.g., rent or supplier deposits) are considered assets because they represent amounts recoverable in the future. Deposits received from customers are liabilities, as they represent obligations to deliver goods, services, or refunds.

What is the classification of a customer deposit?

A customer deposit is usually classified as a current liability, since the company typically provides services or goods within one year of the deposit being made. If the deposit is for a longer-term project that will not be resolved within one year, it could instead be classified as a long-term liability.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Use of Customer Deposit - related Information Consent Form?

The Use of Customer Deposit - related Information Consent Form is a document that allows businesses to inform customers about how their deposits will be utilized and to obtain consent for related activities.

Who is required to file Use of Customer Deposit - related Information Consent Form?

Businesses or entities that collect customer deposits and intend to use them for specific purposes are required to file this form to ensure compliance with relevant regulations.

How to fill out Use of Customer Deposit - related Information Consent Form?

To fill out the form, provide relevant business details, specify the purposes for which customer deposits will be used, and obtain the customer's signature to confirm their consent.

What is the purpose of Use of Customer Deposit - related Information Consent Form?

The purpose of the form is to ensure transparency and protect customer rights by informing them about the use of their deposits and obtaining their consent before proceeding.

What information must be reported on Use of Customer Deposit - related Information Consent Form?

The form must report the business name, customer details, specific uses of the deposit, and any other relevant terms associated with the deposit usage.

Fill out your use of customer deposit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Use Of Customer Deposit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.