TX 74-221 2011 free printable template

Show details

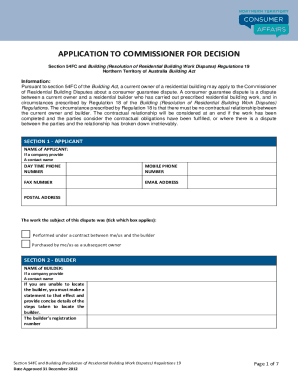

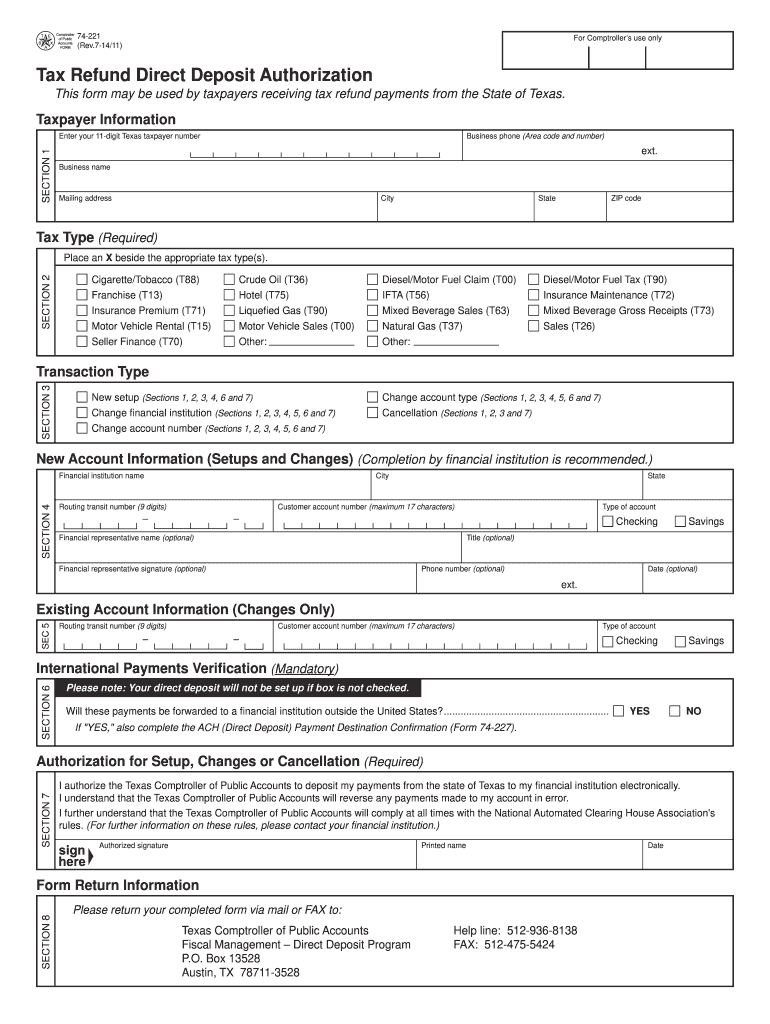

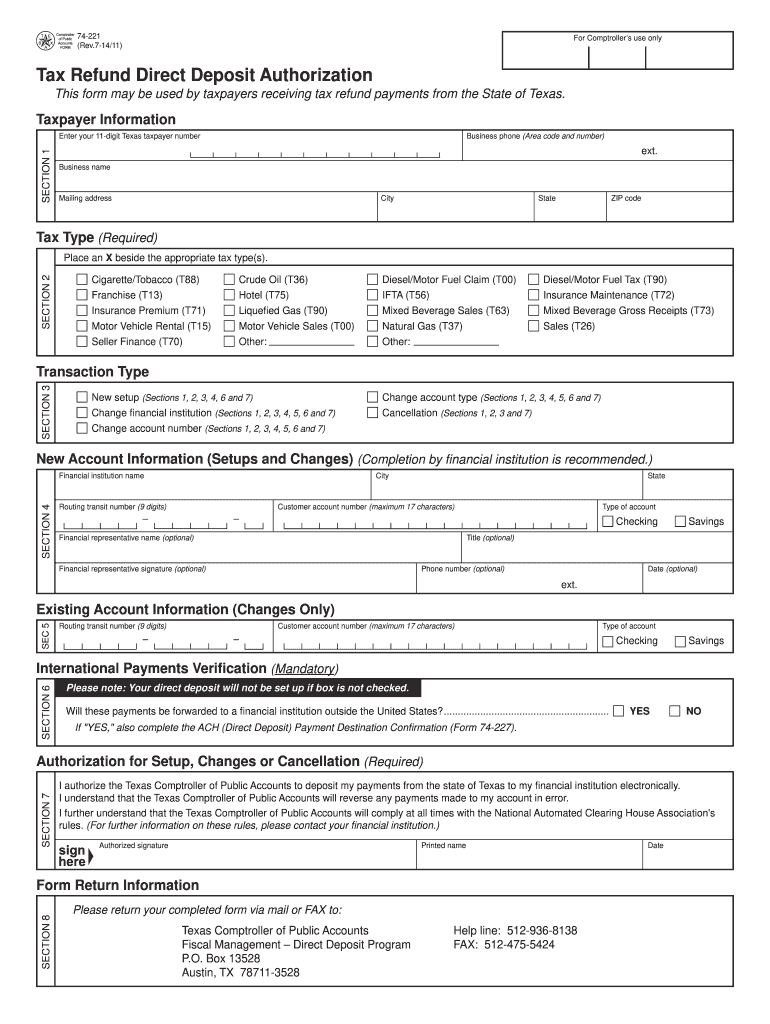

74-221 Rev.7-14/11 For Comptroller s use only CLEAR FORM PRINT FORM Tax Refund Direct Deposit Authorization This form may be used by taxpayers receiving tax refund payments from the State of Texas. O. Box 13528 Austin TX 78711-3528 Help line 512-936-8138 FAX 512-475-5424 Date Form 74-221 Back Rev.7-14/11 Instructions for Tax Refund Direct Deposit Authorization You have certain rights under Chapters 552 and 559 Government Code to review request and correct information we have on file about...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TX 74-221

Edit your TX 74-221 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TX 74-221 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

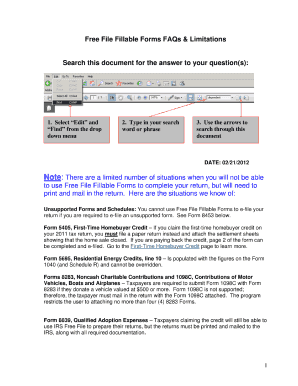

How to edit TX 74-221 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit TX 74-221. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX 74-221 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out TX 74-221

How to fill out TX 74-221

01

Obtain Form TX 74-221 from the Texas State website or your local tax office.

02

Fill out the top section with your name, address, and contact information.

03

Enter the legal description of the property for which you are applying.

04

Provide details about the property owner and any relevant tax history.

05

Indicate the reason for filing the form in the designated section.

06

Review your completed form for accuracy and completeness.

07

Sign and date the form at the bottom.

08

Submit the form by mail or in person to the appropriate county appraisal district.

Who needs TX 74-221?

01

Property owners in Texas who wish to dispute their property appraisal.

02

Individuals seeking property tax exemptions.

03

Anyone applying for a change in property status or classification.

Fill

form

: Try Risk Free

People Also Ask about

What information is on the direct deposit form?

The bank account information you'll need includes your name; transit number (up to 5 digits); account number (up to 7 digits); branch number, which is the first 4 digits of the transit number (e.g., 0234). Use this information to set up direct deposit with the CRA, your employer, or save and print your form.

What is an authorization agreement for automatic payroll deposits?

A direct deposit authorization form authorizes a third party, usually an employer for payroll, to send money to a bank account. Typically, an employer requesting authorization will require a voided check to ensure that the account is valid.

How do I fill out an authorization agreement for direct deposit?

