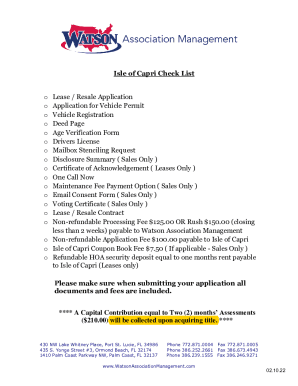

Get the free WAGE WITHHOLDING ORDER

Show details

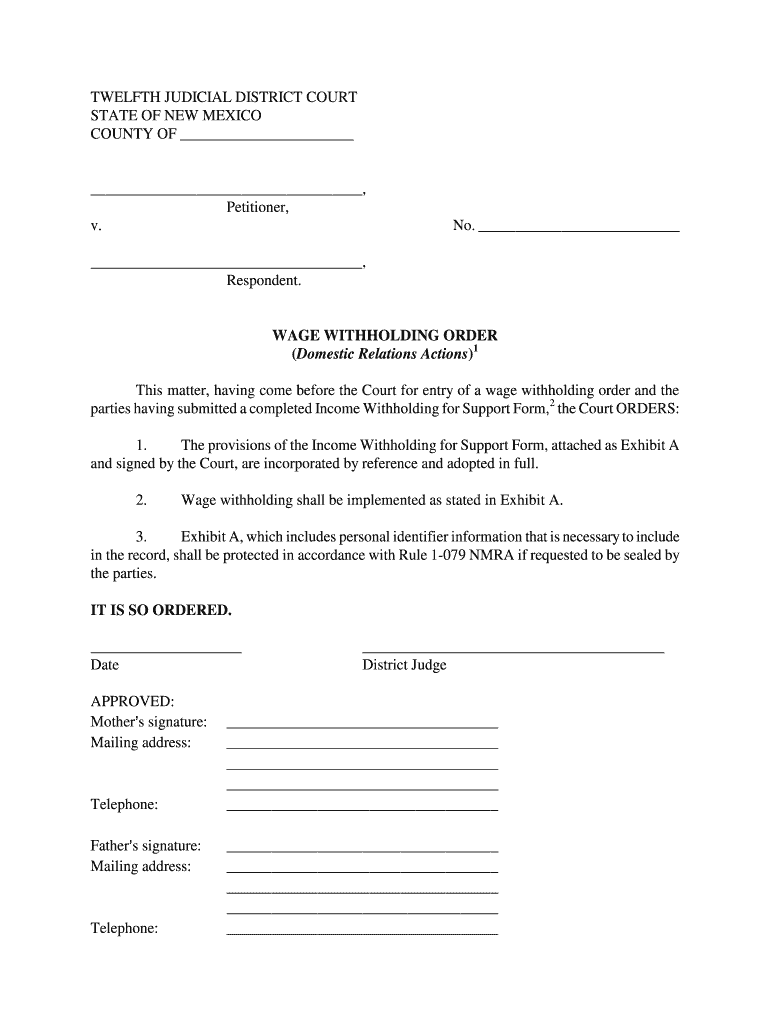

This document is a court order pertaining to wage withholding for support in domestic relations actions, detailing the incorporation of an Income Withholding for Support Form and the adoption of its

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign wage withholding order

Edit your wage withholding order form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your wage withholding order form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing wage withholding order online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit wage withholding order. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out wage withholding order

How to fill out WAGE WITHHOLDING ORDER

01

Obtain the WAGE WITHHOLDING ORDER form from the appropriate authority or website.

02

Fill in the employee's name, address, and Social Security number in the designated sections.

03

Enter the details of the employer, including name, address, and employer identification number.

04

Specify the amount of wages to be withheld and the frequency of payments.

05

Include any relevant case or docket number if applicable.

06

Sign and date the form to validate it.

07

Submit the completed form to the employer and, if required, to the court or agency overseeing the withholding.

Who needs WAGE WITHHOLDING ORDER?

01

Employers who need to comply with court-ordered wage garnishments.

02

Creditors seeking to collect debts through wage deductions.

03

Government agencies involved in child support or alimony enforcement.

04

Individuals receiving court judgments against debtors to recover owed amounts.

Fill

form

: Try Risk Free

People Also Ask about

What is an iwo?

The Income Withholding Order (IWO) is a court order that is provided to the employer. Each IWO directs the. employer to withhold from. your employee's paycheck. for child support and.

What is the maximum amount that can be withheld for child support?

Generally, the maximum amount that can be withheld to satisfy an IWO is 50% of an employee's net disposable income regardless of the number of orders, or obligation amounts. Other states may calculate child support differently. We encourage you to contact the other state to verify.

What is an income withholding order in Massachusetts?

An income withholding order is an order for a specific amount of money to be withheld from an employee's paycheck to pay child support. When a judge issues a child support order in Massachusetts, the order must include a provision for immediate income withholding (unless the judge suspends the withholding).

What does iwo stand for?

An Income Withholding Order (IWO) is an order that a court or a child support agency sends to the non-custodial parent's employer or income payor instructing them to withhold child support payments from the non-custodial parent's income.

What is an income withholding order in California?

Tells an employer that the court made an order for you or the other person in the case to pay child support, medical support, spousal or domestic partner support (and any past-due support).

What is the purpose of withholding income?

Rather than forcing a taxpayer or business to pay the entirety of their tax liability to the federal, state, or local government at a single point and time, businesses withhold or “keep back” a small portion of income to be given to the government throughout the year.

What is Iwo in accounting?

IWO – Immediate write off (where an asset is immediately deductible as opposed to being depreciated over its expected time frame) ATO – no explanation needed for the Government's principal revenue collection agency. A/R – Accounts receivable (those that owe money to you)

What does iwo stand for?

The Income Withholding for Support (IWO) is the OMB-approved form used for income withholding in: • Tribal, intrastate, and interstate cases enforced under Title IV-D of the Social Security Act. • All child support orders initially issued in the state on or after January 1, 1994.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is WAGE WITHHOLDING ORDER?

A Wage Withholding Order is a legal directive that instructs an employer to withhold a portion of an employee's earnings for the payment of debts, such as child support, alimony, or tax obligations.

Who is required to file WAGE WITHHOLDING ORDER?

Generally, the party owed money, such as a creditor or government agency, files a Wage Withholding Order against the debtor's employer to collect owed amounts directly from the debtor's wages.

How to fill out WAGE WITHHOLDING ORDER?

To fill out a Wage Withholding Order, one must provide information such as the employee's details, the amount to be withheld, the reason for the withholding, and relevant court or agency information authorizing the order.

What is the purpose of WAGE WITHHOLDING ORDER?

The purpose of a Wage Withholding Order is to ensure timely and consistent payment of debts owed, particularly in cases of child support or tax liabilities, while ensuring compliance with legal obligations.

What information must be reported on WAGE WITHHOLDING ORDER?

The information that must be reported includes the name and address of the employee, the employer's name and address, the specific amount to be withheld, the duration of the order, and details about the debt being collected.

Fill out your wage withholding order online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Wage Withholding Order is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.