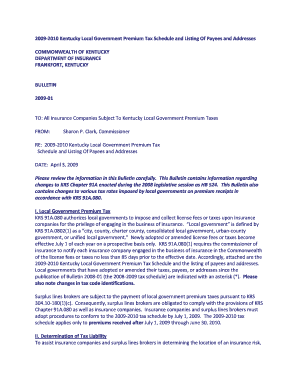

Get the free TAX CREDIT FOR CONTRIBUTION PROGRAM - mdfb

Show details

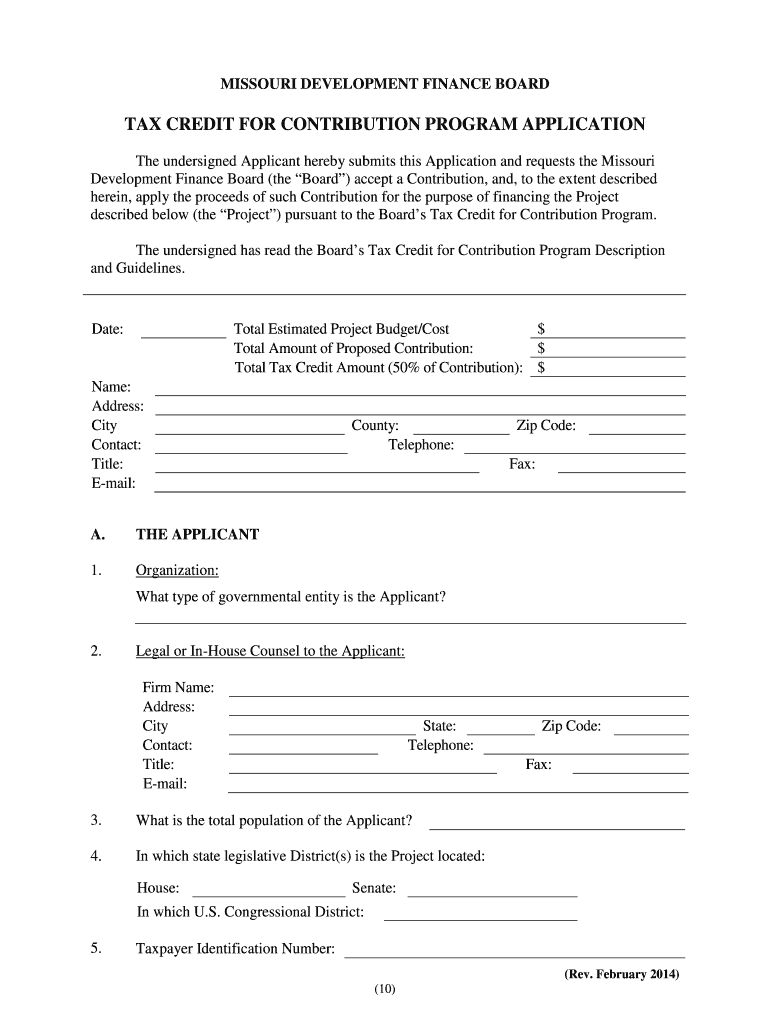

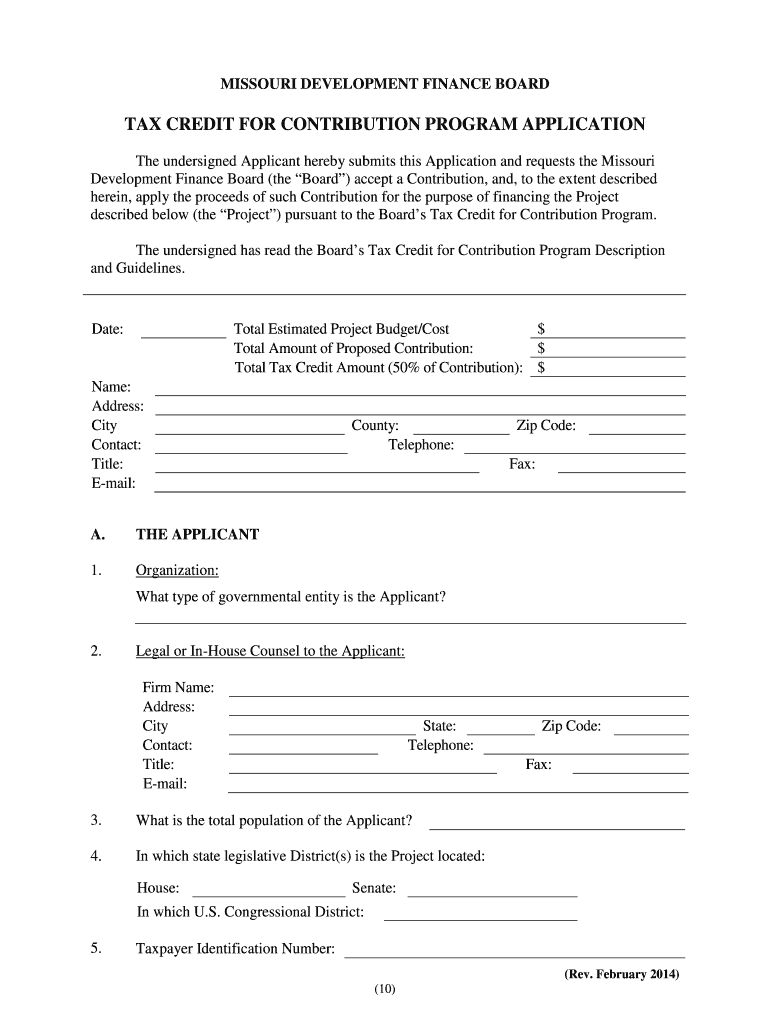

This document outlines the guidelines and process for applying to the Missouri Development Finance Board's Contribution Tax Credit Program. It includes details on eligibility criteria, application

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax credit for contribution

Edit your tax credit for contribution form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax credit for contribution form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax credit for contribution online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit tax credit for contribution. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax credit for contribution

How to fill out TAX CREDIT FOR CONTRIBUTION PROGRAM

01

Gather necessary documentation, including proof of contribution.

02

Obtain the tax credit form specific to the Contribution Program.

03

Fill out personal information such as name, address, and taxpayer identification number.

04

Enter the amount contributed to the program in the designated section of the form.

05

Calculate the tax credit based on the guidelines provided with the form.

06

Attach any required documentation to support your contribution claim.

07

Review the completed form for accuracy.

08

Submit the form to the appropriate tax authority by the deadline.

Who needs TAX CREDIT FOR CONTRIBUTION PROGRAM?

01

Individuals or businesses that have made contributions to a qualified program.

02

Taxpayers looking to reduce their tax liability.

03

Anyone interested in participating in a community contribution initiative that qualifies for a tax credit.

Fill

form

: Try Risk Free

People Also Ask about

Do IRA contributions go on a tax return?

Contributions to a Roth IRA aren't deductible (and you don't report the contributions on your tax return), but qualified distributions or distributions that are a return of contributions aren't subject to tax.

Do I get a tax credit for contributing to an IRA?

You may be able to take a tax credit for making eligible contributions to your IRA or employer-sponsored retirement plan. Also, you may be eligible for a credit for contributions to your Achieving a Better Life Experience (ABLE) account, if you're the designated beneficiary.

Can I write off my IRA contributions on my taxes?

Deducting your IRA contribution Your traditional IRA contributions may be tax-deductible. The deduction may be limited if you or your spouse is covered by a retirement plan at work and your income exceeds certain levels.

