Get the free MORTGAGE VOUCHER

Show details

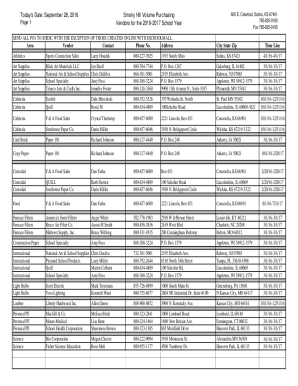

To provide data regarding loans being submitted to AHFC for purchase, ensuring accuracy and legibility for input into the ALCS computer system.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mortgage voucher

Edit your mortgage voucher form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage voucher form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mortgage voucher online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit mortgage voucher. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mortgage voucher

How to fill out MORTGAGE VOUCHER

01

Gather all necessary documents related to your mortgage.

02

Locate the MORTGAGE VOUCHER form, either online or through your lender.

03

Fill out your personal information, including name, address, and contact number.

04

Provide the loan number and any other identification details requested.

05

Specify the details of the mortgage, including the amount and terms.

06

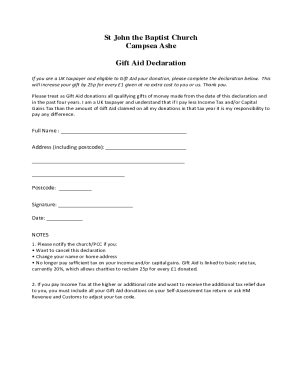

Sign and date the voucher to validate your submission.

07

Review all filled details for accuracy before submitting the form.

Who needs MORTGAGE VOUCHER?

01

Individuals applying for a mortgage loan.

02

Homebuyers looking to secure financing for a property.

03

Real estate investors needing to verify loan details.

04

Lenders requiring documentation to process mortgage applications.

Fill

form

: Try Risk Free

People Also Ask about

How do housing vouchers work in California?

The housing voucher family must pay 30% of its monthly adjusted gross income for rent and utilities, and if the unit rent is greater than the payment standard the family is required to pay the additional amount.

How does voucher payment work?

Vouchers often contain expiration dates as well as terms and conditions. The total amount of vouchers owed is added up, with one lump sum recorded on the balance sheet as accounts payable. Once the voucher is paid, proof of payment is included in the voucher and the voucher is considered paid.

What is a voucher and how does it work?

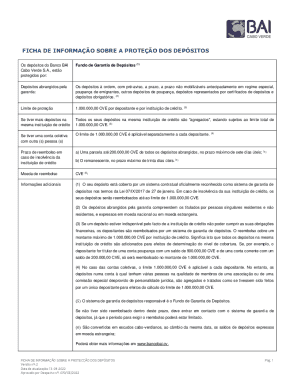

A voucher is essentially a backup document for accounts payable, which are bills owed to vendors and suppliers by businesses. This may contain documents such as the supplier's invoice, the amount owed, the due date, general ledger accounts, and shipping receipts.

Is HCV the same as HUD?

Each year, Congress appropriates funding for the U.S. Department of Housing and Urban Development (HUD) to administer the HCV program. Since 1975, Congress has also passed laws that govern the program. For example, a federal law sets the income eligibility requirements for the HCV program.

What is a credit voucher and how does it work?

A credit voucher is a document issued by a business or organization to a customer as a form of credit or compensation. It typically represents a monetary value that can be applied towards future purchases or used to settle outstanding debts.

What is the purpose of a voucher?

A voucher is a written document that supports accounting transactions and ensures the accuracy of financial records. It serves as proof of payment or receipt in accounting. Examples include bills, invoices, receipts, salary sheets, pay-in-slips, cheque counterfoils, and trust deeds.

What is a voucher loan?

The Housing Choice Voucher Program, also known as Section 8 housing, is a federal program that helps low-income or disabled families obtain affordable private housing. Eligible families can use their vouchers toward any sort of home and are not limited to subsidized housing projects or apartment units.

What does a voucher do?

For many workers, a voucher is a receipt that proves they spent money on something, like travel, which their company will later pay for. A voucher is also a type of coupon that allows you to purchase something for less or no money, even tuition to a school. Both types of vouchers allow you to save money.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is MORTGAGE VOUCHER?

A mortgage voucher is a document that provides evidence of a mortgage transaction, detailing the agreements between the lender and borrower, including terms, conditions, and payment schedules.

Who is required to file MORTGAGE VOUCHER?

Typically, the borrower or homebuyer is required to file a mortgage voucher as part of the mortgage application process, though it may also be required by the lender.

How to fill out MORTGAGE VOUCHER?

To fill out a mortgage voucher, you need to provide personal details such as your name, address, and Social Security number, along with information about the property, loan amount, interest rate, and repayment terms.

What is the purpose of MORTGAGE VOUCHER?

The purpose of a mortgage voucher is to document the mortgage agreement for both parties, facilitate the loan process, and ensure compliance with financial regulations.

What information must be reported on MORTGAGE VOUCHER?

The information that must be reported on a mortgage voucher includes the borrower's identification details, loan amount, interest rate, repayment schedule, property details, and lender's information.

Fill out your mortgage voucher online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage Voucher is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.