Get the free 2013 REAL PROPERTY TAX NOTICE

Show details

This document serves as a tax notice for property owners in Castle Dale, detailing the property tax amounts due and providing instructions for payment.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2013 real property tax

Edit your 2013 real property tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2013 real property tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2013 real property tax online

To use the professional PDF editor, follow these steps:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit 2013 real property tax. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2013 real property tax

How to fill out 2013 REAL PROPERTY TAX NOTICE

01

Locate your 2013 REAL PROPERTY TAX NOTICE document.

02

Find the property description section and ensure it accurately reflects your property details.

03

Review the assessed value section to confirm it aligns with your property’s current market value.

04

Check the tax rate applied; verify it matches the local government rates.

05

Calculate the total tax owed by multiplying the assessed value by the tax rate.

06

Look for any exemptions or deductions you may qualify for and fill those details in.

07

Confirm all calculations are correct before signing and dating the notice.

08

Submit the notice to the designated local tax authority by the due date.

Who needs 2013 REAL PROPERTY TAX NOTICE?

01

Property owners in the jurisdiction that issued the 2013 REAL PROPERTY TAX NOTICE.

02

Individuals who are responsible for paying property taxes on real estate.

03

Real estate investors and landlords with properties subject to real property taxes.

Fill

form

: Try Risk Free

People Also Ask about

Who is exempt from real property tax in the Philippines?

Properties Exempt from Real Property Tax (RPT) Government-owned properties, provided that they are not leased or granted for use to private or taxable entities. Religious, charitable, and educational properties such as churches, mosques, convents, cemeteries, etc.

When did local property tax start in Ireland?

The LPT was introduced in 2013 to provide a stable funding base for local authorities and to deliver significant structural reform by broadening the tax base in a manner that did not directly impact on employment.

What is exempt from real property tax in the Philippines?

Properties Exempt from Real Property Tax (RPT) These exemptions generally apply to properties that serve a public, charitable, or essential service function, such as: Government-owned properties, provided that they are not leased or granted for use to private or taxable entities.

How is real property tax calculated in the Philippines?

Real Property Tax Computation The general formula on calculating your RPT is RPT= RateXAssessed Value. Example, your property is in Taguig City and the assessed value is P2,500,000, your RPT will be: P2,500,000 x 2% = P50,000.

Who pays real property tax in the Philippines?

The taxpayer responsible for paying real property tax is the person “in whose name the property is declared for taxation purposes.”

Which type of property is possibly exempt from real property taxes?

Religious organizations and governmental entities don't pay property taxes due to their eligibility for exemptions. Likewise, specific property tax exemptions are for homeowners who receive a value assessment with a corresponding tax bill from their local government.

What is the example of real property tax in the Philippines?

The general formula on calculating your RPT is RPT= RateXAssessed Value. Example, your property is in Taguig City and the assessed value is P2,500,000, your RPT will be: P2,500,000 x 2% = P50,000.

What are tax exemptions in the Philippines?

Tax Exemption in the Philippines is defined as the legal right of an organisation or an individual to get an exemption or reduction to the taxes they owe to the Bureau of Internal Revenue (BIR) – provided that they meet certain requirements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

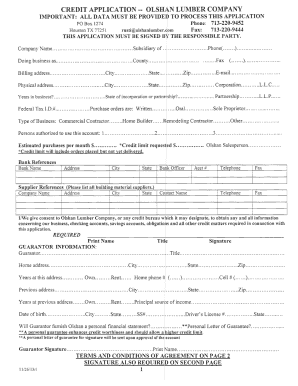

What is 2013 REAL PROPERTY TAX NOTICE?

The 2013 Real Property Tax Notice is a document that provides information regarding the assessment and taxation of real property for the tax year 2013.

Who is required to file 2013 REAL PROPERTY TAX NOTICE?

Property owners who possess taxable real estate are required to file the 2013 Real Property Tax Notice.

How to fill out 2013 REAL PROPERTY TAX NOTICE?

To fill out the 2013 Real Property Tax Notice, property owners need to provide details such as property description, ownership information, and any applicable exemptions or deductions.

What is the purpose of 2013 REAL PROPERTY TAX NOTICE?

The purpose of the 2013 Real Property Tax Notice is to inform property owners of their assessed property value and the taxes owed, ensuring compliance with local tax laws.

What information must be reported on 2013 REAL PROPERTY TAX NOTICE?

Information that must be reported includes property owner’s name, property address, assessed value, tax rates, and any exemptions or deductions applicable.

Fill out your 2013 real property tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2013 Real Property Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.