Get the free Certificate of Insurance - dli mn

Show details

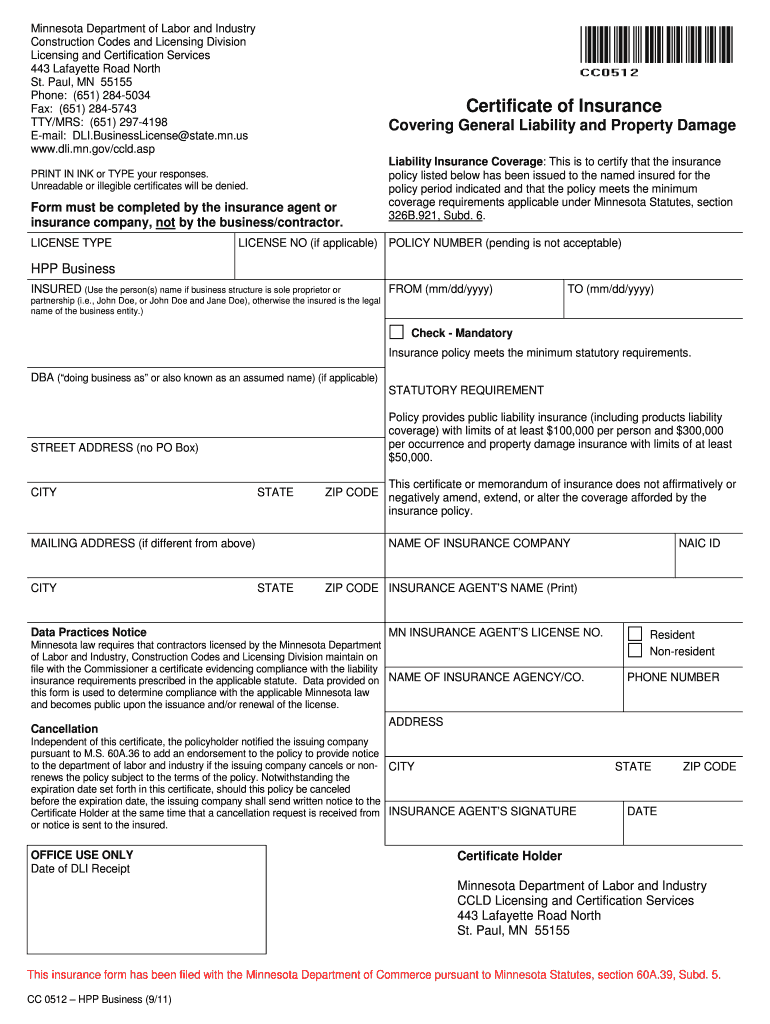

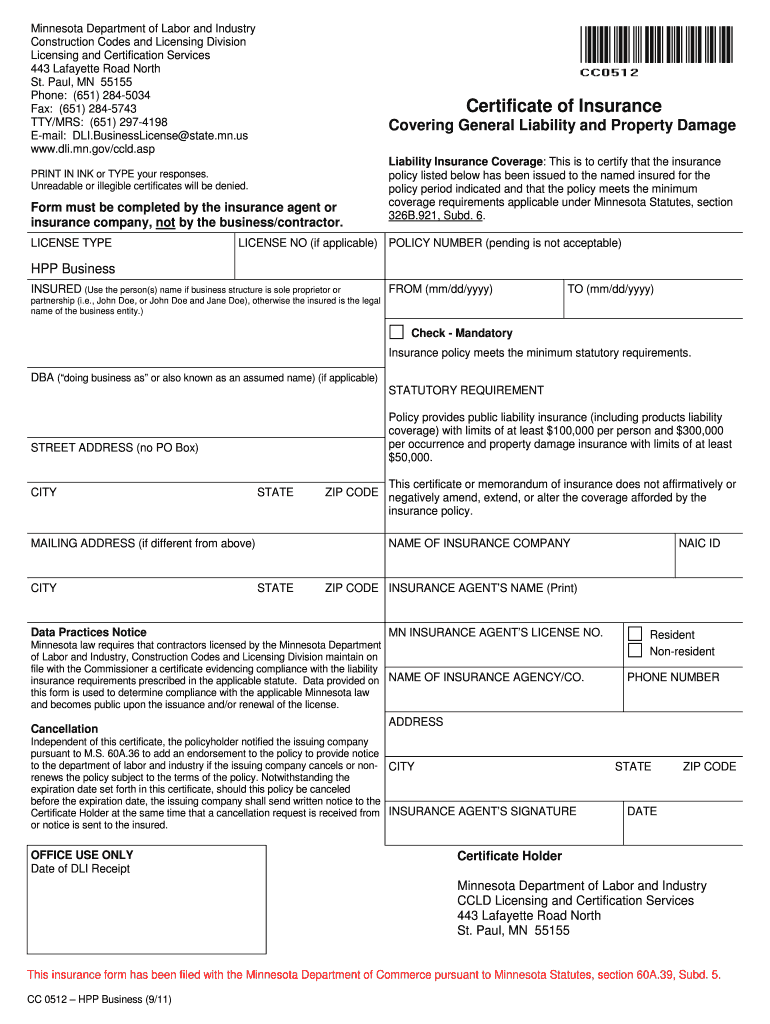

This document serves as a certification of liability insurance coverage for businesses and contractors in Minnesota, ensuring compliance with state insurance requirements.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign certificate of insurance

Edit your certificate of insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your certificate of insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing certificate of insurance online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit certificate of insurance. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out certificate of insurance

How to fill out Certificate of Insurance

01

Obtain a blank Certificate of Insurance form from your insurance provider.

02

Fill in the name and address of the insured party.

03

Provide the policy number(s) associated with the coverage.

04

List the types of coverage included in the policy (e.g., liability, property).

05

Specify the effective date and expiration date of the insurance.

06

Include additional insured parties, if applicable.

07

Sign and date the form to validate the information.

08

Review the completed certificate for accuracy before submission.

Who needs Certificate of Insurance?

01

Businesses seeking proof of insurance for contracts.

02

Contractors needing to show coverage for project compliance.

03

Landlords requiring tenant insurance verification.

04

Clients requesting assurance of coverage from service providers.

05

Organizations pursuing events that require liability insurance.

Fill

form

: Try Risk Free

People Also Ask about

How do you explain a certificate of insurance?

A COI is a statement of coverage issued by the company that insures your business. Usually no more than one page, a COI provides a summary of your business coverage. It serves as verification that your business is indeed insured.

What is COI information?

In addition to coverage levels, the certificate includes the policyholder's name, mailing address, and describes the operations that the insured performs. The address of the issuing insurance company is listed, along with contact information for the insurance agent or the insurance agency's contact person.

What information is needed for a coi?

A COI is used to verify that a company has the appropriate insurance coverage in place. This can be especially important for businesses that work with government agencies or other organizations that require coverage verification.

