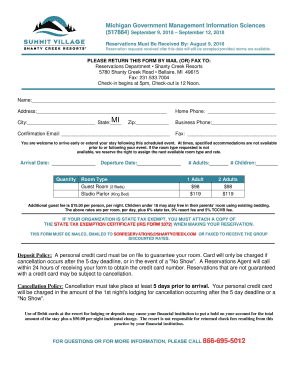

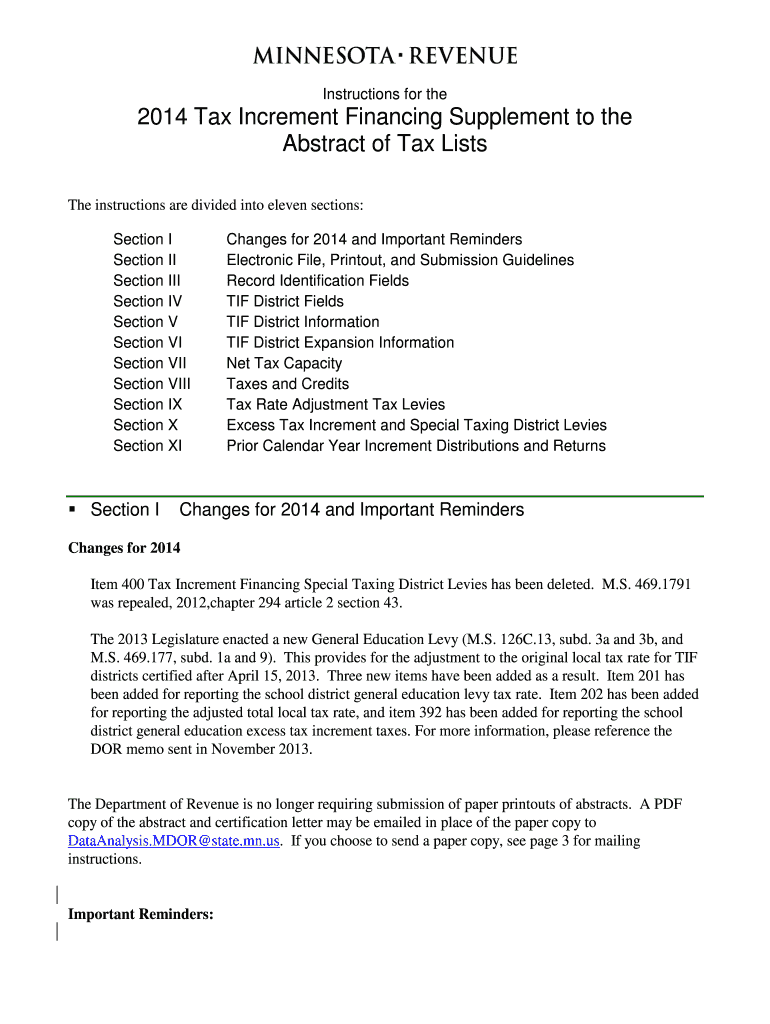

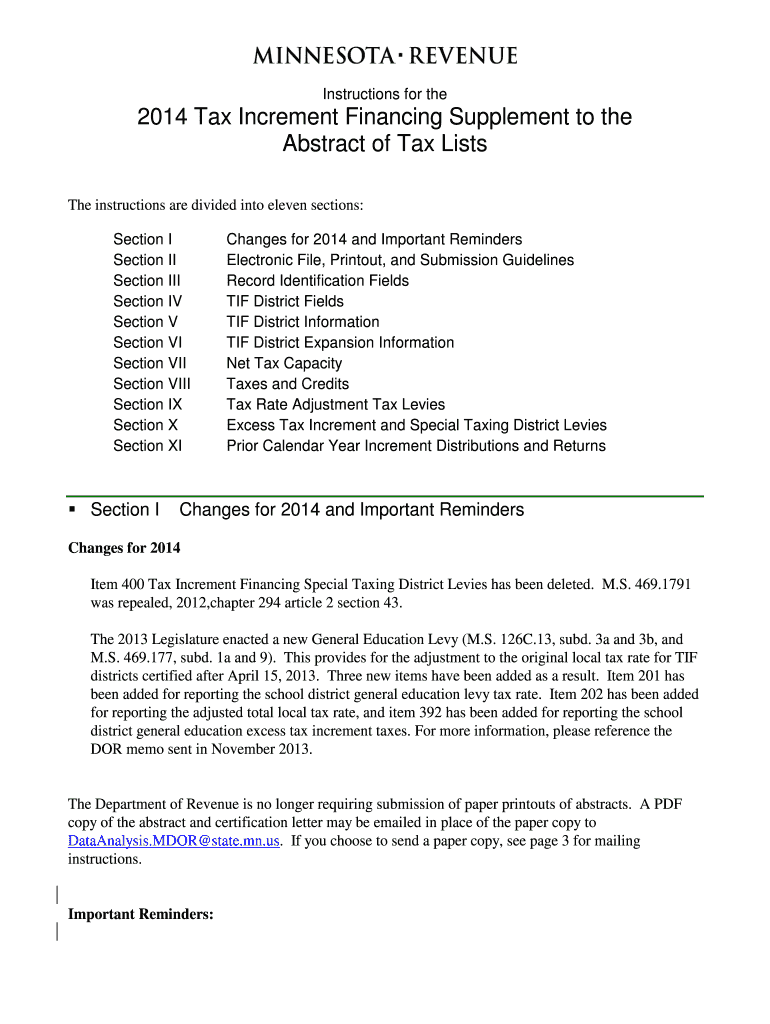

Get the free 2014 Tax Increment Financing Supplement to the Abstract of Tax Lists

