Get the free Domestic Nonprofit Corporation Annual Report

Show details

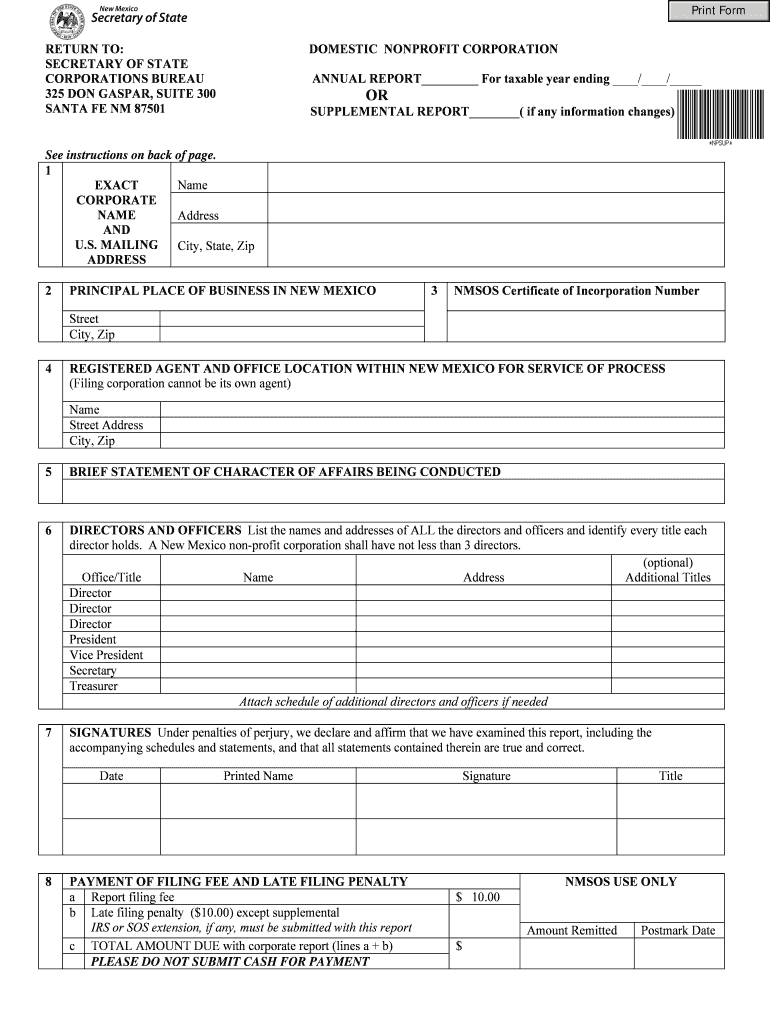

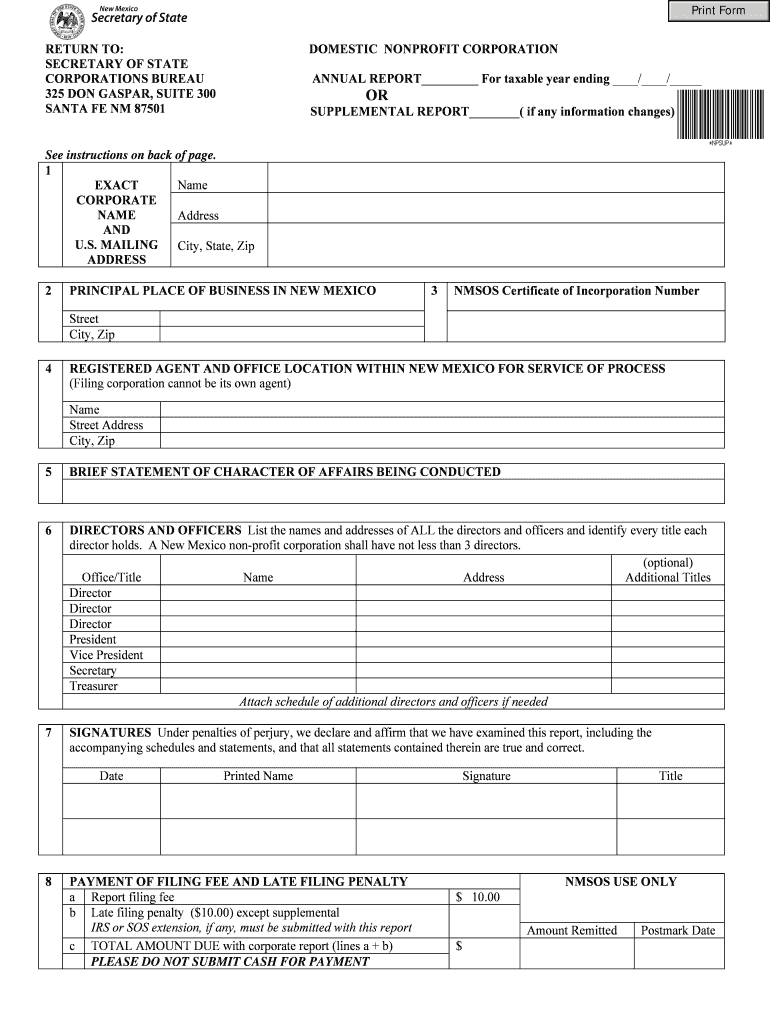

This document is used to report the necessary information for a domestic nonprofit corporation in New Mexico, including directors, officers, and the corporation's activities. It must be submitted