How much will contributing to IRA reduce taxes?

The money deposited into a traditional IRA reduces your adjusted gross income (AGI) for that tax year on a dollar-for-dollar basis, assuming it is within the annual contribution limits (see below). So a qualifying contribution of, say, $2,000 could reduce your AGI by $2,000, giving you a tax break for that year.

What is the donation tax credit?

The most common tax credit for donations is the charitable contribution tax credit, which is available for donations to certain types of organizations, such as public charities and private foundations.

Is there a tax credit for contributing to an IRA?

You may be able to take a tax credit for making eligible contributions to your IRA or employer-sponsored retirement plan. Also, you may be eligible for a credit for contributions to your Achieving a Better Life Experience (ABLE) account, if you're the designated beneficiary.

What is the Secure Act 2.0 tax credit?

SECURE 2.0 Act of 2022 created a substantial new startup tax credit to help small businesses establish retirement plans. This credit is based on contributions the employer makes on behalf of participants. SECURE 2.0 also expands the existing startup tax credit on employer plan costs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is TAX CREDIT FOR CONTRIBUTION PROGRAM?

The Tax Credit for Contribution Program is a financial incentive program that allows individuals or businesses to receive a tax credit for making contributions to qualifying organizations or causes.

Who is required to file TAX CREDIT FOR CONTRIBUTION PROGRAM?

Taxpayers who wish to claim the tax credit after making eligible contributions must file the Tax Credit for Contribution Program.

How to fill out TAX CREDIT FOR CONTRIBUTION PROGRAM?

To fill out the Tax Credit for Contribution Program, taxpayers must complete the designated form, providing information about the contributions made, including the recipient organization and the amount donated.

What is the purpose of TAX CREDIT FOR CONTRIBUTION PROGRAM?

The purpose of the Tax Credit for Contribution Program is to encourage charitable giving by providing tax relief to those who donate to approved organizations.

What information must be reported on TAX CREDIT FOR CONTRIBUTION PROGRAM?

Taxpayer must report the amount of contributions made, the name and identification of the recipient organization, and any other required details specified by the tax authority.

Fill out your tax credit for contribution online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Credit For Contribution is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.