What is English insurance?

an agreement in which you pay a company money, either in one payment or in regular payments, and they pay your costs, for example, if you lose or damage something, or have an accident, injury, etc.: car/holiday/home/health, etc. insurance.

What information needs to be on a coi?

What information is included in a COI? The name and address of the insured party. The insurance agent's or broker's contact information. The name of the insurer(s) providing coverage. The type of coverage. The amount of coverage. A policy number. The policy's expiration date. A description of coverage.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Certificate of Insurance?

A Certificate of Insurance is a document that provides evidence of insurance coverage. It typically summarizes the essential details of an insurance policy, including the types of coverage, policy limits, and the insurance company's contact information.

Who is required to file Certificate of Insurance?

Generally, businesses or individuals entering into contracts, such as vendors, contractors, or service providers, are required to file a Certificate of Insurance to demonstrate that they have the necessary insurance coverage for their operations.

How to fill out Certificate of Insurance?

To fill out a Certificate of Insurance, you typically need to provide information such as the insurance policyholder's name and address, the type of insurance coverage, policy number, effective dates, and the limits of liability. The form usually requires a signature from the insurance broker or agent.

What is the purpose of Certificate of Insurance?

The purpose of a Certificate of Insurance is to provide proof of insurance coverage to third parties, ensuring they are aware of the insurance status of the entity involved in a contract or transaction, thereby protecting against potential liabilities.

What information must be reported on Certificate of Insurance?

A Certificate of Insurance must typically include the following information: the name of the insured, insurance company(ies) providing coverage, policy numbers, policy effective and expiration dates, types of coverage provided, coverage limits, and any additional insured parties if applicable.

Fill out your certificate of insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Certificate Of Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.