Get the free LIKE-KIND EXCHANGE WORKSHEET

Show details

LIKENING EXCHANGE WORKSHEET

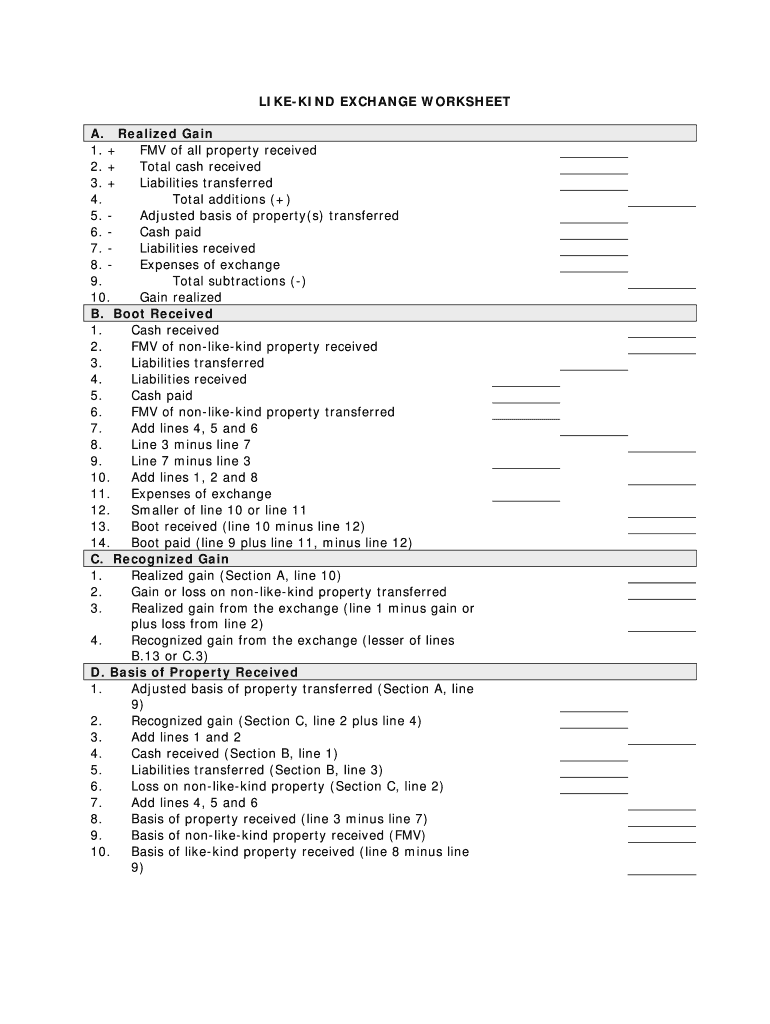

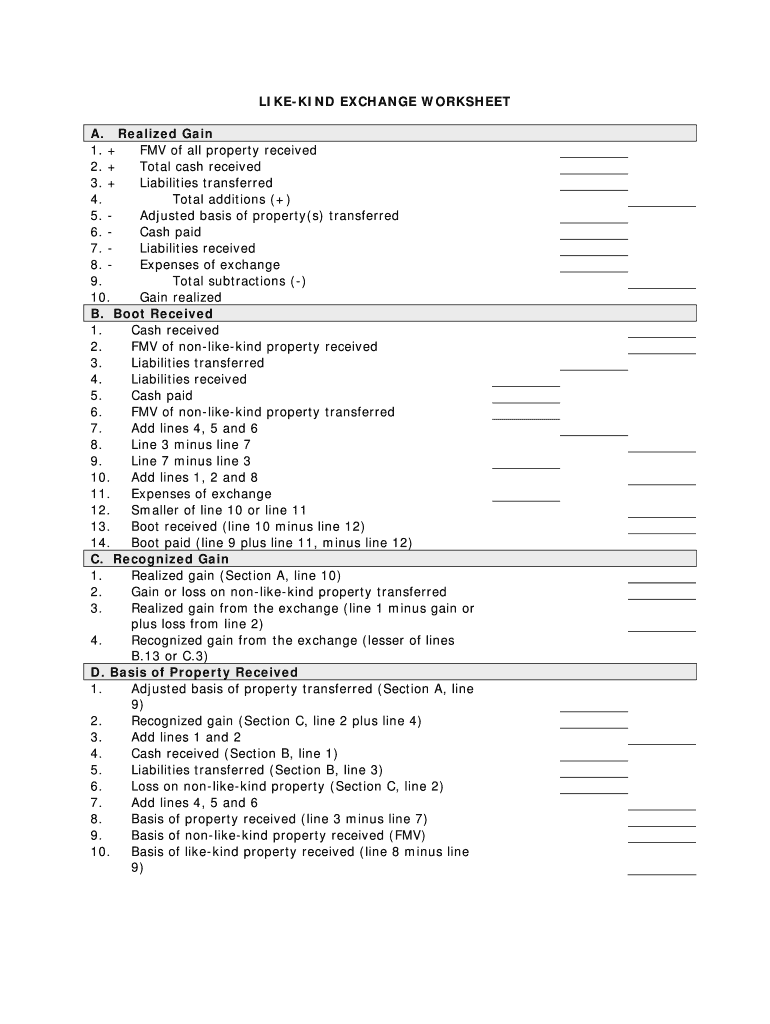

A. Realized Gain

1. +

FMV of all property received

2. +

Total cash received

3. +

Liabilities transferred

4.

Total additions (+)

5. Adjusted basis of property’s) transferred

6.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign like-kind exchange worksheet

Edit your like-kind exchange worksheet form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your like-kind exchange worksheet form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing like-kind exchange worksheet online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit like-kind exchange worksheet. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out like-kind exchange worksheet

How to fill out a like-kind exchange worksheet?

01

Gather necessary information: Before filling out the like-kind exchange worksheet, gather all relevant information related to the exchange. This includes the property being exchanged, its basis and fair market value, as well as any other pertinent details.

02

Identify the taxpayer: The like-kind exchange worksheet typically requires the taxpayer's identification information, such as name, address, social security number or employer identification number. Ensure that this information is accurately provided.

03

Specify the exchanging properties: Indicate the properties involved in the like-kind exchange. Include details such as their descriptions, locations, and dates of acquisition. This information is vital for correctly documenting the exchange.

04

Determine the basis and fair market value: Calculate the basis and fair market value of the property being exchanged. This information is necessary for complying with tax regulations and accurately reporting the transaction.

05

Report any boot: If additional cash or other property is involved in the exchange (commonly referred to as "boot"), document it on the worksheet. This is crucial for determining any potential taxable gains that may arise from the transaction.

06

Complete the worksheet accurately: Make sure that all fields on the like-kind exchange worksheet are filled out accurately and completely. Double-check all calculations and information provided to ensure compliance with tax laws.

07

Attach the worksheet to the tax return: Once the worksheet has been properly filled out, attach it to the relevant tax return. This ensures that the like-kind exchange is properly reported to the Internal Revenue Service (IRS).

Who needs a like-kind exchange worksheet?

01

