Get the free LONG TERM DEBT (Accounts 221 238) - nmprc state nm

Show details

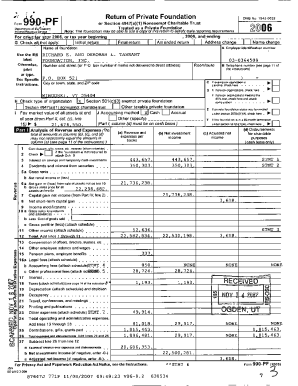

WWW. 13 31, not any as MEA In 11 1, 1. . . “ LONG TERM DEBT (Accounts 221 238) To Note Whom Decision No Dent Issued INTEREST FOR YEAR PUC Line I Issue Ma!y Sheet Principal 974 974 974 CFC For Balance

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign long term debt accounts

Edit your long term debt accounts form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your long term debt accounts form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing long term debt accounts online

Follow the guidelines below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit long term debt accounts. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out long term debt accounts

How to fill out long term debt accounts:

01

Gather all relevant financial information such as loan agreements, interest rates, and repayment schedules.

02

Enter the details of each long term debt account into your financial accounting software or spreadsheet.

03

Make sure to accurately record the principal amount, interest rate, and maturity date of each debt account.

04

Include any additional fees or charges associated with the long term debt accounts.

05

Regularly update the balance of each debt account as payments are made or interest accrues.

06

Reconcile the balances of the long term debt accounts with statements from lenders or financial institutions.

07

Prepare accurate and detailed financial reports that include the long term debt accounts for internal or external stakeholders.

Who needs long term debt accounts:

01

Businesses: Many businesses rely on long term debt accounts to finance large investments or expansion projects. This allows them to spread out payments over an extended period of time, reducing the immediate financial burden.

02

Governments: Governments often utilize long term debt accounts to fund public infrastructure projects such as building roads, bridges, or schools. This allows them to pay for these projects over time rather than incurring a sudden expense.

03

Individuals: Individuals may need long term debt accounts for major purchases such as buying a home or purchasing a car. Taking out a mortgage or a car loan allows individuals to spread out the cost of these purchases over several years, making them more affordable.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find long term debt accounts?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific long term debt accounts and other forms. Find the template you need and change it using powerful tools.

How do I edit long term debt accounts online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your long term debt accounts to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

Can I create an electronic signature for the long term debt accounts in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your long term debt accounts in minutes.

What is long term debt accounts?

Long term debt accounts refer to financial obligations that are due for repayment over a period longer than one year. These typically include loans, bonds, and other forms of debt that a company or individual is required to pay back in the future.

Who is required to file long term debt accounts?

Companies and organizations that have outstanding long term debts, as part of their financial statements, are required to file long term debt accounts. This includes public companies and private entities that meet certain thresholds.

How to fill out long term debt accounts?

To fill out long term debt accounts, entities must gather relevant financial data including the terms of each debt, outstanding balances, payment schedules, and interest rates, and then report this information in the specified format outlined by regulatory bodies.

What is the purpose of long term debt accounts?

The purpose of long term debt accounts is to provide a clear record of an entity's long term financial obligations, helping stakeholders assess the company's financial health, leverage, and repayment capacity.

What information must be reported on long term debt accounts?

Information that must be reported includes the total amount of long term debt, interest rates, repayment terms, due dates, and any collateral associated with the debt.

Fill out your long term debt accounts online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Long Term Debt Accounts is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.