Get the free Start-Up and Annual Expense Worksheets - missouribusiness

Show details

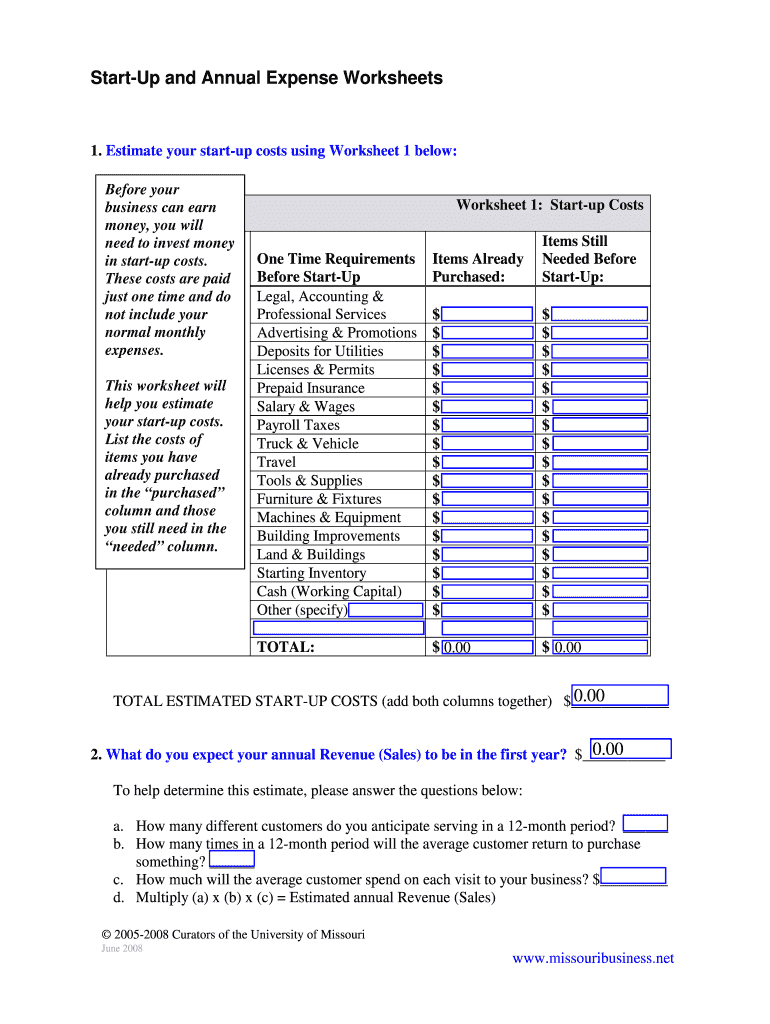

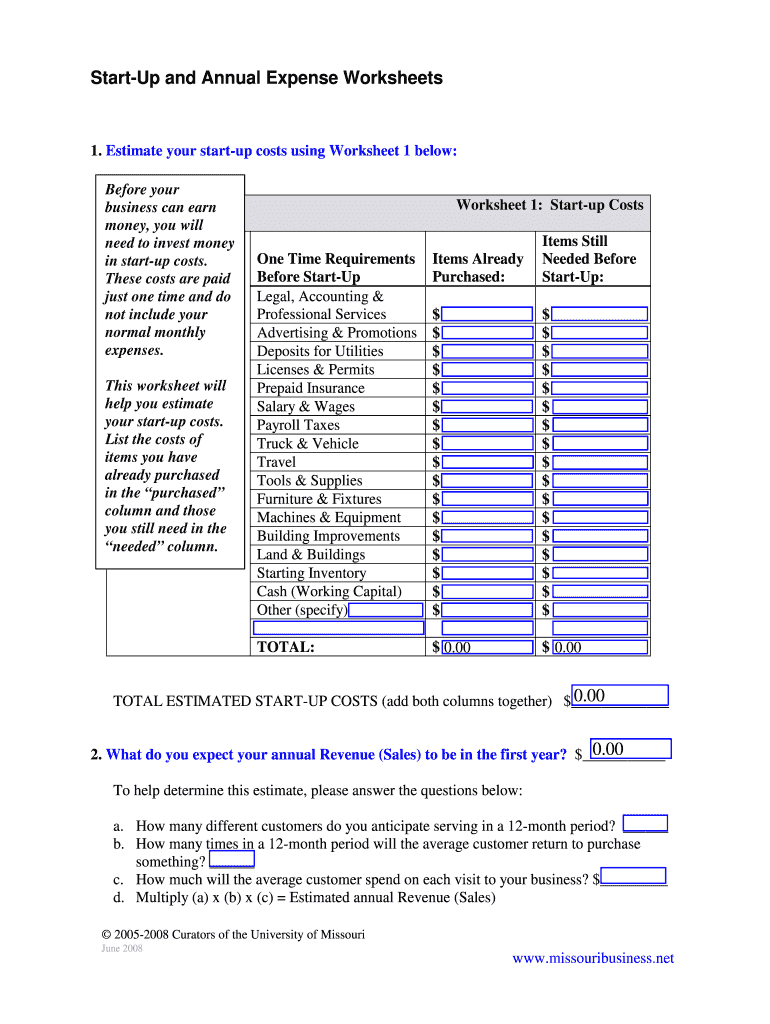

This document provides worksheets to estimate start-up costs, annual revenue, and sales and earnings projections crucial for launching a business.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign start-up and annual expense

Edit your start-up and annual expense form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your start-up and annual expense form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing start-up and annual expense online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit start-up and annual expense. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out start-up and annual expense

How to fill out Start-Up and Annual Expense Worksheets

01

Gather financial data on all expected startup costs and annual expenses.

02

Separate the expenses into categories such as equipment, marketing, salaries, and utilities.

03

For the Start-Up Worksheet, list all one-time costs required to launch the business.

04

For the Annual Expense Worksheet, detail ongoing operational costs that occur each year.

05

Use clear and precise numbers for each entry to ensure accurate calculations.

06

Double-check all figures for accuracy and completeness.

07

Review the worksheets to ensure all necessary expenses are accounted for.

Who needs Start-Up and Annual Expense Worksheets?

01

Entrepreneurs planning to start a business.

02

Businesses looking to budget for future expenses.

03

Investors assessing financial viability of a startup.

04

Financial advisors assisting clients with business planning.

05

Accountants managing the financial analysis for small businesses.

Fill

form

: Try Risk Free

People Also Ask about

How to calculate startup expenses?

To calculate your startup costs, first identify all necessary expenses, like office space, equipment, licenses, permits, salaries, and marketing. Estimate each expense by researching online and consulting with mentors or similar businesses.

What are key start-up costs?

Rent is necessary for securing a business location; marketing is vital for promoting the business and attracting customers; utilities are required for daily operations; employee salaries cover the cost of hiring staff to help run the business; and office supplies are needed for everyday activities.

What are five common startup costs that most businesses need to plan for before starting the business quizlet?