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign domestic nonprofit corporation annual

Edit your domestic nonprofit corporation annual form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your domestic nonprofit corporation annual form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit domestic nonprofit corporation annual online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit domestic nonprofit corporation annual. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out domestic nonprofit corporation annual

How to fill out Domestic Nonprofit Corporation Annual Report

01

Gather the necessary information about the corporation, including its legal name, address, and contact details.

02

Obtain the current version of the Domestic Nonprofit Corporation Annual Report form from the Secretary of State's website or office.

03

Complete the form by filling in the required fields, including the names and addresses of the officers and board members.

04

Review the form for accuracy and completeness, ensuring all required information is provided.

05

Sign and date the form where indicated, usually by an authorized officer of the corporation.

06

Submit the completed form to the appropriate state office by mail or online, along with any required filing fees.

07

Keep a copy of the submitted report and any correspondence for your records.

Who needs Domestic Nonprofit Corporation Annual Report?

01

All domestic nonprofit corporations operating within the state are required to file an Annual Report.

02

Members of the board or officers of the nonprofit must complete the report as part of their fiduciary responsibilities.

03

Entities seeking to maintain good standing with the state and continue their operations need to file this report.

Fill

form

: Try Risk Free

People Also Ask about

What is the 33% rule for nonprofits?

If your organization receives more than 10 percent but less than 33-1/3 percent of its support from the general public or a governmental unit, it can qualify as a public charity if it can establish that, under all the facts and circumstances, it normally receives a substantial part of its support from governmental

What are the four basic financial statements for a nonprofit?

In this blog, we'll explore the four core financial statements every nonprofit needs: the Statement of Activities, Statement of Financial Position, Statement of Cash Flows, and Statement of Functional Expenses.

What is the format for writing an annual report?

Your annual report should include four main components: the chairman's letter, a profile of your business, an analysis of your management strategies, and your financial statements.

What needs to be included in an annual report?

Annual reports typically include financial statements, statements from the CEO and Board Chair, and key activities and accomplishments. Generally, annual reports are intended to offer a transparent view of an organisation's activities over the course of a financial year.

How to write an annual report for an NGO?

Annual Report Template & Elements to Include Clear Mission Statement. Dedicated, long-time supporters and individuals who are brand new to your organization's community will both read your annual report. Major Achievements From the Past Year. Financial Information. List of Major Contributions.

How to write an annual report for a nonprofit?

What to Include in Your Nonprofit Annual and Impact Reports Financial reports: Revenue, expenses, and fund allocation. Program achievements: Key milestones and completed projects. Donor recognition: Lists of major supporters and partners. Leadership updates: Board member bios and governance changes.

What is a domestic nonprofit corporation?

Domestic nonprofit corporation means a corporation not for profit that is incorporated under ORS chapter 65.

Do non-profits have an annual report?

Almost all charitable nonprofits that are recognized as tax-exempt by the IRS are required to file an annual report with the IRS, known as the “Form 990.” The IRS Form 990 is a public document that is available on GuideStar, and also from the charitable nonprofit, upon request, in accordance with IRS “public disclosure

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Domestic Nonprofit Corporation Annual Report?

The Domestic Nonprofit Corporation Annual Report is a mandatory document that nonprofit organizations in the United States must file annually with the state in which they are incorporated. It typically includes updated information about the corporation's activities, governance, and financial status.

Who is required to file Domestic Nonprofit Corporation Annual Report?

All registered nonprofit organizations in the state where they are incorporated are required to file the Domestic Nonprofit Corporation Annual Report. This includes both charitable organizations and other types of nonprofits.

How to fill out Domestic Nonprofit Corporation Annual Report?

To fill out the Domestic Nonprofit Corporation Annual Report, organizations typically start by obtaining the form from the appropriate state agency's website. They must provide current information about their mission, board of directors, financial status, and other relevant details as required by state regulations.

What is the purpose of Domestic Nonprofit Corporation Annual Report?

The purpose of the Domestic Nonprofit Corporation Annual Report is to ensure that the state has up-to-date information about the nonprofit's status, activities, and compliance with state laws. It also helps maintain transparency and accountability within the nonprofit sector.

What information must be reported on Domestic Nonprofit Corporation Annual Report?

The information that must be reported on the Domestic Nonprofit Corporation Annual Report usually includes the organization's name, address, contact information, names of board members, financial statements, and any changes in organizational structure or mission from the previous year.

Fill out your domestic nonprofit corporation annual online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Domestic Nonprofit Corporation Annual is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.