Get the free 2006 Premium Tax for Life Insurance Companies

Show details

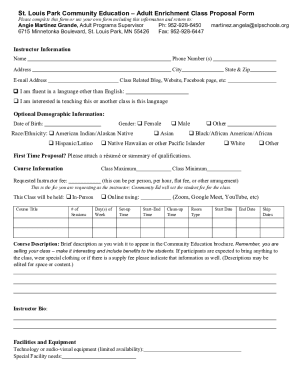

Instructions for filing the premium tax form M11L for life insurance companies in Minnesota, including payment methods, penalties, and filing requirements.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2006 premium tax for

Edit your 2006 premium tax for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2006 premium tax for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2006 premium tax for online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit 2006 premium tax for. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2006 premium tax for

How to fill out 2006 Premium Tax for Life Insurance Companies

01

Gather necessary documentation, including premium receipts and policy information.

02

Calculate the total amount of premiums collected for the year.

03

Determine any deductions applicable to your premiums, such as reinsurance or returned premiums.

04

Fill out the appropriate sections of the 2006 Premium Tax form, ensuring all figures are accurate.

05

Review the completed form for any errors or omissions.

06

Submit the form by the designated deadline, along with any required payment.

Who needs 2006 Premium Tax for Life Insurance Companies?

01

Life insurance companies that collect premiums and are required to remit premium taxes.

02

Individuals or entities operating within jurisdictions that impose a premium tax on life insurance.

Fill

form

: Try Risk Free

People Also Ask about

Do I have to pay back a premium tax credit?

If your income is more than what you told us on your application, you may have to repay some or all of the advanced premium tax credits that you got.

How to avoid paying back Obamacare?

Another way to avoid having to repay all or part of your premium assistance is to elect to have all or part of your premium assistance sent to you as a tax refund when you file your tax return, instead of paid in advance to your health insurer during the year.

How can I avoid paying back my premium tax credit?

To avoid having to repay advance premium tax credits, you should: Make sure that DC Health Link has your most up-to-date income. Report changes in your income, household size, and other offers of health insurance coverage to DC Health Link as quickly as possible. Consider taking less than the full amount.

How much tax do I pay on a life insurance policy?

Generally, life insurance proceeds you receive as a beneficiary due to the death of the insured person, aren't includable in gross income and you don't have to report them.

How to reduce premium tax credit repayment?

to lower your monthly payment, you'll have to “reconcile” when you file your federal taxes. This means you'll compare: The amount of the premium tax credit you used during the year. (This was paid directly to your health plan so your monthly payment was lower.)

What states have an insurance premium tax?

Key Facts About State Premium Taxes on Annuities California, Colorado, Maine, Nevada, South Dakota, West Virginia and Wyoming charge premium taxes on life insurance and annuity contracts. In many of these states, the tax is not charged until the annuity contract has been annuitized.

What is premium tax on life insurance?

Premium Tax refers to a state-imposed tax on insurance premiums, including those paid for Indexed Universal Life (IUL) policies. This tax is typically a percentage of the premium amount and can vary from state to state.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 2006 Premium Tax for Life Insurance Companies?

The 2006 Premium Tax for Life Insurance Companies is a tax imposed on the premium income received by life insurance companies in a given year, which is used to fund state programs and services.

Who is required to file 2006 Premium Tax for Life Insurance Companies?

Life insurance companies that receive premium income from policyholders are required to file the 2006 Premium Tax for Life Insurance Companies.

How to fill out 2006 Premium Tax for Life Insurance Companies?

To fill out the 2006 Premium Tax for Life Insurance Companies, companies must complete the designated tax forms, accurately report their premium income, and calculate the tax owed based on state guidelines.

What is the purpose of 2006 Premium Tax for Life Insurance Companies?

The purpose of the 2006 Premium Tax for Life Insurance Companies is to generate revenue for state and local governments, which can be used for public services and infrastructure.

What information must be reported on 2006 Premium Tax for Life Insurance Companies?

Companies must report total premium income, deductions, and any applicable credits or adjustments on the 2006 Premium Tax for Life Insurance Companies form.

Fill out your 2006 premium tax for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2006 Premium Tax For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.