Starting an LLC involves variable costs including state filing fees, which range from $40-$500 depending on the state, and additional requirements like permits and licenses. Federal tax laws allow LLCs to deduct up to $5,000 in startup costs under certain conditions, with additional expenses amortized over 180 months.

What are 5 common startup costs?

Most common startup costs and expenses Legal fees. Almost every startup will need legal assistance for: Licenses and permits. Insurance. Technology and equipment. Office space. Marketing and advertising. Inventory and supplies. Professional services.

What are some start-up costs?

These costs include pre-opening expenses, like market research and a business plan, and post-opening expenses, such as marketing and employee salaries. Every business has unique costs, but common expenses often involve legal fees, permits, equipment, and technology.

How to record startup costs in balance sheet?

When startup costs are capitalized, they appear on the balance sheet under the “Assets” section, specifically under “Intangible Assets” if they involve intellectual property or patents.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Start-Up and Annual Expense Worksheets?

Start-Up and Annual Expense Worksheets are documents used by businesses to outline their expected and actual expenses during the start-up phase and throughout their operational year. These worksheets help in budgeting and financial planning.

Who is required to file Start-Up and Annual Expense Worksheets?

Typically, businesses that are in the process of starting up or those that need to report their annual expenses to comply with certain regulations or funding requirements are required to file these worksheets.

How to fill out Start-Up and Annual Expense Worksheets?

To fill out Start-Up and Annual Expense Worksheets, businesses should gather all relevant financial documents, estimate their start-up costs or fill in actual expenses for the year, categorize expenses, and enter the data into the provided sections of the worksheet.

What is the purpose of Start-Up and Annual Expense Worksheets?

The purpose of these worksheets is to provide a clear overview of a business's financial needs at the start-up phase and to track ongoing expenses. They assist in financial analysis, funding requests, and compliance.

What information must be reported on Start-Up and Annual Expense Worksheets?

Information that must be reported includes estimated and actual expenses for different categories, sources of funding, anticipated revenue, and any additional costs that may affect the business's financial planning.

Fill out your start-up and annual expense online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Start-Up And Annual Expense is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.