0:08 0:54 Details of a Direct Deposit Authorization - YouTube YouTube Start of suggested clip End of suggested clip Form the following must be completed. Name an address of the account holder bank. Name accountMoreForm the following must be completed. Name an address of the account holder bank. Name account number routing number type of account company name and signature.

How do I get a direct deposit authorization form from my bank?

Ask for a written or online direct deposit form. If that isn't available, ask your bank or credit union for one. We've included a list of forms from top banks, including the Capital One and Bank of America direct deposit forms.

What is a bank authorization form for direct deposit?

A direct deposit authorization form is a form that employees fill out to authorize their employer to deposit money straight into their bank account. Direct deposit is the standard method most businesses use for paying employees.

What is a 74 176 direct deposit authorization form?

This form may be used by vendors, individual recipients or state employees to receive payments from the state of Texas by direct deposit or to change/cancel existing direct deposit information.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit TX 74-221 online?

With pdfFiller, it's easy to make changes. Open your TX 74-221 in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How can I edit TX 74-221 on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing TX 74-221.

How do I fill out the TX 74-221 form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign TX 74-221 and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is TX 74-221?

TX 74-221 is a form used by individuals and entities in Texas to report certain tax information to the state.

Who is required to file TX 74-221?

Individuals and business entities that meet specific criteria set by the Texas Comptroller's office must file TX 74-221.

How to fill out TX 74-221?

To fill out TX 74-221, you need to provide the required identification information, financial details, and any applicable supporting documentation as specified in the instructions provided with the form.

What is the purpose of TX 74-221?

The purpose of TX 74-221 is to collect detailed tax information to ensure compliance with Texas tax laws and to assist in the accurate assessment of taxes owed.

What information must be reported on TX 74-221?

TX 74-221 requires reporting of taxpayer identification, type of entity, financial data including income and deductions, and any other relevant tax-related information as required by the form.

Fill out your TX 74-221 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TX 74-221 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.