Get the free Utility Property Record Return

Show details

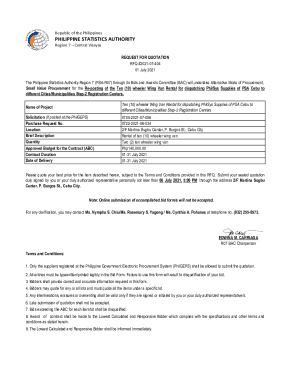

This document provides instructions for companies in Minnesota that own electric, gas, water, transportation, and pipeline property regarding the annual filing requirements, due dates, information

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign utility property record return

Edit your utility property record return form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your utility property record return form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit utility property record return online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit utility property record return. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out utility property record return

How to fill out Utility Property Record Return

01

Gather all relevant information about the utility property including value, location, and ownership details.

02

Obtain the Utility Property Record Return form from the appropriate governmental or regulatory body.

03

Start filling out the form by entering your personal information in the designated fields.

04

Provide a detailed description of the utility property including its type, physical characteristics, and usage.

05

List the assessed value of the property as determined by a professional appraisal or market valuation.

06

Complete all sections of the form, ensuring accuracy and completeness.

07

Review the form for any errors or missing information before submission.

08

Submit the completed Utility Property Record Return to the appropriate authority by the specified deadline.

Who needs Utility Property Record Return?

01

Utility companies operating within the jurisdiction that are required to report their property holdings for tax assessment.

02

Property owners who need to declare their utility property for taxation purposes.

03

Government agencies responsible for assessing and taxing utility properties.

Fill

form

: Try Risk Free

People Also Ask about

Who qualifies for a property tax refund in Minnesota?

There are two types of property tax refunds in Minnesota. One is income based and you may apply for this if your household income is less than $128,280; you owned and occupied a home in Minnesota; are filing a refund for 2021 or later; did not rent out your home; and did not use your home for business.

What are common reasons for delayed MN property tax refunds?

Common Reasons for Property Tax Refund Delays Incomplete or Incorrect Filing: Errors in your tax return, such as incorrect property details or missing signatures, can halt processing. High Volume of Refunds: During peak tax season, authorities may experience a backlog, leading to longer processing times.

Do you get a tax return on property tax?

Real property taxes Homeowners who itemize their tax returns can deduct property taxes they pay on their main residence and any other real estate they own. This includes property taxes you pay starting from the date you purchase the property.

When to expect property tax refund mn?

Refunds will be mailed or direct deposited in late September or early October if received by the August 15 deadline. Otherwise, you can expect your refund within 60 days of when filed. You may receive your refund earlier if you file electronically.

What day are refunds deposited?

When to expect your refund. Processing your refund usually takes: Up to 21 days for an e-filed return. 6 weeks or more for returns sent by mail.

What is a local property tax roll?

A tax roll is an official record of property subject to property tax within a given jurisdiction. Tax rolls are usually maintained by the municipal government department to which the property taxes are owed. Local tax rolls may also be integrated with county, state, and national reporting databases.

How long is MN taking to process refunds?

Longer you can expect your refund to take around 6 weeks to arrive if you opted for direct deposit.MoreLonger you can expect your refund to take around 6 weeks to arrive if you opted for direct deposit. And even longer if you're waiting for a paper check up to 10 to 12 weeks.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Utility Property Record Return?

The Utility Property Record Return is a form used by utility companies to report the value of their taxable property to state or local taxing authorities.

Who is required to file Utility Property Record Return?

Utility companies that own tangible personal property and real estate used in the provision of utility services are typically required to file the Utility Property Record Return.

How to fill out Utility Property Record Return?

To fill out the Utility Property Record Return, utility companies usually need to provide detailed information about their property, including descriptions, locations, and valuation data. It often includes receipts and depreciation schedules.

What is the purpose of Utility Property Record Return?

The purpose of the Utility Property Record Return is to provide tax authorities with accurate and complete information about the property owned by utilities, ensuring proper assessment of property taxes.

What information must be reported on Utility Property Record Return?

Information that must be reported includes details of owned property such as type, location, age, cost, depreciation, acquisition date, and any improvements made to the property.

Fill out your utility property record return online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Utility Property Record Return is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.