Show details

This document provides instructions for the preparation and submission of the 2014 Tax Increment Financing Supplement to the Abstract of Tax Lists, detailing necessary information for compliance with

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2014 tax increment financing

Edit your 2014 tax increment financing form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2014 tax increment financing form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2014 tax increment financing online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 2014 tax increment financing. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2014 tax increment financing

How to fill out 2014 Tax Increment Financing Supplement to the Abstract of Tax Lists

01

Obtain the 2014 Tax Increment Financing Supplement form from your local taxation office or online.

02

Read the instructions provided with the form carefully to understand the requirements.

03

Fill in your property identification number in the designated field.

04

Enter the total assessed value of the property.

05

Provide information regarding the amount of tax increment financing received.

06

List any applicable deductions or adjustments as specified in the guidelines.

07

Verify all entries for accuracy and completeness.

08

Sign and date the form at the bottom to certify that the information is true and correct.

09

Submit the completed form to the appropriate tax authority by the specified deadline.

Who needs 2014 Tax Increment Financing Supplement to the Abstract of Tax Lists?

01

Property owners who benefit from tax increment financing.

02

Developers and businesses participating in tax increment financing districts.

03

Local government authorities managing tax increment financing programs.

Fill

form

: Try Risk Free

People Also Ask about

What are the downsides of tax increment financing?

Con: The project could go either way More, economic conditions change, and public debate can be heated. In the end, the TIF process can be long and drawn out, and even that can a deal. It's important to keep in mind that TIFs can be incredibly complex, and in spite of your best efforts, the deal may fall through.

What is a tax increment financing?

Tax increment financing (TIF) is a public financing method that is used as a subsidy for redevelopment, infrastructure, and other community-improvement projects in the United States.

What best defines tax increment financing (TIF) in urban development and public finance?

Tax Increment Financing (TIF) is a value capture revenue tool that uses taxes on future gains in real estate values to pay for new infrastructure improvements. TIFs are authorized by state law in nearly all 50 states and begin with the designation of a geographic area as a TIF district.

Why is TIF controversial?

The main controversy is that TIF funding prevents the various taxing bodies (such as schools and parks) from getting what might be a natural increase in tax revenue, or one that keeps up with inflation. The money is also ``off-budget,'' under pretty much direct mayoral control with little oversight.

What are the disadvantages of TIF?

More, economic conditions change, and public debate can be heated. In the end, the TIF process can be long and drawn out, and even that can a deal. It's important to keep in mind that TIFs can be incredibly complex, and in spite of your best efforts, the deal may fall through.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 2014 Tax Increment Financing Supplement to the Abstract of Tax Lists?

The 2014 Tax Increment Financing Supplement to the Abstract of Tax Lists is a document used to report information related to tax increment financing (TIF) districts. It supplements the standard tax lists by providing data specifically for TIFs, which are tools used by municipalities to promote economic development.

Who is required to file 2014 Tax Increment Financing Supplement to the Abstract of Tax Lists?

Entities that manage or are involved with tax increment financing districts are required to file the 2014 Tax Increment Financing Supplement to the Abstract of Tax Lists. This typically includes local governments, redevelopment agencies, and other public authorities that oversee TIF projects.

How to fill out 2014 Tax Increment Financing Supplement to the Abstract of Tax Lists?

To fill out the 2014 Tax Increment Financing Supplement, the filer should provide the required data such as the identification of the TIF district, the amount of incremental taxes generated, and details regarding the expenditures of the TIF funds. It is essential to follow the specific instructions outlined in the form to ensure completeness and accuracy.

What is the purpose of 2014 Tax Increment Financing Supplement to the Abstract of Tax Lists?

The purpose of the 2014 Tax Increment Financing Supplement to the Abstract of Tax Lists is to ensure transparency and accountability in the use of tax increment financing. It helps to track financial impacts, monitor the progress of TIF projects, and provide necessary information to stakeholders.

What information must be reported on 2014 Tax Increment Financing Supplement to the Abstract of Tax Lists?

The information that must be reported includes the name and identification of the TIF district, the total assessed value of the TIF district, the amount of tax increment generated, details on the use of the funds, and any other relevant financial data related to the TIF project.

Fill out your 2014 tax increment financing online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2014 Tax Increment Financing is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.