Get the free Spousal Transfer of Business License

Show details

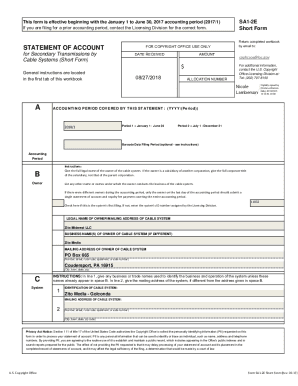

This document outlines the fee schedule and requirements for transferring a business license due to the spousal circumstances, including sections for personal details, business information, and responsibilities

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign spousal transfer of business

Edit your spousal transfer of business form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your spousal transfer of business form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing spousal transfer of business online

To use the services of a skilled PDF editor, follow these steps below:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit spousal transfer of business. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out spousal transfer of business

How to fill out Spousal Transfer of Business License

01

Obtain the Spousal Transfer of Business License form from your local business licensing authority.

02

Fill in the required personal information, including your name, address, and contact details.

03

Provide details about the business, including its name, license number, and type of business activity.

04

Include your spouse's information, similarly to how you provided your own.

05

Sign and date the application, certifying that all information provided is true and accurate.

06

Attach any required documents, such as proof of marriage, current business license, and identification.

07

Submit the completed form along with any applicable fees to the licensing authority.

Who needs Spousal Transfer of Business License?

01

Spouses of business owners who wish to transfer the business license due to a change in ownership, such as divorce, death, or mutual agreement.

02

Individuals who are involved in a partnership where the business is being transferred to a spouse as part of estate planning.

Fill

form

: Try Risk Free

People Also Ask about

How do I change the ownership of an existing business?

Write a detailed bill of sale outlining what the buyer is purchasing. If you're the sole owner of the LLC, make sure it's clear whether they're buying 100% ownership or just the assets of the business. File all required forms with the IRS — including Form 8822-B, for changing the LLC's “responsible party.”

Can I transfer shares to my wife to avoid capital gains tax?

One of the biggest advantages of transferring shares between spouses is that it's treated as a “no gain, no loss” transaction for CGT purposes. This means: The transfer is deemed to occur at cost price (the price you originally paid for the shares). No CGT is triggered at the point of transfer.

Can I transfer ownership of my business to my wife?

Can I transfer my sole proprietorship to another person? You cannot transfer ownership of a sole proprietorship itself, but you can sell its assets and business name.

Can you transfer your business to someone else?

In short, successfully transferring your business to a new owner takes a pragmatic and proactive approach. Although it's never too early to begin planning how to divest from your business, at least five years before a planned sale or transfer is best, allowing you time to consult with heirs and possibly restructure.

How do you transfer ownership of a business to a family member?

One approach for transferring a family business is to include the business as a part of the owner's estate. Essentially, this means that the business will be distributed based on the terms of the owner's estate planning documents (typically a will or trust).

How do I transfer ownership to my wife?

The process typically begins with the execution of a transfer deed, which must clearly state the details of the property and the interests of all parties involved. This deed must then be registered with the Land Registry to legally recognize the change in ownership.

Can I add my wife to my business?

Both spouses carrying on the trade or business The Internal Revenue Code (IRC) generally allows a qualified joint venture whose only members are a married couple filing a joint return not to be treated as a partnership for Federal tax purposes.

How do I transfer a business to another name?

6 Steps to Transfer Business Ownership in the Philippines Step 1: Identify the Type of Transfer. Step 2: Conduct Due Diligence. Step 3: Secure Agreements and Board Approvals. Step 4: Process Registration and Documentation. Step 5: Settle Financial and Tax Obligations. Step 6: Notify Employees and Stakeholders. Plan in Advance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Spousal Transfer of Business License?

Spousal Transfer of Business License refers to the process of transferring a business license from one spouse to another, typically due to changes in ownership, marital status, or business structure.

Who is required to file Spousal Transfer of Business License?

The spouse who is receiving the business license is required to file the Spousal Transfer of Business License, along with the spouse transferring the license.

How to fill out Spousal Transfer of Business License?

To fill out the Spousal Transfer of Business License, both spouses should provide their personal information, details of the business, and any required signatures or declarations as specified by the licensing authority.

What is the purpose of Spousal Transfer of Business License?

The purpose of Spousal Transfer of Business License is to facilitate the legal transfer of ownership and ensure that the business operates under the correct legal ownership as per the applicable laws.

What information must be reported on Spousal Transfer of Business License?

Information that must be reported includes both spouses' names and addresses, business details such as the name and type of business, the reason for the transfer, and any required signatures.

Fill out your spousal transfer of business online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Spousal Transfer Of Business is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.