Real estate investors: Like-kind exchanges are often utilized by real estate investors to defer capital gains taxes when swapping properties. Real estate developers or individuals involved in property investment frequently need to fill out like-kind exchange worksheets.

02

Business owners: If a business owner trades or exchanges certain business assets, such as equipment or machinery, they may be eligible for a like-kind exchange. In such cases, a like-kind exchange worksheet is necessary for accurately reporting the exchange.

03

Tax professionals: Tax professionals, such as accountants or tax advisors, may need to fill out like-kind exchange worksheets on behalf of their clients. These professionals have the expertise and knowledge to properly handle the complexities associated with like-kind exchanges.

Note: It is always recommended to consult with a tax professional or seek professional advice when dealing with like-kind exchanges to ensure compliance with the applicable tax laws and regulations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send like-kind exchange worksheet for eSignature?

To distribute your like-kind exchange worksheet, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I edit like-kind exchange worksheet online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your like-kind exchange worksheet to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Can I create an electronic signature for the like-kind exchange worksheet in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your like-kind exchange worksheet in seconds.

What is like-kind exchange worksheet?

A like-kind exchange worksheet is a tax document used to report a like-kind exchange transaction to the IRS.

Who is required to file like-kind exchange worksheet?

Taxpayers who have engaged in a like-kind exchange transaction are required to file the like-kind exchange worksheet.

How to fill out like-kind exchange worksheet?

The like-kind exchange worksheet should be filled out by providing the necessary information about the like-kind exchange transaction, such as property details, fair market values, and any gain or loss.

What is the purpose of like-kind exchange worksheet?

The purpose of the like-kind exchange worksheet is to report and calculate the tax implications of a like-kind exchange transaction.

What information must be reported on like-kind exchange worksheet?

The like-kind exchange worksheet must report details of the properties exchanged, their fair market values, any boot received or given, and any gain or loss on the exchange.

Fill out your like-kind exchange worksheet online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Like-Kind Exchange Worksheet is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.