Get the free New Transfer on Death Statute for Vehicles - State Bar of Arizona - azbar

Show details

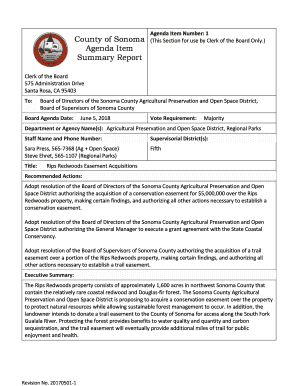

SAVE & THE CLE O THE N JA EW PD ETA DATE NEAR Y 6, 2 012 ROB ATE RU LES ILS T O FOL LOW October 2011 issue four contents This article was first published in the July issue of the Maricopa Lawyer,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign new transfer on death

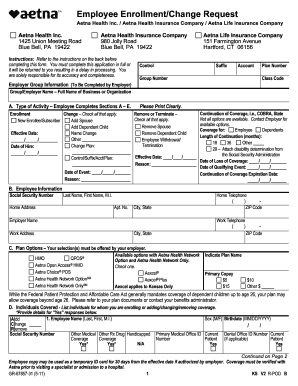

Edit your new transfer on death form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your new transfer on death form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing new transfer on death online

To use our professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit new transfer on death. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out new transfer on death

To fill out a new transfer on death, follow these steps:

01

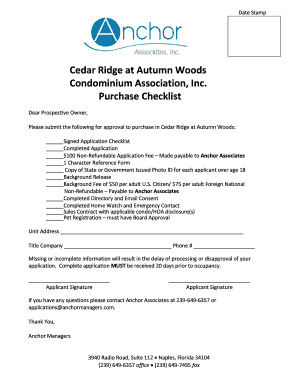

Start by obtaining a transfer on death form from the appropriate financial institution or brokerage firm. This form may also be available online.

02

Carefully read the instructions provided with the form. They will outline the specific information required and any special considerations.

03

Begin filling out the form by providing your personal details, such as your full name, current address, and contact information.

04

Next, you'll need to identify the beneficiaries who will receive your assets upon your death. Include their full names, addresses, and any other required information.

05

Specify the assets you wish to transfer on death. This can include bank accounts, investments, real estate, and any other eligible assets.

06

Indicate the percentage or specific allocations of assets for each beneficiary. Be sure to double-check your selections to ensure they accurately reflect your intentions.

07

If applicable, provide alternate beneficiaries in case the primary beneficiaries are unable to receive the assets.

08

Sign and date the transfer on death form in the presence of a notary public, if required. Some institutions may require additional witnesses, so check the instructions to ensure compliance.

09

Keep a copy of the completed form for your records and submit the original to the financial institution or brokerage firm as instructed.

Who needs a new transfer on death?

A new transfer on death may be beneficial for individuals who want to:

01

Ensure a smooth and efficient transfer of assets to their loved ones upon their death.

02

Avoid the cost and complexity of probate, as assets transferred through a transfer on death do not typically go through this legal process.

03

Maintain privacy, as assets transferred through a transfer on death generally avoid public record.

04

Mitigate potential conflicts among beneficiaries by clearly outlining their entitlements prior to your passing.

05

Use a simple and straightforward method to designate specific assets for specific individuals or organizations.

Overall, anyone who wishes to have control over the distribution of their assets after death and avoid the complexities associated with probate may consider utilizing a new transfer on death. However, it is recommended to consult with an estate planning attorney or financial advisor for personalized guidance based on your specific circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify new transfer on death without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including new transfer on death, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

Can I create an electronic signature for signing my new transfer on death in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your new transfer on death and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I fill out new transfer on death on an Android device?

Use the pdfFiller mobile app and complete your new transfer on death and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

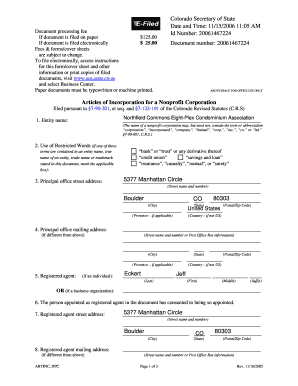

What is new transfer on death?

New transfer on death is a legal document that allows individuals to designate beneficiaries to receive their assets after their death without going through the probate process.

Who is required to file new transfer on death?

Any individual who wants to transfer their assets to specific beneficiaries after their death without probate is required to file a new transfer on death.

How to fill out new transfer on death?

To fill out a new transfer on death, you need to provide your personal information, details of the assets you wish to transfer, and the names of your chosen beneficiaries. The form can typically be obtained from your local county recorder's office.

What is the purpose of new transfer on death?

The purpose of a new transfer on death is to simplify the transfer of assets after an individual's death by bypassing the probate process. It allows beneficiaries to receive the assets quickly and efficiently.

What information must be reported on new transfer on death?

The information that must be reported on a new transfer on death includes the individual's personal details, a list of assets to be transferred, and the names of the designated beneficiaries.

Fill out your new transfer on death online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

New Transfer On Death is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.