Get the free Standing authority (client money) - ADMIS Hong Kong

Show details

(F & O) ADMIT Hong Kong Limited Suites 90810, Lincoln House, Tattoo Place 979 Kings Road, Quarry Bay, Hong Kong Dear Sirs, LETTER OF AUTHORITY FOR ACCOUNT NUMBER I×We would like to authorize the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign standing authority client money

Edit your standing authority client money form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your standing authority client money form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit standing authority client money online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit standing authority client money. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out standing authority client money

How to fill out standing authority client money?

01

Obtain the necessary forms: Start by obtaining the standing authority client money form from the appropriate financial institution or regulatory body. This form is typically used by individuals or organizations that handle client funds on a recurring basis.

02

Provide accurate information: Fill out the form with accurate and up-to-date information. This includes providing your full name, contact information, and any relevant identification numbers or registration details.

03

Specify the purpose and scope: Clearly state the purpose and scope of the standing authority client money arrangement. This may include details such as the types of funds you will be handling, the specific tasks or services you will be performing, and the duration of the arrangement.

04

Disclose any conflicts of interest: Ensure that you disclose any potential conflicts of interest that may arise from your involvement in the standing authority client money arrangement. This is important for maintaining transparency and ethical standards.

05

Review and sign the form: Carefully review the completed form to ensure that all information provided is accurate and complete. Once satisfied, sign the form to indicate your agreement with the terms and conditions outlined.

Who needs standing authority client money?

01

Financial institutions: Banks, investment firms, and brokerage houses often require standing authority client money arrangements. This allows them to handle client funds effectively and efficiently.

02

Fund managers: Professionals who manage investment funds, such as hedge funds or mutual funds, will typically need standing authority client money arrangements to legally handle investor funds.

03

Real estate agents and property managers: Those involved in the real estate industry, such as agents or property managers, may need standing authority client money arrangements to handle rental income, security deposits, or other client funds.

04

Lawyers and solicitors: Legal professionals who hold client funds in trust accounts, such as attorneys or solicitors, often require standing authority client money arrangements to manage these funds properly.

05

Insurance brokers: Insurance brokers who collect premiums or handle client funds on behalf of insurance companies may need standing authority client money arrangements to legally manage these funds.

In summary, anyone who handles client funds on a recurring basis may need standing authority client money arrangements. This includes financial institutions, fund managers, real estate professionals, legal professionals, and insurance brokers, among others.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is standing authority client money?

Standing authority client money is funds held on behalf of a client that have been authorized for ongoing transactions without the need for individual client approval each time.

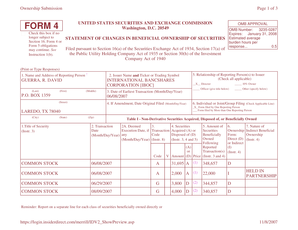

Who is required to file standing authority client money?

Financial institutions and other entities that hold client funds under standing authority are required to file standing authority client money.

How to fill out standing authority client money?

Standing authority client money should be reported by filling out the necessary forms provided by the regulatory authorities.

What is the purpose of standing authority client money?

The purpose of standing authority client money is to streamline transactions and provide convenience for clients by allowing authorized access to their funds.

What information must be reported on standing authority client money?

Information that must be reported on standing authority client money includes details of the client, the amount of funds held, the authorization for ongoing transactions, and any relevant restrictions or conditions.

How can I send standing authority client money for eSignature?

Once you are ready to share your standing authority client money, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I complete standing authority client money online?

pdfFiller has made filling out and eSigning standing authority client money easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I make changes in standing authority client money?

With pdfFiller, it's easy to make changes. Open your standing authority client money in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

Fill out your standing authority client money online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Standing Authority Client Money is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.